GCC and Middle East Banks

Fitch Ratings maintain a stable outlook for GCC/Middle East banks.

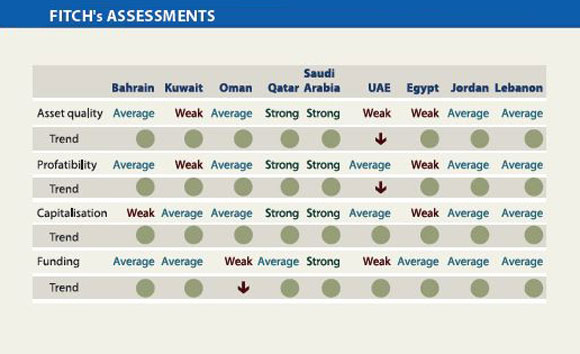

Fitch Ratings issued a report termed “2012 outlook: GCC/Middle East Banks” in which it has maintained a stable outlook on GCC/Middle East on almost all the banks’ Issuer Default Ratings, driven by the probability of sovereign support. However, the Fitch agency warned of lingering risks caused by the regional unrest in GCC and Middle East and the global situation.

The oil price has remained above US$ 100 per barrel, generating strong revenues, comfortably above budget requirements. Non-oil producers would, however, be at a disadvantage, in the absence of economic growth.

Fitch’s view of sovereign creditworthiness in the region has generally remained unchanged despite the political unrest in GCC and Middle East. Indeed, most of the rated sovereigns are on stable outlook. In fact, the majority of sovereigns in the region, especially in the GCC, are helping to stimulate their economies through government-sponsored infrastructure projects as they take advantage of their significant revenue base and sovereign wealth funds. The oil price has remained above US$ 100 per barrel, generating strong revenues, comfortably above budget requirements. Non-oil producers would, however, be at a disadvantage, in the absence of economic growth.

According to Fitch, non-performing loans have peaked. Yet, Fitch expects recoveries along with generally lower impairment charges in 2012. The Fitch agency also forecasted some loan growth in 2012 within the context of improving confidence and infrastructure projects coming on stream, thus stimulating the local economies of GCC and Middle East, but much depends on developments in the global economy. With regards to profitability, margins and fee income have been under pressure due to low interest rates and subdued volume growth. However, lower impairment charges and cost control should lead to a gradual improvement in profitability.

Most banks in the GCC/Middle East region are funded by customer deposits with little or no reliance on the debt capital markets. There is significant liquidity in most markets. In recent months, some banks have accessed the international debt capital markets (through bonds and Sukuk) to address funding mismatches and refinance maturing debt. Fitch expects this to continue in 2012, subject to market conditions, as the banks experience renewed growth.

Any change in the Fitch rating outlooks would depend on changes in the sovereign ratings in the region or a change in Fitch’s opinion of the sovereigns’propensity to provide support. As there is a very strong culture and track record of sovereign support for banks, and many banks have significant government stakes, it is highly unlikely that Fitch’s opinion on sovereign support will change in the foreseeable future.

The article above has been published as a part of Bank Audi`s MENA Weekly Monitor of Week 52 (2011). It can be accessed via Internet at the following web address: http://www.banqueaudi.com