Kuwait Fund for Arab Economic Development

Kuwait Fund for Arab Economic Development (The Fund) is a Kuwaiti public corporation established by the State of Kuwait in order to provide assistance to Arab and ther developing countries in developing their economies and to promote cooperation and friendship between the State of Kuwait and such countries.

About Kuwait Fund for Arab Economic

ContactKuwait Fund for Arab Economic Development

|

Tel : +965-22999000 |

Profile

Kuwait Fund for Arab Economic Development (The Fund) is a Kuwaiti public corporation established by the State of Kuwait in order to provide assistance to Arab and ther developing countries in developing their economies and to promote cooperation and friendship between the State of Kuwait and such countries. The Fund was established originally by Law No.35 of 1961, which empowered the Prime Minister to issue the Charter of the Fund.

The operations of the Fund were confined until the year 1974 to the Arab countries, in accordance with the initial mandate of the Fund. In July 1974 the Fund was reorganized by Law No.25 of 1974 and its object was amended so as to include the provision of assistance to developing countries in general, in addition to Arab countries. Also, the Fund’s authorized capital was increased by virtue of this Law from Kuwaiti Dinars 200 Million to Kuwaiti Dinars 1000 Million.

By Law No.18 of 1981, promulgated in March of that year, the Fund’s authorized capital was doubled to become Kuwaiti Dinars 2000 Million, which is now fully paid-up. The Fund’s Charter was also amended to provide expressly that its mandate includes subscription to capital stocks of development finance institutions as well as capital stocks of corporate bodies which are of a developmental nature.

Our Mission & Activities

The object of the Fund is to assist Arab and other developing countries in developing their economies.

Types of Activities

-

Making loans and providing guarantees,

-

Making Grants by way of technical assistance and providing other types of technical assistance,

-

Contributing to capital stocks of international and regional development finance institutions and other development institutions and representing the State of Kuwait in such institutions.

Scope of Operations

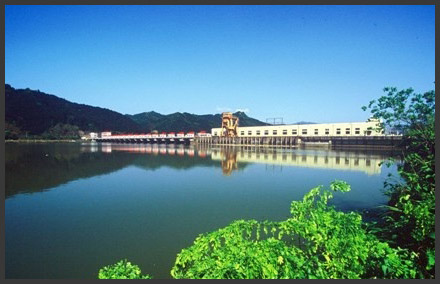

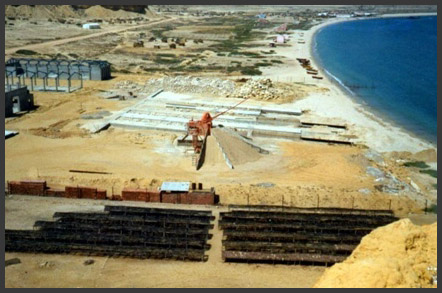

The Fund’s operations are focused primarily on the sectors of agriculture and irrigation, transport and communications, energy, industry, water and sewage.

Eligible Entities

The Fund may extend its assistance to different types of entities which include:

-

Central and provincial governments, public utilities and other public corporations.

-

Development institutions, whether international, regional or national and, in particular, development finance institutions.

-

Corporate entities that undertake projects which are jointly owned by a number of developing countries as well as mixed or private enterprises that enjoy corporate personality, and are of a developmental nature and not merely oriented towards making of profit. Such enterprises must be either under the control of one or more developing country or have the nationality of any such count.

(Where the Borrower is an entity other than the state in the beneficiary country, the Fund usually requires that the state in such country enters into an agreement with the Fund whereby it guarantees the performance of the borrower’s obligations under the respective loan agreement.)

Forms of Assistance

-

Direct loans or the provision of guarantees.

-

Joint or parallel financing with other international, regional or national development finance institutions.

-

Making of grants-in-aid to finance technical, economic and financial studies whether in relation to projects financed by the Fund or otherwise. Such studies may be of such types as pre-investment surveys, studies for the identification of investment opportunities and projects, feasibility studies, project preparation, sectoral studies and the like.

-

Advisory services in relation to technical, financial, economic and legal aspects of projects or programmes or development policies, or in relation to institution building in the field of development.

-

Subscription to the capital, or contribution to the resources of development finance institutions.

-

Subscription to the capital of eligible developmental enterprises.

