Gulf Bank: Strategy to Become the Best Bank in Kuwait

The story of Gulf Bank can be classified as the “rags-to-riches-to-rags-and-back-to-riches-again” story. Why? Read about the inspiring success story of Gulf Bank.

Gulf Bank’s “Rags-to-Riches-to-Rags-and-Back-to-Riches-Again” Storyline

Everybody loves a “rags-to-riches” story where someone starts with nothing and overcomes every obstacle and adversity to achieve success and reach the top. Even more dramatic is the “rags-to-riches-to-rags-and-back-to-riches-again” story — i.e., the one about the individual or institution who struggles to the top, loses or almost loses it all, and is saved by someone who then leads him, her, or it back to success.

The latter is the story of Kuwait’s Gulf Bank, and the name of the leader in this instance is Michel Accad.

A story about the individual or institution who struggles to the top, loses or almost loses it all, and is saved by someone who then leads him, her, or it back to success.

Rags to Riches

Gulf Bank was established in 1960, began operations in 1961, and grew to become the second largest bank in Kuwait, and one of the most respected brands, not only in Kuwait, but across the entire Gulf Region.

The Fall

Then came the collapse of the Wall Street derivatives bubble and the world financial crisis of 2008. Gulf Bank was one of the first and hardest hit and it was late October when rumors surfaced that it was suffering losses of $800 million. Panic spread and Gulf Bank was the first and only bank in the Gulf region to have a run on the bank.

Gulf Bank’s then Chairman of the Board resigned as a direct result of the crisis of 2008. Lightning struck a third time when the Kuwait courts ordered a moratorium on trading in Gulf Bank shares, followed shortly afterwards by suspending all trading on the Gulf stock exchange.

The Kuwait government immediately insured depositors in all banks, ending the run on the bank, and the Central Bank of Kuwait took action to supply funds. Eventually, it became clear that the rumors of an $800 million loss had been too low — Gulf Bank’s loss on a derivatives loan that turned sour were nearer US$1.4 billion.

Thanks to the timely action of the Kuwait government and Central Bank, the crisis passed, but not without Gulf Bank becoming the poster boy for it.

Now began a long period of soul searching for Gulf Bank, as it contemplated the long hard slog back up to the top again. While Gulf Bank’s fall had been halted by timely action from the government to bail out all the banks, it still wallowed in a slough of low self esteem. If it were to successfully rebuild, Gulf Bank realised it would have to find new and dynamic leadership.

The man for the job – Michel Accad

Gulf Bank found all it needed to regain its position in the marketplace in the person of Michel Accad, whom it named as Chief Executive Officer (CEO) and Chief General Manager (CGM) of Gulf Bank in August 2009.

Accad is a Lebanese national who was educated in the US (University of Texas, Austin, MBA Honors, 1978), who joined Citigroup in 1979 where he rose to hold many senior positions, including Division Head for the MENA region, based in Cairo, Egypt. He later went on to become assistant CEO of Arab Bank in Jordan, where he was responsible for all banking business globally, including corporate banking, investment banking, retail banking, private banking, credit and treasury. In addition to his role as assistant CEO, he served on several Boards of the Group, including Europe Arab Bank, Arab Tunisian Bank (as chairman since 2008) and Arab Invest (the investment banking and brokerage arm of the Group).

Accad’s express mission on coming to Gulf Bank was to rebuild the Bank to its former position as a model of growth, profitability, and success in the region. Accordingly, he came in with a clear and objective eye, quickly assessing Gulf Bank’s strengths, finding innovative and imaginative ways to build upon them, and discarding everything else that distracted from them.

Rebuilding Gulf Bank

“We looked at a number of important products – important from our clients’ perspective – and what it was that our clients wanted? They wanted speed and reliability, so if we could deliver the loans the same day or provide a credit card the same day that would make a big difference.”

He began the rebuilding of Gulf Bank with two decisions that would serve as the granite foundation for the Bank’s rise back to success. First, he identified that Gulf Bank’s greatest strength was in local banking, primarily retail banking and commercial local banking. This meant that Gulf Bank would give up all thought and effort of becoming an international or Gulf regional banking leader; it would concentrate on serving the Kuwaiti market.

Accad’s second decision followed on from the first: it was to concentrate on how to serve the local retail and commercial market better. His essential insight was that, as he explains it, “You see, when there is no or limited competition in price—in the retail sector, for example—then, the competition has to be either in product innovation or differentiation in terms of service quality. We have decided to focus on service quality: how can we provide the best and the fastest services to our clients?”

Taking up on this insight, Accad concentrated on how Gulf Bank could achieve the best and fastest service, and this is what happened: “We looked at a number of important products – important from our clients’ perspective – and what it was that our clients wanted? They wanted speed and reliability, so if we could deliver the loans the same day or provide a credit card the same day that would make a big difference.”

