Ghana: Discussing the Impacts of COVID-19 on Investments and the Economy with Yofi Grant of GIPC

Yofi Grant explains how COVID-19 has impacted investment promotion in Ghana, as well as the economy at large. He also talks about the specific measures GIPC (Ghana Investment Promotion Centre), together with the goverment of Ghana, have put in place in order to mitigate the situation.

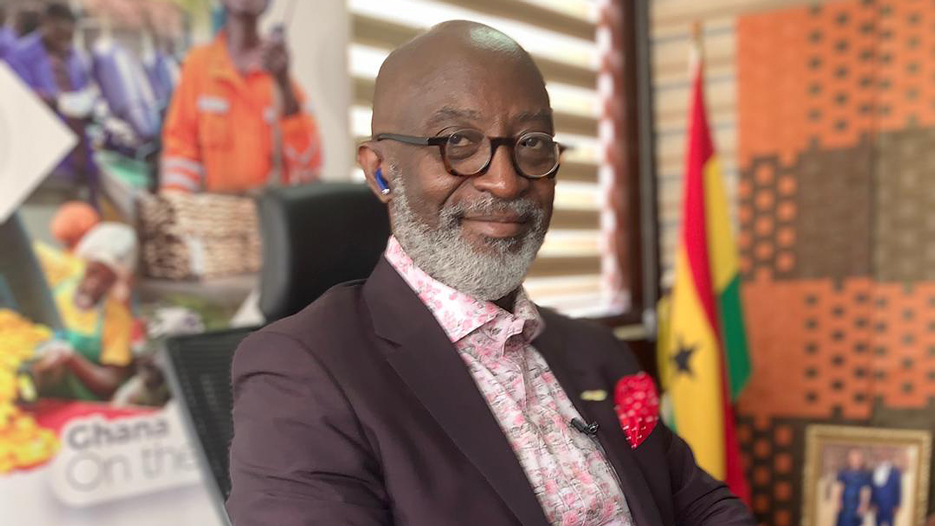

Interview with Yofi Grant, CEO of GIPC (Ghana Investment Promotion Centre)

How has COVID-19 impacted investment promotion in Ghana?

Before COVID, Ghana had a GDP growth projection of 6.8%. But post-COVID, this has actually gone down to 0.9%. We had expected a year of deflation of 8.0% and a fiscal deficit of 4.7% of GDP. But COVID struck, and we had to readjust our GDP growth. And as we have it, right now, we are projecting 0.9% GDP growth. We are expecting to see a projected primary surplus of 0.7% of GDP, and still a gross national reserve to cover not less than 3.5 months of import. I must say that the pandemic has significantly affected not just us but the whole world because a lot of supply chains were significantly disrupted and many countries were locked down, so they couldn’t do business as usual, people couldn’t travel, you couldn’t have meetings, etc. Almost every country was on lockdown for quite a while, at least for two or three months. And now what has happened since then is a matter of history that everybody knows. Inflation in Ghana increased to 10.6% in April, and then to 11.2% in June. But we expected that year inflation rate to be 12.7% and reduced further from 2021 and hopefully we’ll get to single digit by 2022. We also saw a fall in the economic activity as measured by the Central Bank’s Composite Index of Economic Activity, which dropped by 2.2% in March 2020. But as we speak, although we have a projection of 0.9, if you go to the World Bank’s (the IMF’s) website, they have a projection of 1.5%. Recently, Goldman Sachs actually came out to say they expected 1.2% GDP growth. So, we have definitely done something good while many other countries are in deep recession and resorted to large borrowings. We are not going to go into that sort of deep recession. So, we have done something well, and that has also affected GIPC in what we had planned for the year. But in a very interesting way, because if you look at what has happened in the first quarter going to the second quarter, we realized the impacts. The impact on hospitality, of course, was one of the worst hits. We had about almost 1,000 accommodation facilities that had to shut down by 31st May, which was about a quarter of all the facilities that we had, and job losses were about 2,300 people. The tour operators saw a drop in visits by some 11,558 out of cancellations, which represented at least about almost 5 million cedis. But the agricultural sector was also significantly hit because people couldn’t go to the farms for the fear of catching the disease. So, we saw a decline in the price of cashew by 60% between January and April, which was significant for the farmers and for the exporters. We also saw a drop in the energy sector, with about close to $324 million projects actually being shelved as a result of the pandemic. Of course, the transport sector was also significantly affected. If you look at the metro mass transport, for example, they dropped revenues of 5.5 million a month to about 2.1 million a month, that means that more than 50% of the revenues that they made were gone, maybe up close to 60%. The educational sector also suffered some 856 job losses. 32 private schools couldn’t pay because the kids were no going to school, they had to sit at home and the schools were closed. This was just in the second quarter of 2020, which is significant. The impact on the economy at large was significant.

