Saudi Arabia – No Longer a One-Basket Economy

The Kingdom of Saudi Arabia and oil are some of the oldest synonyms in contemporary history. But the kingdom has more to offer than black gold, and the government in Riyadh is working tenaciously to diversify the economy. “If you compare it by GDP, oil represents 85 percent in Saudi Arabia,” says Abdulrahim Al-Zamil, Chairman of the multi-industry conglomerate Zamil Group.

The Kingdom of Saudi Arabia and oil are some of the oldest synonyms in contemporary history. But the kingdom has more to offer than black gold, and the government in Riyadh is working tenaciously to diversify the economy. “If you compare it by GDP, oil represents 85 percent in Saudi Arabia,” says Abdulrahim Al-Zamil, Chairman of the multi-industry conglomerate Zamil Group.

The black gold has made the country with its 30 million people wealthy. With a GPD per capita of 31,245 dollars (as of 2013, according to the IMF), Saudi Arabia ranks in the world at position 29, ahead of Italy, Spain or Russia behind neighboring Bahrain, Finland and France. The Saudi budget surplus is expected to exceed 225 billion Saudi Riyal (60.75 billion Saudi Riyal) thanks to ongoing high oil prices around 100 dollar per barrel. Recently, the current windfall came under the pressure from low oil prices. The true effect of this recent development remains to be seen. Many argue that the Kingdom is well insulated, while others argue that Saudi Arabia is in for a fiscal crisis within 10 years, if the oil prices remain at US$ 50 per barrel.

Many argue that the Kingdom is well insulated, while others argue that Saudi Arabia is in for a fiscal crisis within 10 years, if the oil prices remain at US$ 50 per barrel.

While Saudi Aramco is well-known to be the biggest oil and gas company (and with an estimated 10 trillion dollars the most valuable firm in the world, according to the Financial Times), few have heard of Dar Al Arkan, Ma’aden or Savola Group.

Tales of the unknown

Dar Al Arkan (Arabic for house of corners) is one of the biggest real estate firms in Saudi Arabia. Dar Al Arkan has currently several residential, commercial and retail projects across the country under way and on June 8, the firm listed three Islamic bonds (also called sukuk).

“Real estate is a major issue in Saudi Arabia. It is the second largest sector after oil and gas. Saudis love to invest in the real estate sector,” says Mohammed S. Alkhalil, the president of FAD Investment and Development.

Ma’aden (the Arabic term means metals) is legally called Saudi Arabian Mining Company. Half of its shares are owned by the Saudi government and the firm is the biggest Saudi entity operating in metals, gold mining and infrastructure. Since 2009, Ma’aden has a joint venture with Alco, the top U. S. aluminum blue chip firm.

Savola stands for food, beverages and dairy products. While Saudi Arabia has to import 90 per cent of its nutrition needs, Savola has developed an indigenous food producing industry at its headquarters in Jeddah.

While Saudi Arabia has to import 90 per cent of its nutrition needs, Savola has developed an indigenous food producing industry at its headquarters in Jeddah.

Savola was the first listed firm that published the salaries and gratifications of its management and board members – a quite revolutionary shift amid the widely common closed-doors mentality in the Gulf region where over 80 percent of firms are privately-owned by families. Few growing conglomerates dared in the past to list their share to the public – such as Zamil Group.

Winds of change

The risk appetite could become bigger soon. Amid multiple backwinds towards diversification, the Saudi government opted recently to do keep the kingdom on the opening track. Earlier in the year on July 22 2014, the capital market authority (CMA) has announced to open the Tadawul stock market, the biggest in the Gulf region by market capitalization with 538 billion dollars, for foreign institutional investors. Shortly after, on August 19, the government reached out again to foreign firms. Arab News reported then that the royal government eased procedures for major international companies to participate in the country’s vital projects in infrastructure, energy, information technology, construction, operation and maintenance. The government ordered Saudi Arabian General Investment Authority, also known as SAGIA, was ordered to register such aforementioned companies and qualify them according to specific rules and criteria, in addition to granting them temporary certificates to implement a government project, Arab News quoted the cabinet decision.

Riyadh’s rationale in opening up is simple. The kingdom aims to be upgraded to emerging market status as the neighbor countries Qatar and United Arab Emirates (UAE) have been in June 2013. Such an upgrade by global index developer MSCI would trigger the flow of another billions of dollars into listed Saudi companies.

In addition to that, the kingdom aims to spur investments as it needs urgently to create more jobs in the private sector. “We are the country with the least unemployment in the Gulf and in the world with almost 6% in general,” said the tycoon Al-Zamil. But with almost 60 percent of Saudis being younger than 30, more demand for jobs is in the pipeline.

However, the KSA also lags behind the UAE in other segments. While the Dubai International Financial Center (DIFC), the only financial free zone in the Middle East, celebrated its first decade of existence, the King Abdullah Financial District in Riyadh has yet to be completed.

And while in Dubai citizens can pay with their parking tickets, company registration applications and even the renewal of their driving licenses, “there are a lot of areas of payment in the kingdom that are still cash or bank transfer only, for example, payments to the government and payments for utilities,” says Priyan L. Attygalle, the CEO of American Express Saudi Arabia.

Frictions do also exists in the yet to be completed, albeit booming real estate market. “The major point is the land,” Eng. Mohammed Al-Saja, the chairman of Mizat Development Company. “The land is too expensive. Land should be a maximum of 30 percent of the unit cost but in Saudi it is nearing 50 percent.” Economically, it is better to sell the land than to build on it and then sell it, Al-Saja added. One roadblock the government could impose to reverse this phenomenon, but a law in this regard has yet to be issued.