Once decided, Accad says that “It took about a year working internally to remap our processes, change our IT system and upgrade our credit scoring that would eliminate most of the subjective judgment that is involved in every retail banking decision. A lot of work went into it.”

Imaginative Bank Marketing Borrowed from the US Pizza Industry

But Accad knew that simply revamping procedures and IT would not be enough; the idea had to be sold to the public that Gulf Bank was the best and fastest.

Here, Accad had his most brilliant insight, which he borrowed from the pizza industry in the US. When ordering pizza as a student back in Austin, Texas, in the 1970s, he recalled that all his fellow students knew that Dominos Pizza had the fastest delivery time. Tom Monahan, CEO of Dominos, came up with the idea of advertising a guarantee on fast delivery of Dominos Pizza, which propelled Dominos’ reputation into the public consciousness. America’s pizza website, All Recipe Pizza, recounts how Dominos reputation went “viral” (as we would say today) when it “was parodied by the Teenage Mutant Ninja Turtles movie which specified the “pizza dude has 30 seconds” to complete the delivery. The Turtles’ pizza was late and they received a refund of $3 for “being two minutes late, dude!” However the benefits to Domino Pizza were enormous” as Dominos quickly became famous for fast delivery. From that point on, Dominos Pizza meant fast delivery.

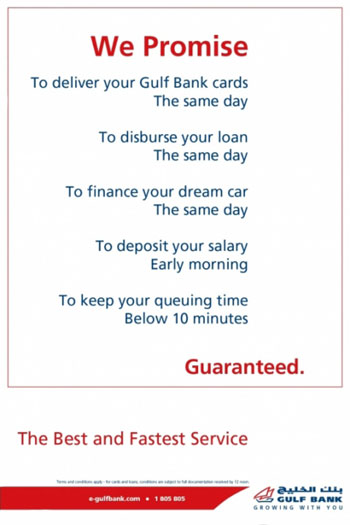

Accad wondered if the same idea might work in the banking industry. So, Gulf Bank crafted a public relations and advertising campaign to achieve the same results. Called the “We Promise” campaign, it consisted of five specific promises for the fast delivery of banking services which are emblazoned in every branch office and advertised in the media. These promises are:

1. We promise to deliver your Gulf Bank cards, the same day

2. We promise to disburse your loan, the same day

3. We promise to finance your dream car, the same day

4. We promise to deposit your salary, early morning

5. We promise to keep your queuing time, below 10 minutes

—Guaranteed

These promises appear on signs, placards, and advertising with the strong identifying message: “The Best and Fastest Service – Gulf Bank.”

Introduced in October 2011, the advertising and PR campaign was instantly successful. Gulf Bank reported that “the program has existing customers enthusiastic, and has also attracted many new customers.”

According to Accad, “Since we introduced the ‘We Promise’ campaign in mid-October of 2011, the daily loan and credit card volume in Gulf Bank has increased by 50%. I think that is remarkable and I believe that right now we are essentially the leader in the market in terms of new loans, which is in large part due to this exercise.”

The Key to Gulf Bank’s Reorientation

Accad never tires of reminding one and all, “Remember, the vision is to be a local retail and commercial bank,” which means that, “Our ambition is to be a dominant player in the local retail andcommercial  banking space. Being a dominant player means you really need to have something like a15% market share. Today, we are far from that; we’re in the range of 11 or 12% depending on the specific product. Of course, I don’t expect to reach 15% in four or five years organically, but the focus of our next plan is indeed to expand our market share—possibly by up to a couple of percentage points—without sacrificing our profitability. So, over time, year on year, we would like to see some improvement in our market share, and this happens by definition if we are able to grow faster than the competition.”

banking space. Being a dominant player means you really need to have something like a15% market share. Today, we are far from that; we’re in the range of 11 or 12% depending on the specific product. Of course, I don’t expect to reach 15% in four or five years organically, but the focus of our next plan is indeed to expand our market share—possibly by up to a couple of percentage points—without sacrificing our profitability. So, over time, year on year, we would like to see some improvement in our market share, and this happens by definition if we are able to grow faster than the competition.”

Concentrating on being local means foregoing the larger regional and international banking market, but Accad sees this as Gulf Bank’s advantage, as he explains, “There are other banks that have a big focus internationally or regionally; if you look at the big ones like NBK or even Burgan Bank, a substantial and growing portion of their business is generated internationally and for them that’s very important. Therefore, their focus is not solely on the local market, and that gives us an edge, because when you’re more narrowly focused then you can focus on that one thing probably better than someone who is focused on several things.”

Similarly, Accad has no qualms about the successes of other Kuwaiti banks in the regional or international fields. “My aim is not to be bigger than Burgan Bank or NBK,” says Accad. “My aim is to grow our market share locally, and if they grow their top line faster overall thanks to their international business that’s fine, I’m very happy.”

