AMS Properties: Ronal Samani Discusses Real Estate and Property Development in Kenya

Ronal Samani gives his assessment of the property development industry in Kenya and presents AMS Group. He also mentions some upcoming projects for AMS Properties, a company focused on the residential, commercial, industrial and hospitality segments.

Interview with Ronal Samani, Director of Corporate Development at AMS Group

What is your assessment of the property development industry in Kenya?

The Kenyan real estate market has evolved tremendously and very quickly over the last 15 years. Since the change of government in 2002, there has been a great deal of optimism and Kenya as a whole has developed very fast. The real estate market in particular displayed double digit growth over a number of years but obviously, this is not sustainable as Kenya has matured. We are not at the level of other mature markets yet, but we have arrived at a middle income level economy. However, there is still a lot of growth to come for Kenya, but with this maturing comes change. There has been an increase in opportunistic investors in the market, but they should exit as the market evolves further. If the right product is provided in the right location, even in this mature market, the industry will still perform well. For example, we have recently developed and finished completion of a truly Grade A commercial development called Fortis Office Park. Within a few of months of completion, it was fully let. However, in the market today, there are also a number of other office developments which are struggling to be let out.

Could you give us an overview of the AMS Group as a whole?

To achieve our growth plans, it would be prudent to look for investors. With the evolution of the Kenyan economy, the scale of our projects has increased tremendously.

AMS Properties is our development company. One of our other group companies include Lanor Holdings, which has a presence in Kenya, Uganda, Tanzania, and Rwanda. This company is the East Africa partner of Regus Serviced Offices, which is a PLC listed on the London Stock Exchange. Together with Regus, we have fifteen business centers all over East Africa, and that number is continually growing. Viva Global is one of our other group companies, and is one of the largest beverage and wine distributors in East Africa. We have also expanded to retail operations and Viva Travel Retail is another focused-on retail operations at international airports across Sub-Saharan Africa. We are now entering into infrastructure, as well and are quite a diversified group that is always looking for new opportunities.

AMS Properties deals with residential, commercial, industrial and hospitality segments. Could you give us an overview of the history of the company and your main business segments today?

AMS started around 25 years ago in the 1990s when the economy was actually very challenging and the interest rates rapidly increased to close to 50 percent, which were truly unimaginable levels. That is when AMS entered the market and even in those challenging times, we completed our first development, Five Star Estate, consisting of 500 maisonettes, under our low to middle income housing brand. We completed this project, paid off the banks on time, and to those customers who could not complete their purchases because of the challenging times, we even refunded them without any forfeit. That created a good base for our later success in the 2000s which was one of the most successful economical periods. Beginning 2003, things began to improve, and we expanded our offering from lower income housing to middle income projects under our “Five Star” brand, which includes Five Star Meadows, Five Star Gardens and similar properties. We continued to expand into our ultra-luxury residential offering through our “One” brand, which includes One Riverside, One General Mathenge and other projects. We have diversified into commercial offices under the “Fortis” brand as a product for SMEs who want to purchase their offices, all the way up to Grade A, multinational clientele who prefer to let. We have also begun to diversify into hotels and are building our first hotel in Westlands under the Park Inn by Radisson brand, which will be managed by Rezidor. One sector we are looking for an opportunity to move into is retail although, there may be a few too many malls in Kenya, currently. We are always open to new opportunities if the right one comes along.

What are the main projects that you are working on?

