Libya Africa Investment Portfolio praises Malta’s business infrastructure at networking event

There was a noticeable and positive buzz amongst delegates attending a business networking evening in Malta last week entitled ‘The Past, Present and Future of Malta – Libya Business Relations’.

There was a noticeable and positive buzz amongst delegates attending a business networking evening in Malta last week entitled ‘The Past, Present and Future of Malta – Libya Business Relations’.

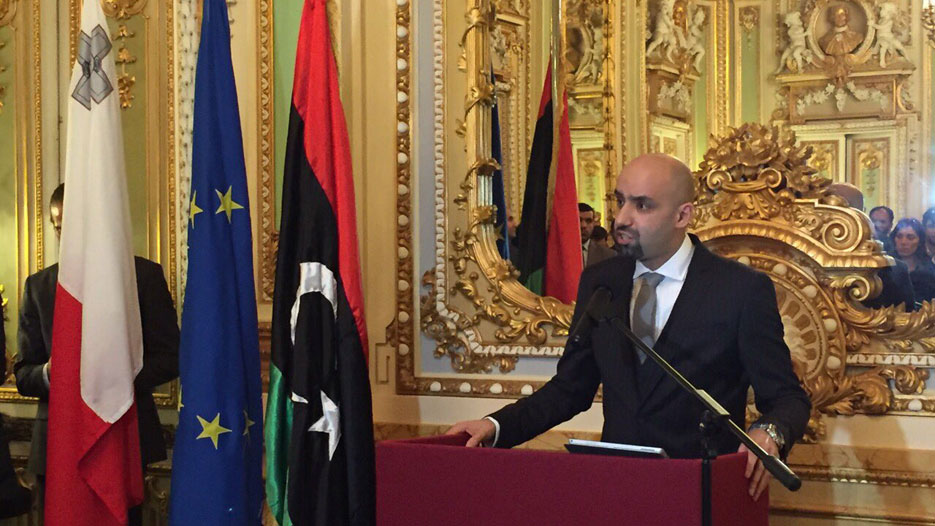

Held at the Palazzo Parisio in Naxxar, the evening’s celebrations, was hosted by Mr. Elhabib Alamin, the Chargé d’affaires at the Embassy of Libya in Malta. The event showcased businesses dealings between the two countries across various sectors and discussed plans to further this collaboration in the near future.

It was attended by representatives from a host of Malta-based Libyan businesses, as well as senior members of the Maltese government and business community and was designed to showcase business dealings between the two countries across various sectors and discuss plans to further this collaboration in the future.

The evening also coincided with the news that positive and concrete steps had been made in efforts to form a Government of National Unity in Libya, creating an extra sense of anticipation among all attending that ‘normal service’ could soon be resumed in the country.

For three very prominent organisations – Libyan Investment Authority (LIA), the Libya Africa Investment Portfolio (LAIP) and The Libyan Post and Telecommunications Company (LIPTIC) as well as this news was an added boost.

All three have established permanent offices in Malta and Ahmad Kashadah, Managing Director of LAIP, said the island served as very important strategic base to ensure business continuity during the difficult times Libya has endured over the past 12 months. He was also very upbeat about his particular organisation’s future.

‘Malta has always welcomed Libyan businesses as illustrated most recently by the support LIA, LIPTIC and LAIP have had in setting up base here while also demonstrating a strong track record in supporting ours and other businesses continued success,” he said. “Historical ties and existing bi-lateral relations are vitally important at this time as our country moves towards a Government of National Unity.

“For LIA, LIPTIC and LAIP, the physical proximity of Malta to Libya is an asset, as is its EU regulation, strong adherence to rule of law which can be coupled with the full support of a vibrant financial and investment community.”

Historically Libya and Malta have always enjoyed very strong economic ties and dependencies. As the private sector in Libya grew in the past 10 years so did trade between Libya and Malta, where it has over than doubled for the period between 2010 and 2013.

“We see this as a positive sign for our partnership in the years ahead and look forward to the time when Libya is back in its feet and these figures can reach new levels,” adds Kashadah.

LAIP is now pushing on in its development.

“The start of this year marked a major milestone in our history,” says Kashadah. “The fundamentals of our business were restored enabling us to fully control our multibillion dollar global portfolio.

“We would be foolish however to think we are completely out of the woods just yet. There are a number of issues surrounding us, some of which we can control, others which we cannot, which can still have negative impact on our activities. That notwithstanding, we now have a clear vision of our how and where we want to grow, which can be coupled with absolute business clarity and a lot of new-found confidence.”

One of the most obvious and foremost challenges facing Libya as a nation is falling oil production and relative low oil prices. This is where LAIP’s broad portfolio of global interests can make a difference.

“LAIP’s founding principles are to be a part of the ‘Libyan future generation fund’ investing Libya’s surplus oil revenues outside the country to help diversify its income away from oil and gas. This goal remains true,” says Kashadah.

“LAIP’s founding principles are to be a part of the ‘Libyan future generation fund’ investing Libya’s surplus oil revenues outside the country to help diversify its income away from oil and gas. This goal remains true,” says Kashadah.

“We have many successful and profitable investments in a number of countries in sectors such as financial Asset management, hospitality, real estate, energy, trade and technology among others,” he adds.

Younis Bishari, International Relations Manager at LAIP adds a footnote.

“Already with these various new offices and resident staff and their families joining an already significant Libyan community in Malta, we are playing a small part in boosting the Maltese economy,” he says. “From our business perspective we are currently continuing evaluating our current portfolio and future global investments, and this too could possibly include Malta.”

“Future, similar networking evenings are planned in the months to come in order to further reinvigorate trade and business relations between the two countries,” he concludes.