‘The Proof of the Pudding’

The results of Gulf Bank’s reorientation under Accad’s leadership are uniformly positive, as Accad explains:

“Gulf Bank was the only bank in the region to receive both a rating upgrade as well as an improved outlook in Standard & Poor’s latest assessment. S&P’s decision is a great endorsement of our excellent management team, its strong leadership and our dedicated work force, as well as our risk management systems and controls.”

“Feedback on the consumer side has been very positive, for example in terms of the ‘We Promise’ campaign and the quality and speed of the service that we offer our clients; I think this has been very much appreciated. On the corporate banking side, I think the feedback has been positive from clients who have faced some difficulty; they know that we don’t automatically pull the rug from under them.”

“Of course, there are cases where we think there is no hope and it’s better for the customer and for us that we liquidate or terminate the relationship, but those cases tend to be the minority. In most cases, we work very closely with the customers who have had issues and when the customers recover, they are very appreciative of what we do.”

“At the same time, there are corporate customers who play a very critical role in sectors such as the contracting business and the trade finance business where we are one of the leading banks. Even in project finance, if you think of the big projects like power stations and roads, essentially there are only two banks on the corporate side and they are NBK Capital and Gulf Bank.”

Recognition Success

In May 2012, Gulf Bank received the “Bank of the Year Award” from Arabian Business. This year’s award recognizes Gulf Bank’s remarkable success in giving its customers the best and fastest tailor-made services.

Gulf Bank has won several other awards in 2012 based on its remarkable customer service programs. These include “Best Retail Customer Service” and “Best SME Startup Packages” awards for 2012 by Banker Middle East; “Best Retail Bank” by Asia Banker, Best Employee Training, Best HR Strategy in line with Business, and HR Professional of the Year (Surour Alsamerai). Last but not least, the successful leadership of Michel Accad has also won him the prestigious “Banker of the Year” award by Banker ME.

2011 was a watershed year for Gulf Bank, and this was confirmed in December 2011 when S&P upgraded Gulf Bank’s rating to BBB with positive outlook. Commenting on the success, Gulf Bank’s Chairman at the time, Mr. Ali Al-Rashaid Al-Bader said:

“Gulf Bank was the only bank in the region to receive both a rating upgrade as well as an improved outlook in Standard & Poor’s latest assessment. S&P’s decision is a great endorsement of our excellent management team, its strong leadership and our dedicated work force, as well as our risk management systems and controls. It also confirms that the Gulf Bank‘s strategy of focusing on providing the best and fastest banking services is working, and is delivering the results we had planned.”

It must be acknowledged, however, that Gulf Bank’s dedication to serving the local Kuwait banking sector long predates Accad’s arrival. In May 2012 Gulf Bank was awarded the coveted “Localization Award” for the seventh consecutive year. According to Surour Alsamerai, General Manager for Gulf Bank’s Human Resources department, “This award endorses our long term strategy of recruiting, developing, and retaining Kuwaiti talent and investing in community initiatives that encourage young people to join the banking sector.” This validates Gulf Bank’s successful efforts to achieving and maintaining one of the highest percentages of Kuwaiti nationals across the private sector, as well as being the first Kuwaiti bank to achieve this.

Summing up Gulf Bank’s Story

Since its meteoric fall as a result of the world financial crisis of 2008, Gulf Bank, under Accad’s leadership and vision, has essentially re-founded, remade, and re-established itself: it has recovered from the huge losses it sustained, brought its non-performing loans to a manageable level, installed new leadership, remapped its procedures, changed its IT system, remade its image in the eyes of its customers and the general public, re-established its reputation, and reoriented itself on its core missions.

Accad himself sees it this way: “I’ll just say a word about our strategy at the end of 2009. We had a two-year strategy to rebuild trust and restore profitability and I think we have essentially succeeded; the program was to end in 2011 and the crowning achievement of this program was the ‘We Promise’ campaign.”

That is about as dramatic of a turnaround and redemption from a fall as any “rags-to-riches-to-rags-and-back-to-riches-again” story as one is likely to find anywhere.

Jumping Off-Point for the Future

But neither Gulf Bank nor Accad are content to rest on their laurels. What they have accomplished is only the jumping off- point for the future. Accad sees that future as follows:

“Now, we have just finalized our strategy for the next four or five years and it is much more ambitious – it’s longer term focused and it’s about growth aspirations and gaining market share. Within this strategy, we’ve decided to focus on a number of initiatives that would hopefully give us the edge over the competition and allow us to grow faster locally. So, we are very excited about what is going to happen to Gulf Bank over the next few years.”

Thus both Gulf Bank and Accad are confident that there will be a few more chapters to add to this story.