But over GIPC, we saw very interesting dynamics, because in the first quarter, we actually registered foreign direct investment over $180 million, which was some 400% increase on what he had the previous year; on the first quarter of 2019. So that was very optimistic. We had great hopes of continuing the year in very good shape and in good tracks, and then COVID hit. And for the first two months of March-April, we barely had any inflows, we barely had any visits. Of course, we had lots of calls because a lot of investors were asking how we were going to cope with this and what were the measures that we were taking. We did our own research to find the impact on investors and in just one month, the average revenue loss or cost to each investor was about $75,000. We were expecting that that was going to increase because by May-June, almost all enterprises had to be shut and locked down. So, the impact was real. But then came June, and we realized that we had actually increased the amount of foreign direct investment that we had by the beginning of June. The number for the second quarter was $207 million dollars, an increase over the first quarter. And by the end of June itself, we had close to $650 million in foreign direct investment, which was enigmatic and confusing because we expected to see FDI drop significantly, which didn’t happen. So, we are still extremely hopeful. But what it tells you is that the investors look at what the opportunities are. They look at the macro and they look at who is still performing well under the pandemic and target it. So, I believe that is what has put us where we are. We are still very optimistic. We are doing new things in new ways to ensure that we recover quickly and get back to the track on which we were before COVID.

What have been the specific measures you put in place to mitigate the situation?

What truly is in my heart is that once we have really stabilized the economy and we have put in the structure for rapid growth, I expect that maybe for the next three to four years, we will see FDI increase significantly.

We are increasing the pace of our aftercare services, in the sense that we are now engaging investors much more. We look at investment as a relationship, not as an event. And so, we are constantly engaging the investors out there. We are also part of a program called the Ghana Cares Program, a three-year COVID-19 alleviation program. It is an effort from the government to stabilize the economy, alleviate and revitalize enterprises, and promote growth going forward. We have set up this program with the Ministry of Finance, the Ministry of Trade and Industry, the Ministry of Planning, the Ministry of Energy, the Ministry of Agriculture, and all the other sector ministries of importance to the economy. This program is a 100 billion cedis program, of which 30% will be funded by the government and the remaining 70% by investments in the private sector. That program is very focused and very dedicated and there are clear areas which we are looking at, for example, health, with what we call Agenda 111; which goal is to build one district hospital in each district that doesn’t have any, and then one regional hospital in all the regions that didn’t have a regional hospital. That means building about 111 real physical structures to support the healthcare sector, because we realized the shortcomings when COVID hit. The goal is to ensure that if there’s any such occurrence again, we are fully prepared. So we went into this Agenda 111. Now all the district hospitals are going to be hundred (100) bed hospitals, providing healthcare to people. We are also strengthening the national health insurance scheme to ensure that we have as many people covered so that, in the future, they would have access to healthcare, which is vital. A lot of people just do not just go to the hospital because they can’t pay, but if you strengthen the health insurance system, then you are better prepared. So, we have engaged in that.

We are also looking at agriculture, which is important to our economy, because it is estimated that some 55% plus of our people engage in agriculture somewhere along the value chain. So, it is important to pay specific attention to agriculture. We have a very dynamic and significant policy called Planting for Food and Jobs, which implementation over the past two years has really revolutionized agriculture. So, for the first time, we are actually exporting 19 food crops this year, which prior to that, we were actually importing. For the first time in many years, we didn’t import maize, we are actually a net exporter of maize. And we had bumper harvests in some food crops. But of course, that didn’t solve the whole problem, then we had to look at the real value chain of it. Where do you want to play: just in the production or in the value addition? So, we have a major project also called Planting for Exports and Rural Development, which means that we are going to add value to a lot of these things and ensure food security, not just to feed the people but also as foundations for industrialization and export. These are some of the things we have decided to do as a government to support it. GIPC is definitely a strategic partner in all of these initiatives. We want to reposition Ghana and diversify into export oriented large-scale agricultural farming in cocoa, oil palm, legumes, cereal, rice and horticulture, but also in the protein size of poultry and meat for the regional markets. So that is where the investment opportunities are going to be significant, especially post COVID.

Manufacturing is another focus. One lesson COVID has taught us is that we have to be self-dependent in certain things and when borders were locked, procurement became a problem, because supply chains were severely disrupted as ports were shut and factories were closed down. So, we turned it into a real lesson learner where we started producing PPE (personal protective equipment) internally, for example, sanitizers, alcohol, wipes, etc. We converted a lot of liquor and beverages factories to produce some of these, and then our textile factories to produce face masks, which have been the saving grace for many countries during this COVID era. We should look more at local manufacturing instead of importing a lot of goods. GIPC certainly is a partner in all these initiatives to make sure that we craft and fashion our investment promotion to facilitate some of these.

We are looking at the investment on the ground, and strengthening investment facilitation, working with the World Economic Forum and the WTO on coming out with an investment facilitation’s template for many countries who are on the WTO. We want to make sure that we have a much more aggressive investment culture going forward. We have seen a drop in FDI over the past four years, due to a lot of countries now looking inwards and not looking outside. Some will see the death of globalization, but I see the rebirth of globalization, because the world is now going to look differently at how to invest, where to invest in, what to invest in, etc. So, we are there.

