Gulf Real Estate: ALARGAN Real-Estate Company

Interview with Khaled Al Mashaan, Chairman and Managing Director of ALAGRAN International Real Estate Company. ALARGAN Real Estate have been very focused on middle income housing. I would say more than 80% of our investments cater to this segment of the market. As the housing projects get larger we need to provide the infrastructure for these communities and the required supportive facilities. We always strive to provide the best quality for the price and we are very much in touch with our clients. We enhance our units on a monthly basis and this gives us a competitive edge due to our focus.

Average residential land pricing has dropped up to 10% in prime locations in 2008 and up to 50% in areas with little infrastructure while commercial land prices continue to rise. How would you describe the current climate in the real estate market and how hard has it been affected by the global economic downturn?

When we look at Kuwait you notice that since the global economic downturn and as a result of the recent legislation enacted by the parliament there was a noticeable effect on certain sectors in the real estate market. The most affected was the residential sector due to legislation preventing homebuyers from obtaining home loans. The commercial sector also suffered as well. On the other hand, residential rental properties have gone up in price as a result of a dropped interest rate in the banks where you can find a fixed deposit at around one or two percent. There is a big demand for this type of real estate in Kuwait. However, the overall situation in Kuwait is quite depressing and there is no medium to long term financing available in Kuwait. Another issue is coverage ratio because this is quite high for real estate in Kuwait. For any financing you need a 200% coverage ratio for any loan you apply for and these parameters make it very difficult, especially at this time where stimulus packages are required to enhanced the economic cycle, in every sector of real estate.

In your opinion what should the government do to facilitate your operations?

The government has a big role in backing and securing the banks and how they apply loans to their clients. We are facing an issue here and assets have dropped in value but the banks have not changed their stance regarding the coverage ration stipulation. We need to focus on medium to long term focusing because it doesn’t exist. For real estate companies it is difficult to work with short term financing.

What is the outlook for 2010 and 2011?

I think the status quo will remain the same. As long as companies pay their interest on the debt they will be kept where they are.

Once you mentioned now was the best time to start developing so when the cycle comes around again you would be in a position to capitalize on different projects. How do you adapt your long term strategy to adapt to the global economic turmoil?

|

Get the Flash Player to see this player.

|

We have not really changed our strategy. We are very focused on middle income housing because it is the most in demand before, now, and after the crisis. We have the highest growth in population in the world and most of the population is under 25 years old (60%) so the influx of young people coming into the market will be huge for jobs and housing. The only think we do is tweaking our strategy to meet current demands in the market and cater to our clients depending on their most recent needs. Currently, it is the best time to build because land values have dropped, construction costs have dropped, and the boom is no longer there. We suffer the most with middle income housing when the economy is in good shape because everything becomes more expensive and we face problems catering to our clientele. Providing the banks will make loans to our end users and have easy access to finance and if we can provide them with easy access to their units it will be ideal.

What is your major challenge?

To deal with all of the current challenges here the easiest thing is just to move out of Kuwait. We could do very well in Saudi Arabia, Oman, and Bahrain and we feel we are being driven out of Kuwait due to the government restrictions. If parliament decided we are not good representation to provide decent dwellings to our clients then we can’t do anything about it and thus, we moved out. If the laws change we are more than willing to come back.

The Public Authority for Housing and Welfare, which guarantees housing for Kuwaiti nationals had over 90,000 application pending in October 2009. Do you see the private sector participating in developing some of these residential developments?

This issue has been going on for the past thirty years. The public and private sectors were supposed to put their heads together to benefit the public sector but it has never happened. Right now people are trying to figure out how to let the private sector get in on these projects but it is difficult to figure out how the private sector will be involved. It’s been a one way street instead of mutual negotiations and compromise so I don’t know if it will work. We need to look at what is beneficial to both the public and private sector in order to come up with the best product for end users.

You mentioned that you have been driven out of Kuwait and have offices in Oman, Bahrain, Saudi Arabia, Lebanon and Egypt. How would you define your expansion plans? Is there any systematic strategy behind it and what are your strategic goals for 2010-2011?

We have issued companies, not offices (except for in Dubai). In Saudi Arabia, Oman, and Bahrain we have strategic partners where we have set up companies that have taken on the role of development of each of these companies and these companies will eventually be public and listed in each market. Our strategy is to be a local company in each of the markets in order to meet their needs and enhance what is available in the market to deliver the best product for value.

