Steel industry in Libya: Local market to drive steel demand despite global surplus

Dr. Mohamed Abdulmalik Elfigih, Chairman of LISCO (Libyan Iron & Steel Company)

When we look at the local market in Libya; we must consider that this is a transitional period, if we compare 2013 with 2012, the local market has improved a great deal, with increased demands every month. We also must consider that Libya in general will have increased demand. I consider Libya a virgin country in terms of infrastructure, and so we need a lot of projects.

Interview with Dr. Mohamed Abdulmalik Elfigih, Chairman of LISCO (Libyan Iron & Steel Company)

Libya went through some very difficult times during the revolution; do you think the business friendly image of the country has been damaged? What kind of business climate are we seeing here at the moment?

The Libyan economy is an oil based economy. The other sectors’ share in very limited. On the other hand, the Libyan market is really big. The population of Libya is about 6.5 million plus another 3 million or so of foreigners who are working here. So that’s about 10 million people inhabiting a huge territory in a big geographical area , which means that the market is very broad. Libya is a promising and emerging market.

We consider the current period to be a transition period, so we can’t really judge the Libyan economy based on this transition period. We are still dealing with a lot of consequences from the war and the revolution. However, we can say that the situation is improving; particularly in comparison to 2012.  There are still many challenges to face; principally the security situation, which is improving and I hope we will reach stability soon. The Libyan people have not yet recovered from the war and revolution; we are not yet back to normal because there was a lot of damage and suffering. It will take some time to return to normality. We must also remember the fact that there are still some who are resisting and are against the reconstruction of the state, perhaps because they don’t feel that situation will be better for them. Hopefully they will realise that reconstruction of the state and the country will be for the benefit of all Libyans, regardless of whether they were originally supporting Gaddafi’s regime or if they were supporting the revolution. We need all Libyans to work together to rebuild this country and its institutions so that we can build the country. Libya is for all Libyans.

There are still many challenges to face; principally the security situation, which is improving and I hope we will reach stability soon. The Libyan people have not yet recovered from the war and revolution; we are not yet back to normal because there was a lot of damage and suffering. It will take some time to return to normality. We must also remember the fact that there are still some who are resisting and are against the reconstruction of the state, perhaps because they don’t feel that situation will be better for them. Hopefully they will realise that reconstruction of the state and the country will be for the benefit of all Libyans, regardless of whether they were originally supporting Gaddafi’s regime or if they were supporting the revolution. We need all Libyans to work together to rebuild this country and its institutions so that we can build the country. Libya is for all Libyans.

What does the future hold for Libya? How stable is the country?

I am always comparing the situation of Libya; from 2011 and the liberation, 2012 and now 2013. The situation in general is improving, the climate is better every day. Of course this doesn’t mean that there aren’t some events that don’t support this from time to time, for example the recent events in Benghazi. I think such events are to be expected when we consider the huge war and resulting damage that occurred. I can’t also exclude outside agendas, I can however conclude that in general the situation in Libya has greatly improved.

Now let’s discuss the steel industry globally, have you been affected by the slowing of the steel sector on the global market?

When we look at the local market in Libya; we must consider that this is a transitional period, if we compare 2013 with 2012, the local market has improved a great deal, with increased demands every month. We also must consider that Libya in general will have increased demand. I consider Libya a virgin country in terms of infrastructure, so this means we need a lot of projects.

The steel sector is incredibly important to us as we are a steel manufacturer. We have to consider the local market and the international market. The international steel market is in a very bad state, the prices are declining a lot. We can say that there is almost no margin for profit. The problem is that the prices for finished steel products have greatly decreased. While unfortunately on the other hand the price of the raw material is still high in comparison. This means that the profit margin is really squeezed.

When we look at the local market in Libya; we must consider that this is a transitional period, if we compare 2013 with 2012, the local market has improved a great deal, with increased demands every month. We also must consider that Libya in general will have increased demand. I consider Libya a virgin country in terms of infrastructure, so this means we need a lot of projects. For example I think we need thousands of houses, a lot of roads, bridges, hospitals, schools and social and cultural organisational buildings. There is definitely going to be increased demand. We can see this increase in demand just from last year to this year. I think the demand for steel products in general could reach 3 million tonnes per year; I think at least 30% of this will be concentrated on rebars for the construction programs.

I also have to consider that of course now we are facing a strong competition from the private sector and as I said because the international market is down, we are facing a lot of competition from imported steel companies, who are undercutting prices. A lot of steel producers abroad have a large stock of finished products and are in need of money. They want to sell their stock of finished products at any price. We are facing an unhonest competition.  We are struggling but we are relying on the high quality of our products which I think the Libyan people are finally starting to recognise. As I said the demand for LISCO products is increasing, as is our share on the local market. Last year I think our share on the local market was not more than 50% but this year I expect it to be 80%.

We are struggling but we are relying on the high quality of our products which I think the Libyan people are finally starting to recognise. As I said the demand for LISCO products is increasing, as is our share on the local market. Last year I think our share on the local market was not more than 50% but this year I expect it to be 80%.

Do you think Libya has the potential and the energy to foster a very competitive steel industry?

