Kenya Investment Authority: Kenya Offers Amazing Investment Opportunities

Moses Ikiara gives an overview of KenInvest (Kenya Investment Authority) and explains how the institution can help investors on a daily basis. He also mentions some of the country’s main advantages and most relevant investment opportunities.

Interview with Dr. Moses Ikiara, Managing Director of KenInvest (Kenya Investment Authority)

Kenya Investment Authority’s mission is to promote and facilitate domestic and foreign investment in Kenya by advocating for a conducive investment climate, providing accurate information and offering quality services for a prosperous Nation. You provide 2 types of services which you call “Pre-Investment Services” and “Post-Investment Services”. Concretely, what do these services consist of and how do you help investors on a daily basis?

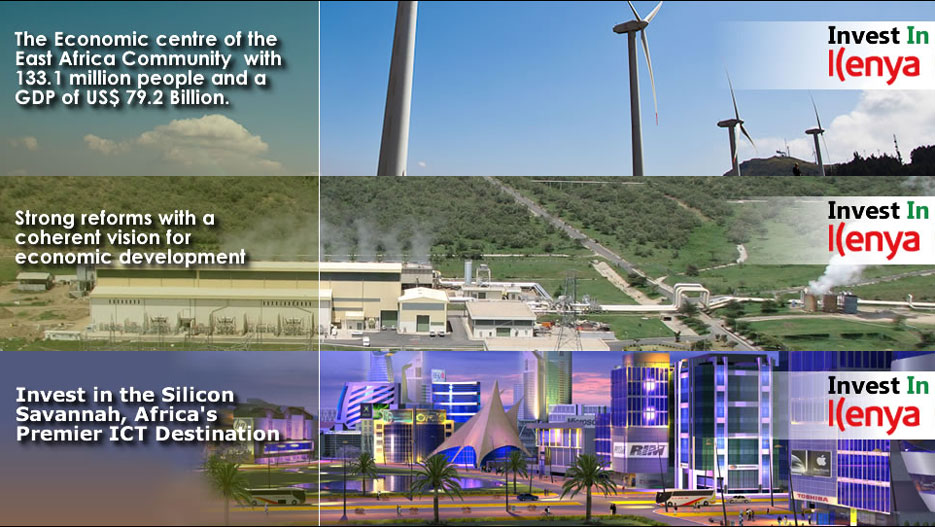

Our functions are actually three. One is investment promotion. This involves telling investors why they should choose Kenya, and what’s so good about our country. We tell them about our strong economy, our strategic location, the hub status we enjoy as a country, we tell them about the quality of our human resource and the market access you can achieve if you locate here, and all other such factors. We then also tell them where the opportunities lie, in which sectors and in which counties. We have 47 devolved units of government, so we let them know what kinds of opportunities are available in each of these counties. We also tell them about the investment procedure and everything that’s involved. This sums up our investment promotion activities, which we carry out through conferences, some of which we attend, others that we organise ourselves, along with those organised by other agencies. These are forums where investors are present, and we take advantage of the audience and tell them about the great project that Kenya currently represents. Our second function is that of investor facilitation, so that when an investor has identified an opportunity and has decided they want to invest here, we then provide them with facilitation services. This can involve anything that an investor requires to settle down, such as providing them with advice on how to register their company and how to do this speedily, as well as advising them on how to obtain work permits, or if they are looking for land, for local partners or somewhere to stay, school for their children, etc. Anything an investor needs. Our third function is post-establishment or after-care support. This is where a company has already been set up and is in operation here, and we keep an active account management system, so that we have officers who regularly keep in touch with the company, whether through physical visits or via email or telephone – just to make sure if the company is doing fine or whether they are facing any issues, be it as a result of a policy change, a conflict with competitors or anything else, which we can then take up and refer to the relevant government agencies for resolution. A recent example is Uber taxi. I believe when they set up the technology, it caused some issues here in Nairobi, as has happened in other countries, and within a few days, we were able to bring together the agencies and provide them with security with regard to competition in the country. We were able to ensure the matter was resolved within a few days.

A few reasons why investors should consider Kenya as a top investment destination include: tax treaties, investment promotion and protection agreements that are being put in place, the country’s stability, the implementation of regulatory reforms, the country’s strategic location, etc. Could you list for us the main reasons why you believe investors should come here and perhaps explain in a little more detail all of these positive aspects that make the country stand out?

Our Kenya Vision 2030 is a very transformative initiative that seeks to ensure there are no Kenyans below the poverty line by the year 2030, with the average Kenyan earning at least USD 3,000 and aiming for a very modern, middle-income, industrialized economy, together with up-to-date infrastructure and communication services and a clean environment.

