Egyptian industry in 2014: Back in business after a bumpy ride

Though coming out of a challenging period Egyptian industry is showing marked signs of a steady recovery. Industry is the second largest sector in the Egyptian economy and accounts for nearly 40 percent of GDP.

By T.K. Maloy

CAIRO: Though coming out of a challenging period—both economically and politically—Egyptian industry is showing marked signs of a steady recovery.

Industry is the second largest sector in the Egyptian economy—next to the service sector—accounting for nearly 40 percent of GDP.

In the following article, Marcopolis takes a look at Egypt’s industry sector in 2014 through the viewpoints and opinions of top managers at Wadi Group, SCCT, GM, Ghabbour Auto and Engineering Square. The common theme running through the interviews with these industry heads is that there is a new climate of increasing stability and security.

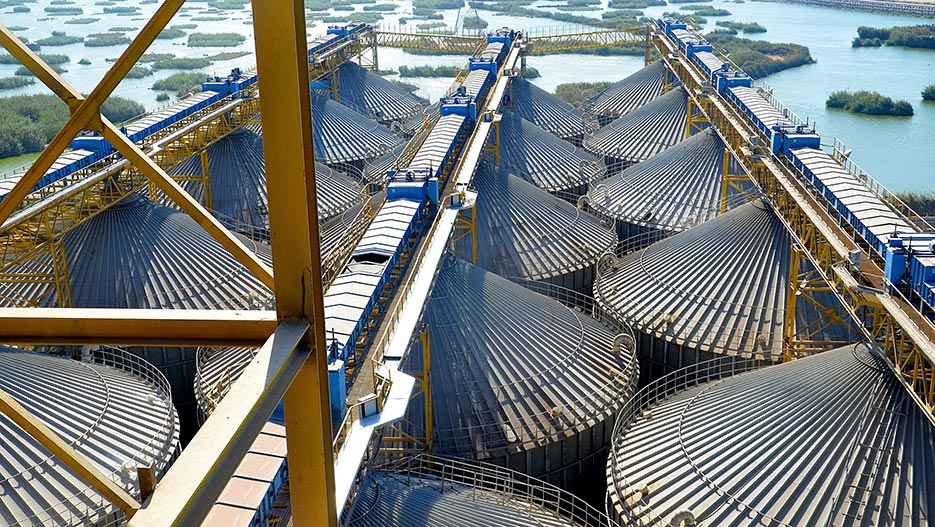

”The last few months have been like an injection of fresh air (economically) of optimism, of positive energy into the business environment of the country,” said Tony Freiji, President and CEO of Wadi Group, a large Egyptian agribusiness company, “Egypt is moving in a positive direction. And today, with the new government being formed, we are extremely optimistic about the outlook for Egypt.”

The agribusiness chief added that the current economic climate might help foster government/private sector partnerships in Egypt. ”The private sector in Egypt is extremely resourceful simply because they had to do things in an unconventional way to get through the bureaucracy and ”red tape.” Key to launching a new Egypt will be public sector partnerships with the private sector will be first in the areas of legislation and creating the right environment for the sector to grow. ”

For Klaus Holm Laursen, CEO of the Suez Canal Container Terminal (SCCT), the leading container terminal on the Suez Canal, ”There are many opportunities for logistics business in Egypt going into global trade. For the local market, it’s is also interesting as it is a 90 million person society, and so when we get stability back and we have economic growth, it is going to be very interesting to be in transport.”

SCCT registered 9 percent growth in 2013 and is expecting between 7 to 10 percent growth for the current year.

”We expect good business growth over the coming two to three years,” Laursen said.

Looking back on the challenges of the 2013 and the overthrow of Morsi and the political chaos that followed, Laursen said that ”We (SCCT) felt we had to play our part in helping the country. One way we thought we could do this was by helping young people get an entry into their work life. Together with the Arab Academy we created 155 positions last year for apprenticeships where we offer to take people from the academy… where they come to work at the facility, where we give them skills – based training for operating our equipment.”

He added, ”We pay them a salary, so not only do they get a job with real money in their pocket…but also with the training, we create job opportunities for them to get employment either with SCCT or in another part of the industry.”

Laursen added that there were three main points for both the government and private sector to work toward.

”We believe the future is right and bright for Egypt,” Tarek Atta, Managing Director of GM Egypt & North Africa

As he noted above, there is a large opportunity for growth in logistics and trade in Egypt. ”Therefore, my first vision would be for the Suez Canal and the government of Egypt to succeed in developing more business in relations to the Suez Canal.”