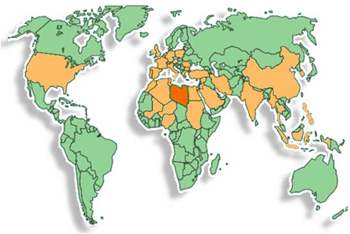

If we look at the past 20 years in which this company has been in existence, we have been covering the local market and we have also been selling our products to all the international markets; to Europe, Africa, Asia and even the United States. We mostly export our flat products, and in previous years we exported rebars, however after that due to the high demand for rebars in the local market we have stopped exporting them. We are capable of competing internationally both in terms of prices and quality.

Of course the price of energy in Libya is considered to be very cheap in comparison with international prices. If we talk about the prices of HFO, oil and natural gas, they are much cheaper here than internationally. This gives us a big advantage over our competition. Now I do think the country is reconsidering these prices and is going to raise them, although not to the same level as international prices. This of course will have an effect on our costs and our competitiveness; it will be a new challenge to squeeze our costs to get an acceptable profit margin. It will challenge us to better utilise our resources such as man power, so that we can make a profit and continue selling our products nationally and internationally. However all countries are supporting their local industries. We should also get support by having a special energy prices.

What is your current production level and what are the expansion plans? Was the pre-revolution plan to increase capacity to 4.5 million tonnes per year?

Our production level of rebars is in the range of 650,000 tonnes per year. This was not enough to cover the demand from the local market. We want to utilise this opportunity from the increased local demand and so we have made an expansion plan to increase our finished product capability of rebars to approximately 1.6 million tonnes per year. I hope this capacity will be ready to be implemented by the second half of 2014. By that time in 2014 our rebar production capability will reach 1.5 million tonnes. this will be enough to cover the local demand. In terms of the flat products, our capacity is in the range of 580,000 tonnes. our expansion plan is to reach 1.5 million tonnes in two stages. So far I think in the range of 30% of our flat products are for the local market and the other 70% are exported to the international market. Therefore our expansion plan includes increasing our share on the international market and also the local market. The liquid steel production capability as per the plan will reach 4.0 million tonnes per year.

What is the volume of investment capital that these projects require?

It will be in the range of 3 billion dollars.

Where is this investment going to come from? How are you going to finance this expansion plan?

The financing of the expansion plan has been divided into 3 parts. One part will be self financed by LISCO, another part will be financed by a loan from the local banks, and the remaining part will be financed by either local or foreign investment. This means we are looking for some investors to help finance the rest of our expansion.

Are you going to sell part of the company or are you looking for a foreign investor to loan the money?

Registering LISCO on the financial stock market is an ongoing project. After that stage some percentage of LISCO will be bought by foreign or local investors. We are also looking for some local or international investors to participate in some of our projects to cover the investment.

What are the plans for privatisation and the stock exchange? When do you plan on being listed?

I think it will take some time. Before the revolution the plan was to start this process in 2011. Obviously we are very happy that the revolution occurred but unfortunately it has postponed these plans to register LISCO on the financial market. It now depends on the general situation of Libya and its financial market. It could take some time.

What are the main strategic deals for LISCO?

As I mentioned of course we have this big expansion plan to cover the local demand for rebars and flat products. We also intend to increase our share on the international market particularly for flat products and also for some other semi-finished products that is hot Briquetted Iron (HBI) which is 100% for export.

Our government is seriously thinking of raising the energy prices, we have to squeeze our costs and maximise use of our resources. We also have to increase the productivity of our man power. The location of LISCO in Libya is strategic as it is a gateway to Africa and Europe, this gives us an advantage. The Libyan market is very promising and is emerging; this is a challenge and an opportunity for us to increase our returns.

Has your profitability come under pressure from having to cut off production for repairs or are you still profitable?

During the war we really suffered a lot of damage. Most of the factories and the infrastructure was damaged because of the continuous bombing from March 2011 to August 2011. Besides this we were also paying over 6,000 employee salaries for the year whilst the plant was completely shut down. After liberation, a lot of our workforce did not come straight back to work. We took a lot of time to resume the production line because we had to do a lot of maintenance. So last year in particular we didn’t actually generate any profit because our production level was very small and we had to pay a lot of money for repairs. I think this year things will be much better and I hope we will generate some profit. Any way the challenge during this transitional period was to keep the company running and to cover, at least, the variable costs.

You mentioned that you are looking for a foreign investor to help you increase capacity, what would be your message to any potential investors, what are the advantages of this investment?

I would say to foreign investors that firstly the Libyan market is very promising and it is emerging. Secondly I recognise that many foreign investors may be concerned that the country is not very secure yet. However I would tell them that the security level is improving and apart from a few occurrences from time to time in the southern and eastern regions the situation in general is ok. The western region and particularly Misrata has nearly achieved a normal security level. We are receiving, different visitors from different companies from the UK, Germany, Italy, the Arab countries etc. nearly every week. I invite all foreign investors to come to LISCO and Libya and to participate in rebuilding this country and I am sure that soon the security level will be even better than it was during the past regime.

You are based in Misrata which is Libya’s third city and also a hub thanks to its seaport. Can you tell us a bit about Misrata and the role that LISCO plays here as the largest company in the city?

During the revolution, LISCO gave a lot of support to Misrata, as its workshops were of the disposal of the military services. For electrical energy and water, LISCO was the only source, in particular, during the first two months. LISCO as the biggest company in Misrata, will contain supporting Misrata as a part of its social responsibility. Misrata as the third city in Libya comprises the place of several small and medium sized industries mainly those depending on the steel products as primary raw materials.

Misrata’s share during the revolution was at the front and the same will be its share in the construction and rebuilding of Libya.