The number one reason why investors should come to Kenya, if they are not here already, is the fact that it makes for a very compelling economic case, with a very strong economy, plenty of investment opportunities, and the returns to investment are very competitive, among the best available. Recent reports have, for instance, indicated that if you invest in the real estate sector, Nairobi has the highest returns in the whole world, followed by Mombasa, which is our second largest city; the third being a state in the US. This is just one sector, where the returns to investment in this country are very high. And we then have many investment opportunities, supported by our Kenya Vision 2030, which is a very transformative initiative that seeks to ensure there are no Kenyans below the poverty line by the year 2030, with the average Kenyan earning at least USD 3,000 and aiming for a very modern, middle-income, industrialized economy, together with up-to-date infrastructure and communication services and a clean environment. Essentially, a country our people can be proud of. As a result of this vision, opportunities have arisen across all sectors, whether you are interested in megaprojects, medium-sized or smaller projects. This is the number one reason. To sum up, we have the opportunities and the economy is very strong, with an average growth rate in excess of 5% yearly over the past two decades. Last year, when the Sub-Saharan Africa average was 3.3% growth, Kenya’s was 5.6%. We expect growth above 6% this year, and our target is to reach double-digit growth of 10% and above, and maintain it at that level. The fundamentals are strong, in terms of the economy.

Second, comes the quality of our human resource. When you ask multinationals that have chosen to locate here and make Nairobi their continental headquarters, they will tell you that this is one of the reasons that prompted their move. When you combine the productivity of our workers with the cost of wages, you will find that we are competitive in very close terms to even China and India. The value for money you get, in term of the wages you pay, is very strong. This is an advantage that Kenya seeks to retain for a long time, going forward, because both public and private investment in education remain very high.

The third reason is that when you invest in Kenya, you have a lot of market access. You have a big and growing market, firstly when it comes to Kenya itself: we have a population of 44 million, growing at a rate of 2.1% per year. In terms of the share of the population that is middle class, we are in the lead in Africa, according to research by the Africa Development Bank. Since the middle class is what represents purchasing power, consumption has been a major factor in accounting for the economic growth we are currently experiencing as a country. As such, Kenya itself provides you with ample market access, given its young population. Around 70% of the population is below 35 years of age. This means they are very modern, with preferences similar to those elsewhere, as well as being very educated. We have among the highest literacy rates, together with high levels of social media activity, internet and mobile phone usage. The Kenyan consumer is very sophisticated and savvy, which is very attractive to companies who are investing here.

But besides the Kenyan market, there is the East African market, which is a customs union, operating more or less like a single market, because tariffs are being brought down and barriers are being continually removed. This means you can easily move capital, labour and services within the entire region, which represents a market of 140 million people. Other economies in East Africa are growing equally strong, perhaps even outpacing Kenya in some cases, despite being smaller economies. Uganda, Tanzania and Rwanda are all growing very nicely. Moreover, we are developing a transport corridor connecting Kenya and Ethiopia, which has 98 million people and so it is a large market and their incomes are also increasing. Therefore, by connecting through the LAPSSET (Lamu Port Southern Sudan-Ethiopia Transport) corridor, you are able to gain access to further markets. Beyond this, we are also members of COMESA, a common market for Eastern and Southern Africa, including 19 African countries with a combined population of 450 million people. When you locate in Kenya, you are able to sell across that market. Even better, the region’s countries have agreed to form a tripartite free trade area, which encompasses the East African Community, COMESA and the SADC. This will create a free trade area of 600 million people, thus becoming the world’s third largest market behind China and India. This gives you a glimpse of the market that a company operating from here is able to serve.

We also have access to the US market under the AGOA, the Africa Growth and Opportunity Act (2000) encompassing 6,000 products, which allow for both quota-free and tax-free access to the US market. In addition, we have access to the EU market, through Economic Partnership Agreements, all of which endows us with strong market access. Besides this, Kenya is also pursuing a number of special status agreements. We already have one with Ethiopia, whose market size I have already mentioned. We have another with Nigeria, with its population even larger than Ethiopia. These kinds of arrangements allow us a great deal of market access.

The next reason why it’s very advantageous to locate here is Kenya’s hub status. We are located in a strategic position, which allows access to all regions. So, whether you are looking for financial services, telecommunication services, diplomatic services or transport services, Nairobi is a hub. I will give you an example. Kenya Airways is a member of Sky Team and you can reach five destinations within Africa very conveniently, as well as connecting with Asia, Europe, the Middle East and the Americas with ease. Kenya Airways now flies directly to Guangzhou in China, and it is finalising negotiations with Japan, in order to fly directly there. We have also qualified for Category 1 with the US, and I believe it’s a matter of time before we will be able to fly directly to the US.

With those markets in mind, coupled with the connectivity, you can see why it’s very good to do business in Kenya.

I will give you another example of how convenient it is for business people. There are cases of business people who may fly from Nairobi to another destination at 10pm at night through Kenya Airways or one of its partners, spend their night in business class, in the morning they’re in London say, do their business, then return home in the evening, so this is quite convenient.

