Kuwait Oil Economy Developments

“There hasn’t been much Kuwait oil development here in the past 20-30 years compared to the rest of the region. However, with the new four year economic development plan we are going to be able to see where Kuwait can go to drive development and change” – Wataniya Telecom ’s CEO Scott Gegenheimer

Tastes oily, must be from Kuwait

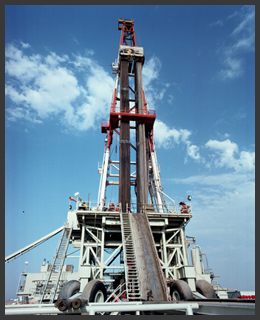

Oil was found in 1938, and by 1953 Kuwait was the largest producer of oil in the Persian Gulf. The black gold is concentrated both offshore as well in Kuwait’s northern desert. The dispute with Iraq about the Rumailah oil field in the northern border region eventually led to Iraq’s invasion in 1991. Historians are still divided about the role of the US regarding the border dispute. April Glaspie told then-Iraqi president Saddam Hussain that Washington “has no opinion” about the differences, a diplomatic codeword for giving green light to whatever action.

Although the state of Kuwait is only half the size of Switzerland, it is has one of the wealthiest economies in the Middle East. Its relatively open foreign trade policy has made the country also a reliable partner to many states in both East and West.

Nevertheless, as a result of the financial crisis, Kuwait has become more cautious with its investment policy. On December 29 2008, the Kuwaiti parliament decided to scrap a multibillion-dollar deal with the US giant Dow Chemical.

The cancellation of the agreement after the start of the New Year 2009 would have made Kuwait liable to pay a penalty of up to $2.5 billion. This move was a blow to the largest US chemicals firm which had planned to use the proceeds to repay a large part of $13 billion in debt it had to shoulder by its acquisition of rival Rohm & Haas early 2009.

As a result, shares of Dow Chemical dropped below U$10. Dow also had to cut its dividend by 64% in 2009. This was the first dividend cut since it started to pay out an annual profit share in 1912. Careful steps have been taken since then to open Kuwait economy on a larger scale. Today, 95% of Kuwait’s revenue is still based on oil production and exportation.

As the fourth-largest OPEC producer, Kuwait has benefited enormously from the surge in energy prices during the first millennium’s decade. During the last period of the oil price hype, oil revenues stood at U$19.7bn, according to Global Investment House. The surplus reached KD 2.743bn. When the oil bubble popped, oil revenues plummeted by almost two thirds to KD 6.92bn while the ministry of finance reported a deficit of KD 4.04bn.

Many Kuwaiti managers are proud to show their MBA certificate from Lausanne’s IMD, INSEAD in France, or the London Business School in their offices. But higher education is a struggle for all GGC states as there is no single Arab university that is among the world’s top 500. The unstable situation in Iraq also remains a burden for more cross-border-trade.

Upon the latest government initiative, however, optimism spread among business leaders. “Kuwait is a very nice country and there is a lot of potential here”, says Wataniya Telecom’s CEO Scott Gegenheimer and he concludes:

“There hasn’t been much development here in the past 20-30 years compared to the rest of the region. However, with the new four year economic plan we are going to be able to see where Kuwait can go to drive economic development and improve investment climate in Kuwait.”

Abdul Aziz Al-Mazooq , General Manager, of Muthanna Investment Company agrees with Gegenheimer:

“I am very optimistic about the future, especially with the government’s plans and expectations. The next five years look like they will be very busy; it is a good opportunity for investors abroad to take a look at what part they can play in the new projects offered by the government.”