Kuwait Economic Plan

Kuwait strategic economic plan is worth 30 billion dinars (US$104 billion). On the agenda is a detailed roadmap to implement Kuwait economic plan a long-term strategy after years of short-term planning. It is the first of its kind since 1986.

The state of Kuwait does not want to be overshadowed by the other gulf states any longer. Although the northern gulf state is less present on the global media stage, Kuwait wants to attract foreign investments, people, and know-how for multi-billion KD projects at home. On top of this, the ruling family is preparing its people for a future which will likely not have much in common with the sheikhdom’s past, economically.

Kuwait City – When in mid-March Kuwait’s prime minister Sheikh Nasser Mohammed al Ahmed al Sabah called more than 150 top government officials to discuss the country’s five-year plan, money was not the main issue. This plan is worth 30 billion dinars (US$104 billion).

On the agenda is a detailed roadmap to implement a long-term strategy after years of short-term planning. It is the first of its kind since 1986. According to the deputy prime minister for economic affairs, Sheikh Ahmed al Fahad al Sabah, there are 798 construction projects worth 4.8bn dinars planned for the forthcoming fiscal year. This is twice the budget for such projects in the previous year. In order to achieve this ambitious objective, the government has 45 new laws.

Five public sectors – housing, electricity, ports, warehouses and health insurance – were chosen to be privatized with the aim to provide its citizens competitive jobs. Sixty per cent of the 1.3 million Kuwaiti nationals are younger than 25 years (foreigners make up to 62% of the total population).

Black gold for blue skies

The objective: Kuwait aims to be a prosperous state that is less dependent on oil but based on a well diversified multi-industry. The country wants to play a pivotal role in the gulf region. With production of 3,15 million barrels per day (bpd), Kuwait, whose surface of 20,000 square kilometers is half the size of Switzerland, produces more crude oil per day than Algeria and Indonesia combined. Within the Organization of Petrol Exporting Countries (OPEC), consisting of 12 members states, Kuwait stands at number four in production ranking, together with the United Arab Emirates (UAE) and Nigeria.

In addition to its role as a major oil supplier, Kuwait is also the home of global players in the non-oil sector. From A like Agility to Z like Zain, Kuwait corporations are increasingly quoted in the Middle Eastern business news sections. Agility is a leading logistics firm in the region and is listed at both the Kuwait Stock Exchange KSE and the Dubai Financial Market DFM.

In addition to its role as a major oil supplier, Kuwait is also the home of global players in the non-oil sector. From A like Agility to Z like Zain, Kuwait corporations are increasingly quoted in the Middle Eastern business news sections. Agility is a leading logistics firm in the region and is listed at both the Kuwait Stock Exchange KSE and the Dubai Financial Market DFM.

The Kuwait-based telecom giant Zain (formerly MTC Kuwait), was founded in 1983 as the region’s first mobile operator. It has since emerged as one of the leading players in the Middle East and North Africa (Mena). Zain operates today in 22 countries and has a client base 56.3m people.

Kuwait’s Minister of Commerce and Industry , Amad A-Haroun , stresses that “Kuwait has a strategic geographic location, which is unique in the region. Situated between three major economies, it has much potential to become a trade center and a trade route, bringing back the glories of the historic Silk Way.”

Kuwait is a member of the Gulf Cooperation Council (GCC), a political and economic union founded in 1981, which is composed of Kuwait, Saudi-Arabia, Bahrain , Qatar, the UAE and Oman. Among GCC members, Kuwait has always been on the forefront of investing abroad. No other people travel more. No one is investing more aggressively abroad than Kuwaiti businessmen.

Curious about the world and open-minded, Kuwait financed integral parts of the Western world such as Daimler AG and the modern city of London. The state’s main sovereign wealth fund, the Kuwait Investment Authority (KIA) holds assets in access of $200bn.

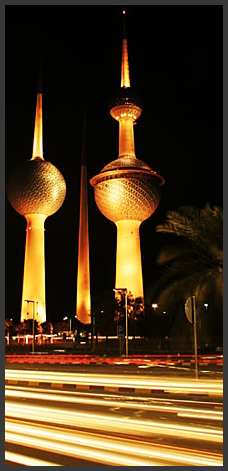

The KIA became a major shareholder in German carmaker Daimler AG for the first time in 1974, long before the term “sovereign wealth fund” was coined. During the 1980s, the already modern business city of Kuwait, with its iconic, skyscraper-rich cityscape, financed the construction of the London docklands, a symbol of “Thatcherism” at that time, meaning a laissez faire economy.