There are many other reasons why Kenya is a good place. Your investment is safe. We have a very strong political democracy and our country has a track record where the government has never confiscated private property, so we respect private property as a country and this has been the case for a long time. We also have a very strong private sector, led by the Kenya Private Sector Alliance and the Kenya National Chamber of Commerce and Industry, so if investors are looking for partners, they will easily find them.

To round off this question, I would say that all this is reflected in the companies that are already located here and their performance, such as our largest company, Safaricom, our banks such as KCB, Equity, or even our manufacturing companies, including cement and beer manufacturing, all of which are returning significant profits and are continually growing. We also have a huge multinational presence, which is an indication that it’s good to do business here.

Clearly, if investors don’t come I don’t know what else would bring them here…

Yes, and if you look at the last three to four years, we have seen unprecedented acceleration in foreign direct investment. In 2013, it increased by 8%, in 2014 by 93% and last year by 46%, so you can see that growth in FDI is very strong indeed, and expect this to continue robustly for several years to come.

What is your assessment of doing business in Kenya? How easy is it for foreign companies to adapt here?

That is actually a further reason why it makes sense to choose Kenya, because the agenda conducive to a good business and investment climate is a top concern for our government, so there is a cabinet committee keeping track on the ease of doing business, together with an inter-institutional dedicated unit which brings together different departments, in order to craft solutions to any challenges identified by business people and making sure these are addressed. By the end of this year, we will be opening a one-stop-shop for investors, with the aim of making things even easier for them. As a result, Kenya moved 21 or so places in the World Bank’s ease of doing business rankings, a result which goes to show the reforms we are undertaking. We have modernised our laws with the Companies Act, the Insolvency Act, Business Regulations Law, Procurement Law, Public-Private Partnership Law, all of which make for a brand new set of laws, including the Constitution itself. In doing so, we have removed all the burdensome regulation, and the process is ongoing. We listen to investors to understand what constraints their business still face, and we now have the relevant institutions crafting solutions to remove those. What is happening is really encouraging. Besides this good showing on the World Bank’s ease of doing business rankings, we are targeting an even better rank, because last year Kenya reached rank 108 out of close to 200 countries, which is respectable, but we aim to be among the top 50 by the year 2020.

If you look at the World Economic Forums and the Global Competitiveness Index, which is also published yearly, the areas where Kenya has had an outstanding performance are in its ability to innovate, the quality of the environment, the legal rights index, the quality of education, the strength of our financial services and ease of access to credit. All of these are indicators where Kenya has been doing well when compared to the world average. In terms of the Legal Rights Index, I believe Kenya was the world’s No. 1 two years ago, so we continue to enjoy many rights and freedoms in this country. As I said, this is a very strong democracy, where freedom of speech and association are very jealously guarded.

When it comes to ICT, we have been ranked by the Brookings Institution in the US as being the world’s No. 1 in terms of financial inclusion, thanks to mobile money innovations. Nairobi has been voted as Africa’s most intelligent city in terms of ICT use. The city has also been voted No. 11 in the world, in terms of its ability to reinvent itself, together with liveability and other aspects. It has also been voted ‘entertainment capital of the world’, in terms of the entertainment options it offers.

The country has also invested heavily in infrastructure. If you look at our power, we currently have more electricity than is being consumed, for the first time ever, and the decision is to continue investing in generating more power, so that we may see costs come down as a result of supply being far greater than demand, thus further encouraging companies to set up here. We have also built a great number of new roads, so that our paved road network is large in terms of total kilometres. By the middle of next year, we will have a new standard-gauge railway in operation, which is expected to reduce logistics and transport costs by up to 50%.

Issues relating to security, the fight against corruption and improving governance are all receiving the highest attention, by firming up measures to address them.

On the other hand, what would you say are the main challenges to be faced? What are the main problems that foreign companies might face upon arrival?

One of the key issues here is that many companies will face more competition than they would in many other parts of Africa, because as I mentioned our private sector is already quite strong. But for companies who are not scared about competition, this is a good ecosystem. Even though there may be competition, it is useful to work within an ecosystem where you can call upon other companies able to provide you with other services through sub-contracting.

As far as other challenges go, we can’t say that we are where we want to be, in terms of our reforms. We want to further reduce the time it takes to register a company, we would also like to speed up and improve the process of obtaining work permits and other immigration documents; we would like to streamline the land registration process, as land is crucial for investors. These are all factors we are working on. We would also like to improve investment incentives and policies even further, in order to make the country even more attractive to investors.

One advice I would also give investors is that before starting to work with any agents, it is worth receiving advice from public agencies like ourselves, in order to better guide them and introduce them to more professional service providers, thus allowing them to fast-track their business.

