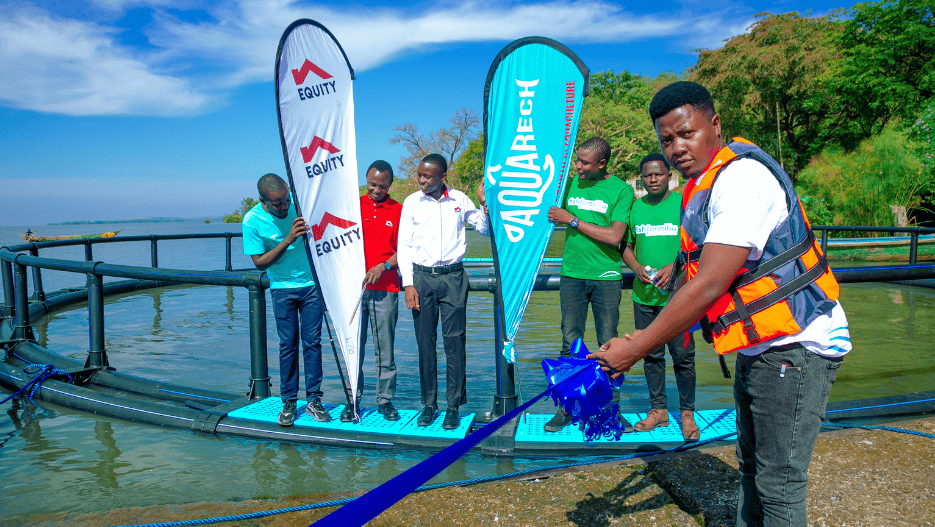

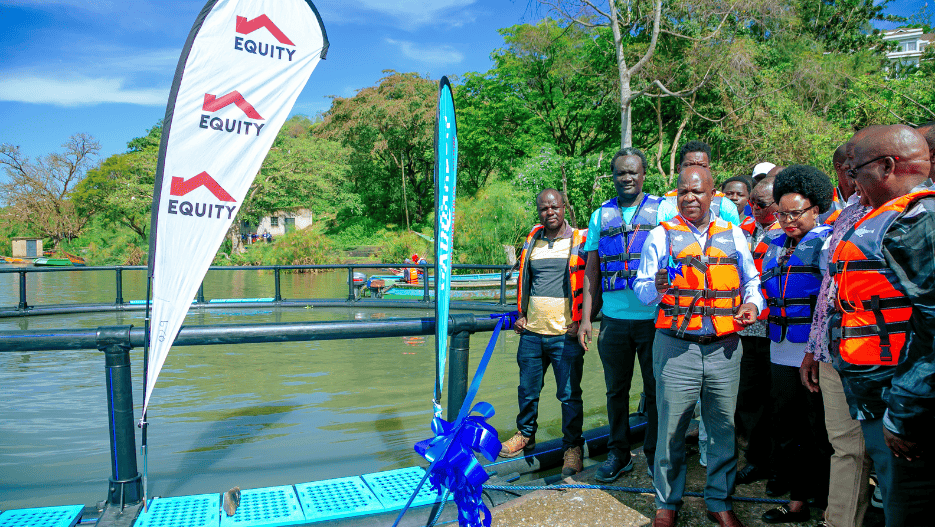

AquaRech LtD Launches AquaFedha: Africa’s First Credit Finance Product

AquaRech LTD, in collaboration with Equity Bank and TechnoServe, has introduced AquaFedha, Africa’s inaugural credit finance product tailored specifically for small and medium-sized fish farmers. This initiative aims to bridge the significant financing gap that has traditionally hindered these farmers from transitioning from subsistence to profitable, commercial-scale operations.

Addressing the “Unbankable” Challenge

Many small-scale fish farmers face obstacles in securing traditional loans due to a lack of collateral, formal records, or sufficiently large operations. AquaFedha’s innovative credit model evaluates farmers based on their production potential rather than conventional banking metrics, offering a more inclusive approach to financing.

Facilitating Commercial Transition

Access to credit through AquaFedha empowers farmers to:

