Positive Outlook for Libyan Economy: 9.6% Growth between 2013-2017

Libya Top Stories

Positive Outlook for Libyan Economy: 9.6% Growth between 2013-2017

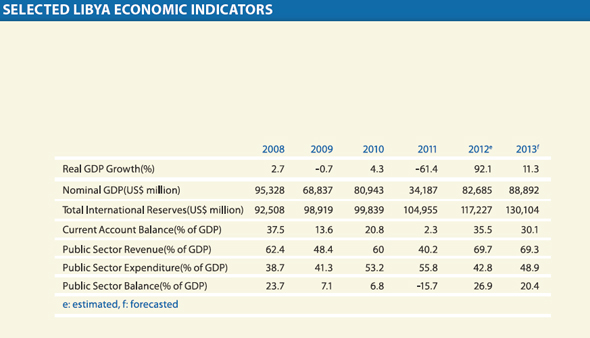

The Libyan economy is expected to grow by an annual average of 9.6% in the period between 2013 and 2017.

Positive Outlook for Libyan Economy, Provided Security is Maintained

In addition, there is potential for growth, although from a low base, for the non-oil sector, supported by government infrastructure projects. The economic policy in the post-revolution era is expected to combine a mix of heavy-central government role in reconstruction along with market-oriented reforms.

According to its recently published country report on Libya, the Economist Intelligence Unit (EIU) forecasted an economic growth of 11.3% in 2013 reflecting a significant expansion in oil production.

This follows a year of massive rebound of above 100% growth (according to the IMF) from a low war year base in 2011. The Libyan economy is expected to grow by an annual average of 9.6% in the period between 2013 and 2017.

According to the EIU, political uncertainty will remain high for the coming few years. In the case where security is maintained and the government succeeds in articulating clear policies towards business, foreign direct investment (FDI) is expected to pick up.

The need for post-conflict reconstruction will provide foreign companies with profitable infrastructure contracts. As to oil exports, Libya exported 1.26 million barrels/day in January of this year.

Total domestic consumption averaged around 140, 000 barrels/day while total production averaged 1.4 million barrel/ day, according to the National Oil Corporation.

In addition, there is potential for growth, although from a low base, for the non-oil sector, supported by government infrastructure projects. The economic policy in the post-revolution era is expected to combine a mix of heavy-central government role in reconstruction along with market-oriented reforms.

Inflation in Libya

As to inflation, it grew by 6.1% year-on-year in 2012, down from 15.9% in 2011. Food and beverages prices declined by 3.8% year-on-year, while housing costs rose by 22% over the same period. Inflation is expected to fall in 2013, owing to a positive base effect and falling global non-oil prices.

According to the EIU, it will be sustained from 2014 onwards, owing to a revival in consumer demand and increased government spending. It is forecasted to average 4.8% a year in the period between 2013 and 2017. Regarding total lending by commercial banks, it rose by 23.4% to US$ 12.6 billion at end-2012, but its impact on economic growth will remain limited given the ongoing dominance of the state-owned oil sector.

According to the Central Bank governor, Libya may issue sovereign bonds. The declared reason does not revolve around raising capital for the state, but rather an attempt to increase tradable assets and develop investment banking.

Source: Bank Audi Research