Laursen added that ”secondly I would like to see further development of the economy in general; to get back into what we all know Egypt for — the tourism attractions, the pyramids, the diving at Sharm el Sheikh…”

”Thirdly, there are 90 million people in Egypt and Egyptians are good workers; they like to work. Hence there are many opportunities for developing the production industry in Egypt what will create prosperity for country that today, is relatively poor, There are many opportunities out there.”

Along with the previous two business persons, Tarek Atta, Managing Director of GM Egypt and North Africa, the belief is that the country is on the right track.

”We (GM) are building on the good economy that we expect to see in Egypt in the future.”

Atta noted for Marcopolis, that the automotive-industry sector of Egypt produces 230,000 units annually, which is a low number given the size of the country’s population. ”So we think there is a huge opportunity in the market.”

”The way we are trying to position ourselves is continue investing and building our employees capabilities, investing in the facility and on building on our supply and distribution network. We believe the future is right and bright for Egypt.”

Atta noted of the chief challenges that the company has faced: ”If we take the previous years into consideration, we definitely faced challenges related to political stability with reference to what happened in the last three years.”

Osman Sever, Chief Business Development Officer, Ghabbour Auto – the leading automotive company in MENA, said that since the 2011 revolution business conditions have been negative and that for Ghabbour 2013 was a nadir in terms of sales, but the company believes overall conditions have now turned the corner.

Osman Sever, Chief Business Development Officer, Ghabbour Auto – the leading automotive company in MENA, said that since the 2011 revolution business conditions have been negative and that for Ghabbour 2013 was a nadir in terms of sales, but the company believes overall conditions have now turned the corner.

”Essentially, the issue of stability is affecting the economy in general, especially when it comes to making important decisions such as purchasing passenger vehicles or renewing a fleet of commercial vehicles. These kind of big-ticket decisions of customers have become quite difficult to make,” Sever said.

”Overall, the conditions in Egypt have been rather challenging for us. In fact, 2013 was one of the worst years in terms of business that we have ever experienced. However management’s outlook for 2014, is reasonably optimistic.”

Sever added that with the recent presidential election of former general Abdel Fattah el-Sisi, both Egyptian citizens and companies are hoping that ”Stability will prevail in Egypt and therefore, we expect to see more confidence and an improvement in the market.”

Among other details, an upswing is being reported in early 2014 statistics.

”If you look at the first few months of this year according to the statistics, the market has been picking up. I hope that with more stability, the market will recover and we will return to more positive conditions,” Sever said.

Omar Mandour, General Manager of the leading beverage company in Egypt – Coca-Cola Egypt, Yemen, Libya, Sudan and South Sudan—like his fellow Egyptian business colleagues—is optimistic about industry and the general economy going forward. Albeit, with a more cautious outlook. He noted for Marcopolis that the hard work of the private sector must be met with fiscal reform from the government sector, including investment laws.

”As a population, we are very hopeful and businesses are very hopeful, too. I believe that since the country is settling down after our second presidential election, there will be a positive mood going forward. … I believe 2015 will be very important; some of the policies and laws concerning the financial market—such as fiscal laws and some of the investment laws that may change—will then have an effect.”

He articulated the often repeated theme of security and stability being the two absolute necessary factors for the Egyptian economy and industry to move forward.

”I would say that putting the country back on track and having a secure situation is key. I think that this is one of the key challenges for the new government,” Mandour said. ”We need the country to get back on track and for it to be safe and secure.”

Marcopolis also interviewed Sameh Attia, Managing Director of Engineering Square, the largest industrial developer in Egypt, for his take on industrial opportunities going forward.

The company is the largest industrial developer in Egypt with a 3.1 million square-meter industrial park that is 85 percent built-out. ”We have about 35 factories operating. Another 25 are under construction. They should be operating very soon, within the next two to three months. Our goal is to finish 50 factories this year, God willing.”

Attia said that the EG industrial park companies already include Flex Films, and Indian manufacturer of packaging foils, which exports to 17 European countries for its Egyptian facility; German companies RKW and Doehler; Pegas from the Czech Republic; Bostick from France; Fine from Jordan and Chloride, a maker of car batteries, from Morocco.

Attia said more companies are in the pipeline for the industrial park.

”I always think that the youngest population of Egypt is a very good opportunity for everyone to work with and invest in. I never lost faith in the future of Egypt – neither before nor after the revolution, nor after the Muslim Brotherhoods and not even now. I strongly believe now we have a better chance to move forward.”

FAIR USE POLICY

This material (including media content) may not be published, broadcasted, rewritten, or redistributed. However, linking directly to the page (including the source, i.e. Marcopolis.net) is permitted and encouraged.