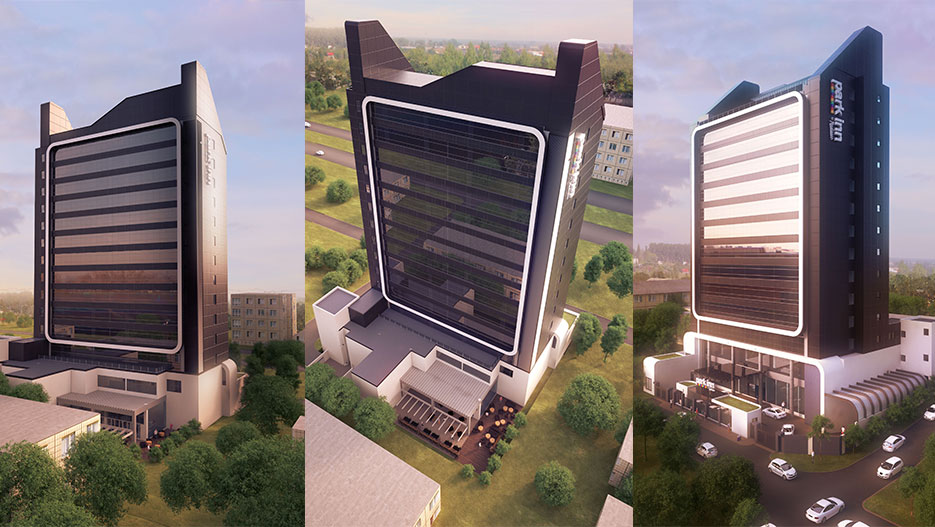

One General Mathenge is going to be complete in the next few months. It is over 60 percent sold. As it approaches completion, we obviously want to sell the last few units there. These units are truly one of a kind. They are the first one million dollar plus apartments in Kenya. We are also very excited about our new hotel, Park Inn by Radisson and are hoping to open our doors by March 2017. Recruitment and training have started, and we have just begun our marketing campaign. The Kenya Tourism Expo is currently being held at the Kenyatta International Conference Centre and Rezidor is there featuring our Park Inn by Radisson among other properties. That is something we are quite excited about. We have many upcoming projects we are hoping to start soon. The first is a new office park that we will begin to work on in 2017 in Karen. Kenya and Nairobi especially are evolving. Because of the traffic congestion, many nodes are being created. Westlands and Upper Hill are two nodes that are already quite established apart from the old CBD. Now, there are new nodes such as Gigiri, which is near the UN, and another area called Karen. In Karen, residential properties were always being developed, but now offices are on the rise. We will soon start marketing our new office park there. We are also thrilled to be starting work in 2017 on a large mixed-use development project in Upper Hill. It is a 200 million dollar project which will encompass retail, hospitality, office, and residential offerings. There are a number of additional opportunities we are about to embark on in Western Kenya and Rift Valley, as well, such as a new residential project and a new commercial project, in order to take advantage of the new constitution and devolution.

Are your projects mainly in Nairobi?

We use the term “Greater Nairobi” because Nairobi is actually a county. We have expanded into Machakos County, which could be considered part of Greater Nairobi, but it is actually in a separate county. All the regular pre-approvals come from that county. Machakos County is located just beyond Jomo Kenyatta International Airport. Kiambu County is another area where we are active. We completed a project there in 2015 called Five Star Meadows which was very successful. We then completed development and got approval for Five Star Paradise, over 200 villas for customers in the middle-income bracket. There is actually quite a lot of interest in this project even though formal marketing is yet to commence, which we intend to start in early 2017. Up to now, Greater Nairobi has been our focus, but with this expansion into Western Kenya and Rift Valley, we are also looking at many other opportunities in East Africa where we already have a presence with our group companies.

What are some of the company’s most significant success stories?

The main success story is getting satisfied customers. In fact, it is much better hearing first-hand from customers how happy they are living in or working in a property we have sold to them. We hear many stories like that. That is not to say that we do not have one or two dissatisfied customers, but we always learn from them. The majority of them are satisfied, and that is the best satisfaction that we can have. Five Star Estates was our first project in the 1990s and this was a good success story in creating that base for us. Financially, the projects which we undertook in the following decade were much more successful. We have received accolades in the International Property Awards with quite a few commendations for the majority of our projects. This culminated in the latest award we received, which was for the best upcoming hotel not only in Kenya, but in Africa as well, for our innovative design with our Park Inn by Radisson in Westlands. It was not even planned, but some people have started calling it “The iPad.” Who knows if it will stick but it gives the project that additional marketing buzz. We were the first real estate company in Kenya to be awarded Superbrand status, and we continue to maintain that status. One Riverside Drive also won the Best Residential Real Estate Infrastructure Development in Africa in 2012, a development by AMS Properties.

How would you describe the philosophy of the company? What makes you different from the competition? Why should potential clients buy from you and not someone else?

Our motto is “Building Kenya – Creating Lifestyles.” We have helped quite a lot of people to do that in the last 20 years. We handle the whole process, from design to project management to sales and are involved from the Director and Board level all the way to the people onsite. Through that interaction between our teams, we can satisfy our customers much better. Our brand is something which people have come to believe in. Some developers may not have the same status as our brand, or may do things differently than us, but there are some other great developers here and we all learn from each other. We are all proud of being Kenyan. We hope we can build Nairobi’s and Kenya’s skyline together.

Is your company involved in CSR activities?