How would you define your investment strategy?

We have been very focused on middle income housing. I would say more than 80% of our investments cater to this segment of the market. As the housing projects get larger we need to provide the infrastructure for these communities and the required supportive facilities. The other sectors depend on opportunities available in a particular company. We research these opportunities extensively and make educated decisions as to whether or not to invest.

How would you define your competitive strategy? How do you differentiate yourself from the other developers?

We always strive to provide the best quality for the price and we are very much in touch with our clients. We enhance our units on a monthly basis and this gives us a competitive edge due to our focus.

How would you define your communication strategy with your clients given the crisis?

I don’t believe it has changed. Our clients have always held the power because the sector of the market we are involved in holds a standard profit margin and you need to be careful with costs. Middle income housing needs to be looked at respective to the market where you are operating in.

What are some of the latest developments you will announce in the next six months?

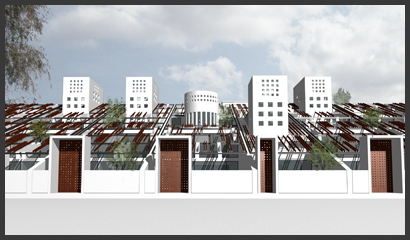

Unfortunately, we don’t have anything in Kuwait at the moment. We are focusing in Saudi Arabia and there we have an on going project of 500 units in Riyadh with a component of two vertical developments that could reach 1000 units. We are also going to announce at the end of the month that we are going to construct detached or attached dwellings of single family units. Also we have two developments in Oman: one with 180 units with a commercial component attached and the other in Muscat that will be quite a large development unlike any other. In Bahrain we are starting an 100 unit project and in a couple of weeks we will start an even bigger project with a commercial component attached to it to enhance the neighborhood. We don’t feel we need to slow down at this time but rather we would like to accelerate our progress because the demand is there and it will not be slowed due to demographics in the area.

Would you define your customers as homeowners or investors?

Mostly we focus on homeowners. We try to limit investors buying into our units. Speculation drives the prices up and this isn’t what we want to impact our end users.

Can you mention some of your developments in Kuwait?

In Kuwait we are getting ready to open up our offices and these are partly leased by us and the rest will go to others. It is 10,000 meters squared and it will be the first in Kuwait to be recognized by the green building council in Kuwait. This is one way we work to fulfill our obligation to the community. One day we hope to make all of our residential units “green.” With government recognition, these types of projects should be subsidized and pushed forward so other companies can follow suit.

Do you see the GCC customer being concerned about the environment and corporate social responsibility?

We have a very enthusiastic research team and their findings will help us cater towards this segment of the market. We would also like to bring awareness to the areas of the market we are involved in order to help the environment.

What message would you like to deliver to potential GCC or International partners?

Right now we manage and partner up in the amount of 2.4 billion dollars and this amount is a result of the confidence of our shareholders, partners, and investors who partner up with us on certain projects. To potential investors we would say to look carefully regarding who to invest with because each company has their own advantage and focus in each sector of real estate. We are very focused on middle income housing so if an investor comes to us we would advise them on what to do but we cannot do whatever they would like due to our focus. If someone would like to focus on middle income housing with us that would be great and we could sit down and try to make plans to cater to their needs.

How do you define yourself in this middle income market and what is your competitive edge against companies doing the same thing?

If you look at the markets and look for companies doing similar work to us then you will see that the market is lagging and there aren’t enough qualified developers that take business so seriously. According to international norms we are focused on doing our developments according to quality and the needs of our clients. We try to stay very transparent regarding our expenditures and returns with our investors and this is rare within this market. Our resource department is also quite strong so they keep us up to date constantly so we can learn more about the recent market.

What is your final message about Kuwait?

I may have sounded pessimistic but compared to other sectors and territories in the world we are doing quite well. The market is very optimistic. We cannot ignore that many GCC countries are welfare states so most of the people going to work and looking for housing are government employed and backed for financing. As long as the petrol price is above 50 dollars a gallon everything should be fine. This area is quite secure in terms of middle term investment. I invite everyone to come and take a look to see what is possible here.