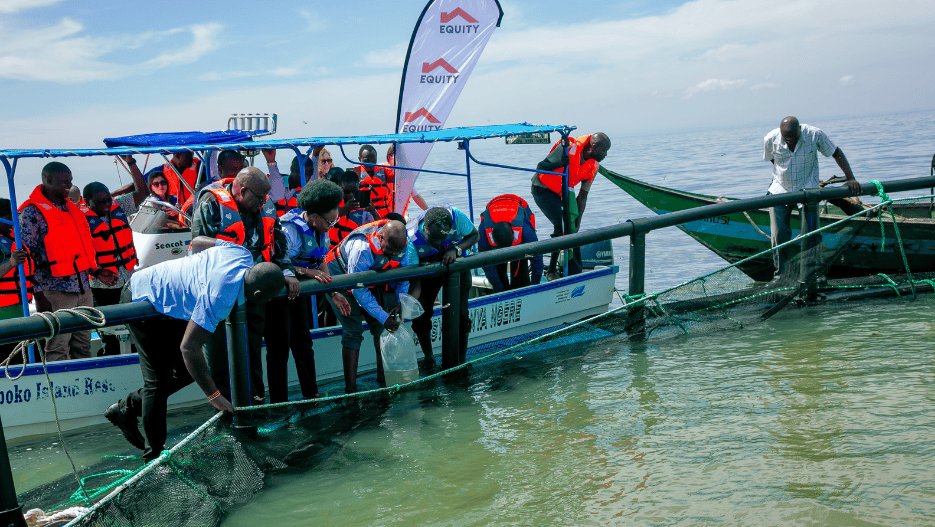

- Purchase High-Quality Fingerlings and feeds in Bulk: Reducing costs and improving fish quality.

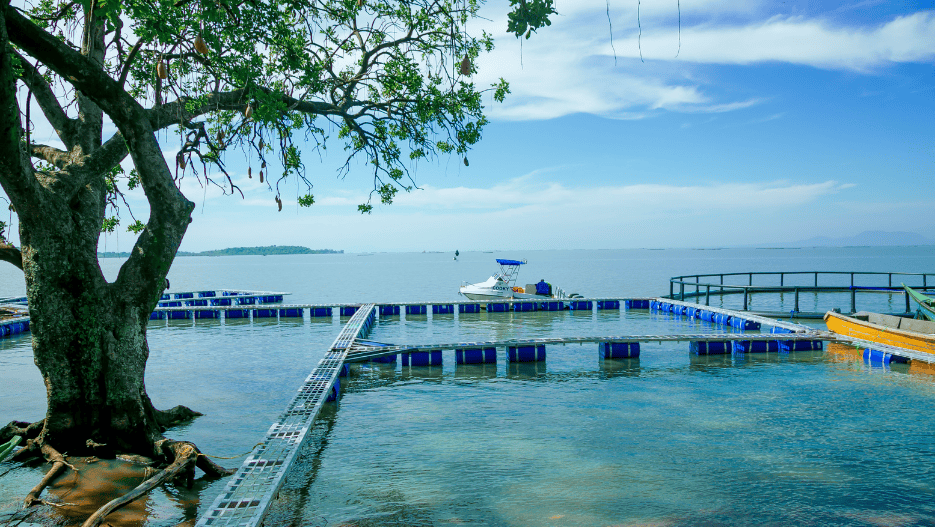

- Invest in Infrastructure: Acquiring HDPE cages and expanding pond systems to increase yield.

- Adopt Technology and Data Management: Utilizing mobile applications for better farm management.

- Consistently Meet Market Demand: Ensuring a steady supply to local fish traders and markets.

Strengthening Africa’s Food Systems

Small and medium fish farmers contribute approximately 60% of Africa’s aquaculture output but often remain trapped in poverty due to limited capital. AquaFedha aligns with broader food system goals by promoting:

- Nutritional Security: Providing affordable protein sources to local communities.

- Job Creation: Generating employment opportunities, particularly for women and youth in fish farming and processing sectors.

- Climate Resilience: Funding sustainable practices that mitigate environmental impact.

Collaborative Partnerships

The success of AquaFedha is underpinned by the synergy between:

- AquaRech LTD: Offering expertise in aquaculture training and technology to ensure effective loan utilization.

- Equity Bank: This provides a financial inclusion model tailored to smallholder needs, including flexible repayment options and digital lending.

- TechnoServe: Supporting the blended finance product through its CASA program.

Key Features for Farmers

- Affordable Loans: Access to capital for purchasing feed, equipment and facilitating farm expansion.

- Technical Support: Training on best practices and disease control to enhance productivity.

- Market Access: Connections to processors, retailers, and consumers to streamline sales.

- Digital Integration: Mobile-based platforms for loan applications, repayments, and advisory services.

AquaFedha: Transforming Aquaculture

By addressing a $5 billion credit gap in African aquaculture, AquaFedha presents a sustainable, high-impact model that uplifts farmers from poverty while bolstering local economies. This initiative is not merely about providing loans but also transforming Africa’s aquaculture into a driver of growth, food security, and prosperity for millions of small-scale farmers.

For more information on AquaFedha and partnership opportunities, please visit AquaRech LTD’s LinkedIn post.

CONTACT DETAILS

WEBSITE: www.aquarech.com

PHONE: +254-721985145

EMAIL: Daveokech@aquarech.com

LINKEDIN: AquaRech LTD