Lebanon: Capital Markets Outlook 2012

Beirut Stock Exchange is welcoming the new financial market law, which was issued in August 2011. The law calls for an establishment of a financial markets’ authority which would regulate and control the stock exchange and will ensure greater transparency.

Interview with Dr. Ghaleb Mahmassani, Vice President of Beirut Stock Exchange

What is your frank assessment of Lebanon’s capital markets? (Market capitalization, number of companies listed, top ten movers and largest sectors.)

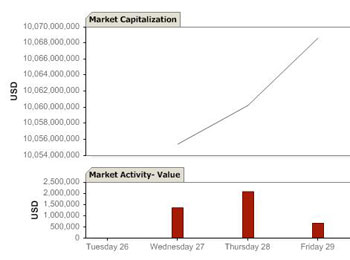

The market activity at the Beirut Stock Exchange witnessed relatively modest trading movement during the first four months of the year. Cumulative trading from the beginning of the year till the end of April 2012 totaled 17.3 million shares valued at USD 126.2 million, against 43.6 million shares for a value of USD 243.9 million for the corresponding period of last year. On the other hand, the stock capitalization increased by almost 2% at the end of April to reach USD 10.5 billion against USD 10.3 billion at the end of December 2011.

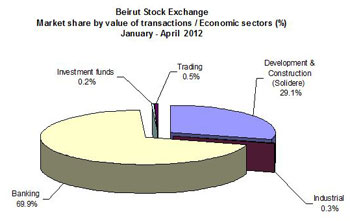

Bank stocks accounted for 70% of the aggregate trading value during the mentioned four month period, followed by real estate sector (solidere) 29%, while other sectors shared the remaining 1% of the trading value.

The performance of the financial market of Lebanon and despite the recent decline is reassuring as the market has not witnessed sharp and fast fluctuation in prices.  And through our follow up to the market we believe that negative impacts will quickly disappear as most listed companies showed better than expected profits during the first quarter of the current year and are currently trading below their book values.

And through our follow up to the market we believe that negative impacts will quickly disappear as most listed companies showed better than expected profits during the first quarter of the current year and are currently trading below their book values.

What are the major challenges facing Lebanon’s capital markets?

The Republic of Lebanon is a small country, with few local industries capable of being listed on the stock exchange. The main challenge is the number of the listed companies which is very low, when compared to that of stock exchanges in the region, with only ten companies listed in addition to a single investment fund.c

In addition, the Lebanese businesses, both in the industrial and service sectors, are in their vast majority small family-owned firms and therefore personal relationships between individual partners tend to prevail over other forms of interaction.

Likewise, the Lebanese economy can be labeled as an “overdraft” economy in which the activities of the major businesses are financed through bank credit.

Another challenge that we face is the lack of stock exchange culture among the Lebanese.

What is your strategy to meet these challenges? (Increase number of listed companies, invite traders and speculators.)

We are trying to give increase attention to educational and promotional program that aim to attract and convince medium-sized Lebanese companies to list their shares on the Beirut stock exchange and to increase their capital through broadening the shareholders base by showing them the advantages and opportunities of financing through the stock exchange.

We are very confident in the message that the creation of the new financial market authority sends to national and foreign investors: at least Lebanon has the tools, the proper legislation to control and regulate the financial markets.

On the other hand, we have worked closely with the Ministry of Finance and the Lebanese Government to give some tax incentives for the companies that list their shares on the BSE and to limit the distribution tax for listed companies to five percent instead of the ten percent applied to other non-listed companies.

The lately approved Financial Market Law that took into consideration the privatization of the Beirut Stock Exchange within a two year period from the date of the establishment of the Financial Market Authority, will transform the BSE into a private commercially minded entity equipped with a Sales and Marketing division serving its customers and not as a government body dealing with the public.

Do you think that international investors find it difficult to get growth in the developed markets and switch to emerging markets such as Lebanon? What are the benefits Lebanon can offer to an international investor?

Equity flows to developing countries have increased sharply in recent years, as many professional investors closely watch developing countries for signs of revolutionary growth. However, before investing in a given market one should consider a number of basic issues as political stability, ease of entry and exit, attitude toward foreigners and many other questions necessary to make any investment a profitable deal.

As for Lebanon:

The Lebanese economy is characterized by its openness to trade in goods and services. Likewise, the Beirut Stock Exchange is an open market for foreign investors. There is no restriction on foreign investment flow into the Beirut Stock Exchange listed securities.

The absence of controls on capital flows into and out of the country.

A flexible exchange rate regime that accommodated external shocks.

An unconditionally convertible currency and a liberal “laissez faire” approach to economic policies.

Dividend distribution tax is limited to five percent for listed companies while the capital gains on the transfer of companies’ shares are tax-free.

What are the newest technologies you are trying to implement to Beirut Stock Exchange?

After the reopening of the Beirut Stock Exchange in 1996 we have dedicated ourselves to providing our customers with highly financial services. In serving this purpose we have moved from a fixing to a continuous trading system by implementing the NSC-UNIX trading system used and developed by NYSE-EURONEXT. Lately we have adopted an Online Trading System and developed an up to date Website that provide an easy to use engine for investors is searching for market data and listed companies’ information. Likewise, we equipped a Disaster recovery site outside of Beirut to be used in case of emergency. Briefly speaking, we are always developing the information technology of the BSE and we are keen on updating our system to match the highest international standards.

What is the current legislation regarding the capital market in Lebanon?

A new law for Lebanese Financial Markets has been recently approved by the Lebanese Parliament that took into consideration the creation of a higher financial authority that oversees the regulation of the creation of various types of financial markets according to the recognized international standards. The newly established authority will have a sufficient independence in the exercise of its functions from any party involved in the trading activities at the stock exchange. Likewise, the new law noted the necessity of separating the function of trading from other functions through the establishment of a separate body to oversee stock exchanges and financial markets in Lebanon, where the membership of the new body does not include the issuers of financial instruments or brokers at the stock exchanges.

What would be the outlook for 2012 and 2013 – short-term and long-term – for the Beirut Stock Exchange and capital markets in Lebanon?

From an economic point of view, I believe Lebanon’s real economic performance is likely to be close to the one prevailing over the second half of 2011. I mean a moderate real growth in the range of 3 to 3.5 percent increases. This expected moderate growth is due to the regional turmoil that will likely to continue impacting private investment confidence. In addition the parliamentary election that will take effect in the summer of 2013, with major investment decisions expected to be delayed till the mentioned date, will also have an impact on the trading activity at the Beirut Stock Exchange.

On the other hand we look forward to the implementation of the new law for Lebanese Financial Markets that has been recently approved. We are very confident in the message that the creation of the new financial market authority sends to national and foreign investors: at least Lebanon has the tools, the proper legislation to control and regulate the financial markets. We hope that this law enforcement will progressively contribute to the development of our financial markets, and will boost the activity of the Beirut Stock Exchange.