Tourism

In relation to travel and tourism, the kingdom did a quantum leap forward in recent years. Not only has the government launched initiatives to encourage its nationals to spend more leisure days at home, but is has also eased some visa restrictions.

For some European countries, like Germany, group tourism visas have been enabled in the mid of the first decade of the new millennium.

According to Abdullah Saad Al-Mogren, General Manager at Riyad Palace, “Saudi Arabia is now starting to encourage and support both the leisure and the business tourism by creating a private sector for tourism, with one big commission for tourism, the Saudi Commission for Tourism and Antiquities.”

President of the commission is His Royal Highness Prince Sultan bin Salman bin Abdulaziz, a former Royal Air Force pilot and NASA astronaut. Prince Sultan Bin Salman, whose son is married to a daughter of the Saudi Arabia’s foreign minister Prince Feisal, is so keen in upgrading his country’s tourism profile that he regularly visits the annual Arabian Travel Market, the biggest tourism fair in the Middle East. There he inspects the Saudi pavilion to the last detail and does not leave out the opportunity to speak to every single journalist he meets.

With travelers pouring in, global hotel brands followed. In 2011, Ritz Carlton opened its first luxury resort in Saudi Arabia, in Riyadh.

Riyad Palace’s Al-Mogren says: “We have recently planned for an 85 percent increase in the supply for hotel rooms in Saudi Arabia. This will fuel competition. Yes, we are hoping to get more business and more visitors, but supplies will also be at almost 80 percent, which is an enormous figure.”

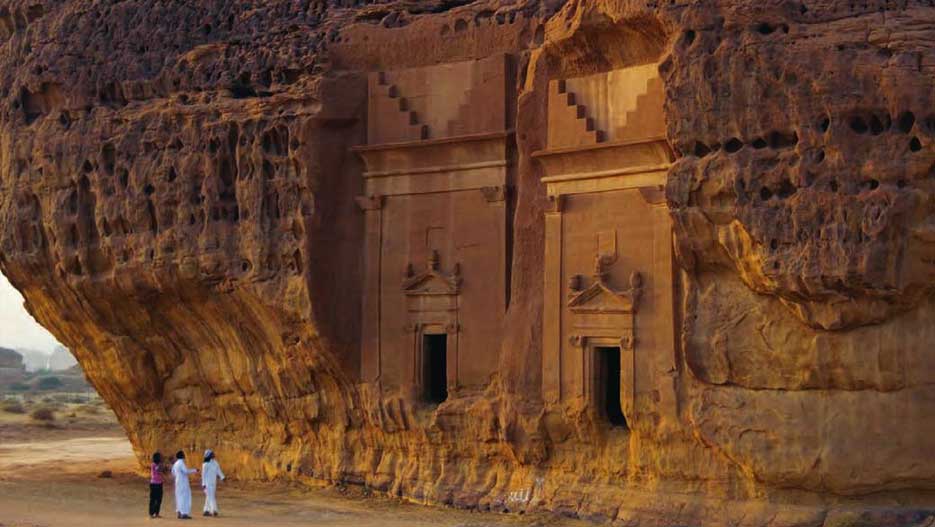

So, which places does he recommend? “Saudi Arabia is a very big country with a lot of sites of historic interest such as Mada’in Saleh, Abha and Mecca and Medina. The eastern provinces also offer a lot of places for tourists to enjoy,” said Al-Mogren.

Outlook for the Economy

So far, thing seem to go well. Earlier in July 2014, the International Monetary Fund increased its growth projection for KSA’s real GDP to 4.6 percent from 4.1 percent.

“Private sector growth is expected to remain strong, and oil production is expected to be little changed from 2013,” stated the IMF.

Challenges may come up if the Unites States will overtake the KSA as the world’s biggest oil producer. Fracking and shale oil are the key words.

According to the International Energy Agency in Paris, the world’s biggest economy will top Saud Arabia by 2015 in relation to oil production.

The effect of shale gas on prices in gas is already visible. “The US shale gas revolution has confused the gas pricing structure,” says Paddy Padmanathan, President and CEO at ACWA Power in Riyadh.

“Forget about the mythical two dollars per million BTU (British thermal unit) gas price which is also not true in the United States. The gas price in the United States today is around five dollars per million BTU. But globally, the average gas price is in the range of nine dollars or ten dollars.”

“Forget about the mythical two dollars per million BTU (British thermal unit) gas price which is also not true in the United States. The gas price in the United States today is around five dollars per million BTU. But globally, the average gas price is in the range of nine dollars or ten dollars.”

With nine dollars or ten dollars numbers on a global basis while Saudi Aramco is required to supply gas inside the Kingdom of Saudi Arabia at 75 cents per billion BTU, “it is no surprise that Aramco is not exactly enthusiastic about pulling out gas which is actually going to cost even more than 75 cents to extract.” Experts say, the kingdom could see its last years of budget surpluses if oil prices plummet in the wake of rising American oil production figures to come.

In order to cushion the effect, Saudi Arabia has discovered the use of renewable energy like solar or wind power. “Therefore Saudi Arabia is also embarking on a diversification program of its fuel mix in power,” says Padmanathan. Analysts also expect that Riyadh would turn towards the East where most economies are dependent on Arab oil while the U.S. might lose interest in maintaining its traditionally strong bounds with house of Saud.