Yes, of course. We are currently a family-owned company. Individually, and as board members and corporate, we are all involved. We have been active in CSR for many decades. From informal support to individuals and orphans, to bringing people into education, we have now started assisting in more organized projects and institutions. For example, we are involved with The Dignitas Project which is a program that assists schools and educators with training, acquiring resources for education, and improving their schools. We are also involved with the Mbugua Rosemary Foundation, which was named after a couple that was tragically killed in the Westgate attacks. The program supports, motivates, and trains entrepreneurs to fulfil their dreams. We are quite proud to be a part of that. We are also very interested in the welfare of animals. People focus so much on human beings and often do not think of the need for support of animals. This is especially important in Kenya which is one of the few places in the world where we have animals in nature. Over the last few years, we have given support through the Rhino Charge event, the African for Elephants Foundation, and other projects. We are doing our part, and will continue enhancing and making a positive impact.

Are you looking for partners or investors?

To achieve our growth plans, it would be prudent to look for investors. With the evolution of the Kenyan economy, the scale of our projects has increased tremendously. It is not only about size, but also about bringing expertise. For example, our project in Upper Hill that we are going to embark upon in 2017/2018 is a 200-million-dollar project. Getting an international investor or institution with global expertise and a background in developing in more mature markets would bring in quite good value and, of course, we would be there with the Kenyan and local expertise. One of the challenges we are facing today is exorbitant land prices in Kenya. For us to continue doing multiple projects, we are also looking at engaging and partnering with land owners and institutions with large portfolios of land. We have a great brand name to bring to the table, great in-house expertise, and partners, finances, and banks who can help us in providing development finance. We are also talking to the Kenyan government and other East African governments in regards to public-private partnerships. These governments are now offering partnership opportunities where they provide the land and we provide our expertise and the finance for development. This usually results in making affordable housing even more inexpensive. We hope to utilize all these avenues in order to achieve our Vision 2030 goals in Kenya.

What is your assessment of the property development industry in the next five years? Do you foresee any major changes? As AMS Properties, what would you like to have achieved by then?

Even though Kenya is a maturing market, there are a number of opportunities ahead. Kenya is still growing at five or more percent per annum. There is much more development to come and we have seen many great opportunities, recently. A new interest rate capping bill was passed through Parliament only a few weeks ago. The President assented to it and most people, including the media, were quite surprised. Even with the lobbying of powerful players in the banking sector, the President still thought about the country and the common man first. This is a great opportunity for the housing sector and banks in Kenya are already processing three to four times as many mortgages on a daily basis now than they were a few months ago. Currently, there are just over 20,000 active mortgages in Kenya and that number should increase significantly over the next few years. We are also seeing more multinationals coming to Kenya and East Africa. This can be seen in Lanor Holdings, which is one of our related companies that serves as the East African partner for Regus Serviced Offices. This shows good promise that more growth is to come, and AMS will be a part of this growth in real estate development. We want to enhance our brand name, create more customer loyalty, and forge more partnerships with institutions, private investors, and governments. And with this, perhaps prepare the company for a full listing on the Nairobi Securities Exchange in the coming years.

Why should people consider Kenya as a business and investment destination?

There has been some negativity about Africa as a whole, recently. This has perhaps been created by those investors looking for short term returns, in areas such as commodities. With the volatility of commodity prices, some international investors have become demoralized. International investors need to start looking at Africa as a medium to long term investment destination. In this, Kenya has become savvy. International investors are looking at dollar returns, and there are many investments locally that offer these. Occasionally, an emerging market currency like the shilling will depreciate, as we saw in 2015. However, looking at a ten to fifteen year average, it only averages out to about three to four percent depreciation per annum. If you convert the shilling returns to dollar returns while taking that into account, you will find that the returns in Kenya actually significantly outweigh the returns available in other markets, especially mature economies. International investors also need to look at each country in Africa separately. Strangely, the Kenyan tourism sector was affected by the recent Ebola crisis in West Africa. We all know that West Africa is thousands of kilometers away. It did not affect us directly or even indirectly, at all. Finally, people sometimes consider the impact of elections in Africa, and their interest in investment wanes. In Kenya’s history, the most difficult time we had was the 2007 elections. Even after that, the prices of real estate did not decrease. Our last elections were very peaceful, and there is great hope for the upcoming elections to be the same. Investors need to look at Kenya as an opportunity. There are great returns to be made in Kenya for quite a while to come.