Kenya is a country with many investment opportunities in all kinds of sectors. Some of these include, as you mentioned, infrastructure and power generation. You also have natural resources, building and construction, manufacturing, ICT, tourism, agriculture, etc. Which are the most relevant ones to be considered, in your opinion?

Thank you very much for this question. In our Kenya Vision 2030, which is the main framework guiding our country, we have singled out certain sectors, in order to drive that vision. No. 1 is agriculture, No. 2 is manufacturing, No. 3 is tourism, followed by ICT, wholesale and retail trade, to which we have added mining and oil, because we have recently discovered natural resources. These are the key sectors identified to drive the vision.

Now, there are many opportunities within these sectors. Let me give you an example of the industrial transformation programme. Industrialisation is a key focus, since as I mentioned, our vision is to become a prosperous, industrialising, middle-income country, where our citizens are wealthy and proud of their country, so industrialisation is crucial, in terms of creating employment and creating wealth. The industrial transformation programme focuses on three main areas, first of which is agro-processing, i.e. adding value to our agriculture, since agriculture accounts for a large percentage of our economy as we speak, and our industry is also quite dependent on agriculture, yet we sometimes lose close to 40% of our produce due to inadequate post-harvest management. Agro-processing is therefore a number one priority, and we are setting up large schemes, such as a 1 million acre irrigation project, where the government has identified land to irrigate and create a number of enterprises for in situ processing before selling to the market.

The second priority sector in the industrial transformation programme is that of textiles and apparels, i.e. clothing. We feel we can be very competitive in this regard, given that the cost of power has come down and we have geothermal steam, which can be used in part of the manufacturing process, so we are planning to build a couple of textile cities.

The third one is leather processing. In Africa, we are second only to Ethiopia, in terms of the livestock population, so we would like to build a strong leather processing industry. Last week, we launched a 500 acre ‘Leather Pack’, which is a special economic zone, where all leather-processing businesses can be brought together to add value to leather, by producing articles such as shoes, leather jackets, etc.

Those are three key areas, but we also have opportunities in tourism, which is a crucial sector for us; as well as in housing, where we have a deficit of between 150,000 to 200,000 units every year. When it comes to construction, we also have many infrastructure projects, not only in Nairobi and Mombasa, but also in all the other counties, together with the construction of housing and residential space.

We also have opportunities in education, especially for training technical personnel, i.e. technicians. Because the economy is growing, demand for technicians is high, and we need investors to come in and produce good technicians in different areas. The health sector is also worth mentioning, as all our 47 counties are set to have a referral hospital, i.e. a large modern hospital for each county. Again, this requires a good deal of investment from the private sector. ICTs are also vital. As I told you, Kenya is among the globally-recognised players in this regard. We have M-Pesa, the mobile money transfer service, which has made Kenya No. 1 in the world, in terms of financial inclusion, so ICT remains a sector, and we are building Africa’s largest Technocity. We have 5,000 acres of land set aside for this project. Basically, I would say that we have opportunities across all sectors, and rather than even saying which sectors are our key priority, we are essentially looking for quality investment projects across different sectors.

How do you see the country evolve in the next 2 to 3 years?

Our economy, as I said is on a growth trajectory. We have elections next year, and our country usually experiences a small dip in growth whenever an election is held, after which it picks up again. This year, we are determined for things to carry on smoothly and not go through any dip, and so I am actually very optimistic for the next two years, given that the economy has been growing very strongly and it has momentum. There are many infrastructure projects in the pipeline, such as new power-generation projects which are due to be commissioned any time now, the standard-gauge railway will be ready soon, and there are several projects due to be launched over the next two years. These infrastructure projects are going to give the economy an even bigger boost, in terms of growth, so I see our economy accelerating and getting stronger by the day. Kenya has already joined the ranks of middle-income countries, albeit at the lower end. We now have a per capita income of about USD 1,500, which already places us within the middle-income range. As such, I see the economy strengthening further over the next two years. In terms of investment, I see us hitting close to USD 3 billion in the next two years or so.

What would be your final message to the international business community and investors considering Kenya as a destination, in a nutshell?

My message to investors who have been considering Africa and East Africa in particular, is that Kenya is ready and open to them. We have some really amazing opportunities, given that Kenya is transforming at a very rapid pace, and they just need to look at what has been happening over the past 4-5 years, in order to understand the growth, dynamism and vibrancy of the economy. At KenInvest, we are here to help and provide them with all the information they need, hold their hand and take care of them as they invest and go forward. I would also encourage them to adopt the joint venture model with local investors, because we have very aggressive and let’s say very effective people in this country, and when you form partnership, you can be sure that your investment will grow much faster than if you simply go alone.

My parting shot is that you are all welcome, we are ready to be your facilitators as investors and we believe that you will be glad that you made the decision to come and invest in Kenya.