Video & Organization

|

loading the player….

|

Organization and Management of the Fund

The Fund is an autonomous legal person, enjoying financial and administrative independence, and operates under the overall supervision of the Prime Minister. It is managed by a Board of Directors whose members are appointed by the Prime Minister,  who is the Chairman of the Board. In exercise of a power granted to him by the law reorganizing the Fund, the Prime Minister has delegated his aforesaid powers to the Minister of Finance. Management of the day-to-day affairs of the Fund is the responsibility of its Director General, who is appointed by an Amiri Decree on the recommendation of the Board of Directors of the Fund. The Director General is the legal representative of the Fund and is assisted at present by three deputies. Business within the Fund is conducted on the basis of close cooperation among its various departments. These departments include, the Operations Department, which is in charge of loan operations, legal affairs and international cooperation, the Disbursement Department, in charge of the disbursement of loans, the Information Systems Center, the Information and Studies Department, the Accounts Department, the Investment Department, the Internal Audit Department, the Follow-up Department and the Administration Department.

who is the Chairman of the Board. In exercise of a power granted to him by the law reorganizing the Fund, the Prime Minister has delegated his aforesaid powers to the Minister of Finance. Management of the day-to-day affairs of the Fund is the responsibility of its Director General, who is appointed by an Amiri Decree on the recommendation of the Board of Directors of the Fund. The Director General is the legal representative of the Fund and is assisted at present by three deputies. Business within the Fund is conducted on the basis of close cooperation among its various departments. These departments include, the Operations Department, which is in charge of loan operations, legal affairs and international cooperation, the Disbursement Department, in charge of the disbursement of loans, the Information Systems Center, the Information and Studies Department, the Accounts Department, the Investment Department, the Internal Audit Department, the Follow-up Department and the Administration Department.

Project / Loan Status: Pipeline

THE REQUEST

1.1.1. The Borrower’s country should be a developing country. However, countries whose economies are in transition may be considered as eligible. No geographic, ethnic, religious, caste or cultural barrier restricts benefiting from the Fund’s loans and assistances.

1.1.2. The request for assistance must be made by the governmental authority responsible for international cooperation and external borrowing.

1.1.3. The requesting authority should indicate that the project is a priority project to the government.

1.1.4 The project should have a strong public sector element and be of a developmental nature. The Fund’s assistance is not limited to a particular sector. The project may be in any of the following sectors: infrastructure, agriculture, irrigation, transport, communications, energy, water supply, sewage treatment, education and health.

1.1.4 The project should have a strong public sector element and be of a developmental nature. The Fund’s assistance is not limited to a particular sector. The project may be in any of the following sectors: infrastructure, agriculture, irrigation, transport, communications, energy, water supply, sewage treatment, education and health.

1.1.5 The project, if not in the education and health sectors, should be supported by a detailed techno-economic feasibility study. The feasibility of the project must be demonstrated by cost-benefit analysis and the calculation of an internal economic rate of return, with an indication of sensitivity to changes in parameters. For projects in the health and education sectors, it is sufficient to demonstrate the feasibility of the project through technical and social data, in addition to evidence establishing the need for the project. The studies of the project should include the proposed components, the cost estimates in local and foreign currencies, and the proposed financing plan. abidance to the “Kuwait Fund Requirements for the Preparation of a Feasibility Study” is advisable. It is preferable that the services of an independent specialized consultant be obtained for the preparation of feasibility studies.

THE PRELIMINARY APPROVAL

1.2.1. A team is formed by the Operations Department of Fund to prepare a memorandum regarding the project, summarizing the available information thereof.

1.2.2. If the recommendation of the team is positive, and if the studies are adequate, the Fund’s management submits, on approval of the Board’s Internal Loans Committee, a recommendation to the Board of Directors to, preliminarily, approve the participation in the financing the project.

1.2.3. Upon the Board’s preliminary approval, the management of the Fund may proceed to consider the project for further evaluation.

THE APPRAISAL

1.3.1. A mission, composed usually of an engineering adviser, an economic adviser and a legal adviser, visits the country to appraise the project. The mission would visit the project site, collect all necessary project and sector information and, if satisfied, negotiate and initial a draft loan agreement before the end of the visit. The draft loan agreement wouldl state the amount of the proposed loan, the lending terms and other conditions based on the findings of the mission.

1.3.2. Under normal circumstances, and in accordance with the regulations of the Fund, the amount of the loan would not exceed 50% of the total cost of the project and would not include financing of local costs of goods produced in the territories of the borrower.

1.3.3. Upon its return, the mission would prepares a project appraisal report which includes information about the economy of the country, the sector, the implementing agency, the project, the economic and financial viability of the project (if required), and the lending terms and conditions. Such report would be discussed in a meeting attended by all the technical staff of the Fund.

For more information click here