We are embracing digitization in a massive effort to ensure that there’s as little human contact as possible, but also supporting the government’s engagement to the citizenry. In the process, we have quite a number of projects like the introduction and implementation of the Ghana digital card, which is the card that will incorporate a lot of the facilities that we need. Then, of course, there is the e-business registration, where Registrar General has put in place a digital platform where you can register a business without leaving your kitchen or bedroom, or the e-justice system that lists some of the cases and gives you references. We have the digital property addressing system whereby every five-by-five-meter grid in Ghana has a digital address. And that is going to help us clearly identify ownership and possession of land, release land from ownership, identify the use of land for industrial purposes or growth purposes, so that people are very clear. In the past, this has been a major stumbling block in some investments. So that’s very good. We also ushered in the mobile money interoperability platform, which has significantly increased the number of mobile money transactions using the phone and the computer. We introduced the paperless port system; we introduced the e-smart driver’s license where you can actually start your registration for a request for a driver’s license digitally. We have the renewal of the National Health Insurance Scheme; you can actually pay your premiums electronically. And these are some of the digital programs that we have had to focus on and expand; pre COVID and post COVID, to bring a lot of efficiency.

The government’s main program is to create a business architecture that will make Ghana a hub for West Africa, but also in the medium term to make Ghana the best place to do business in Africa. Some of these initiatives are supported by building a stronger physical infrastructure, so we are doing 4,000 new kilometers of railway, 10,000 kilometers of new roads, we are putting in schools, we are putting in hospitals, we are building factories with the One District One Factory (1D1F) initiative. We also have the One Village One Dam policy. When you put all these things together, you find a network of interrelated activities that are going to be growth-oriented but will also position you as an efficient and effective destination for investment and business.

The e-commerce sector is getting a lot of momentum since the government’s idea to go into a cashless society. We recently launched the QR Code and Proxy Pay facility, introduced by the Central Bank, and there is a payment platform called GhIPSS (Ghana Interbank Payment and Settlement Systems Limited), to ensure that in the future, we will have paperless payments and people will use their phone to make payments. And that in itself is very important for people during the COVID era and post COVID to limit as much human interface in those things and use electronics, e-commerce and e-governance tools to facilitate efficiency within the country.

Is funding for the Ghana Cares Program secured?

Well, I wouldn’t say secured. It is programmed from now to 2024. And what we have done at GIPC is also to develop a program accordingly, where we have targeted specific investors based on projects already ongoing, for which we have seen significant investment appetite. Now I wouldn’t say secured because secured for me is when the check is written. But we do have significant appetite, we have significant engagements. And I must say that since COVID, my work has become like waking up in the morning and standing on a treadmill. You are constantly in conferences and webinars with investors who are looking for opportunities. And the interesting thing is that you always have one specific question at the end: when are you opening the borders so we can come in and go ahead with what we want to do? There are commitments, there is significant interest. We will work assiduously to ensure that these move away from ideas into real, executed businesses.

What kind of impact would the election create?

I suppose that it should be the same government. It is just going to facilitate and strengthen what has been put in place, but also do a lot more. Bear in mind that, since this government came into power, a lot has changed. I mean, in 2016, GDP growth has slumped to almost a 20 year low of 3.6%, despite being an oil producing country, but through fiscal consolidation, better management of debt, and significant reforms, GDP growth went to 8.1% in 2017. In 2018, it was up by 6.3%, 2019, 6.8%. It was projected this year to grow at 6.8%. So certainly, on the economic front, this is a government that has done wonderfully well and it has been recognized. We even had an upgrade on our sovereign rating, which was only recently rerated because of COVID. Even in those hard times, if you look at our recovery rate, it is about almost 99%, while our death rate is about 0.6%. When you compare those rates to the ones in so-called better managed economies with stronger healthcare systems, we are doing phenomenally good. So, I dare say that this government definitely deserves to continue the story, because it is one of significant transformation. We have seen Ghana transform radically. And the government’s intention is to move from aid to trade. You must have heard the President’s rallying call of a “Ghana Beyond Aid”, which definitely is the way to go and move away from the export of raw materials and resources into value addition and production; that in itself would elevate us up the value chain of the export commodities. It will rake in more revenue, enable us to control our currency and the depreciation of our currency, but also create more jobs, and more jobs in an economy is always a great thing. The more investments you have, the more businesses you create, and then the more businesses you create, the more jobs you can have. And so, for us, it’s very clear that this is a government that has his hands on the pulse. We will create growth and set an example for where Africa should be going.

You have been involved in all investment promotion missions around the world. COVID-19 has changed the normal. How have you adjusted to this new situation?

Well, we have adjusted comfortably. Perhaps, that is why we saw a bit of growth in FDIs during the second quarter. But of course, like everybody else, we have resorted to e-meetings. Technology has been a great aid and a great servant. For most of our conferences or webinars, I have used platforms like Microsoft Teams and Zoom, to ensure effective business continuity. That is important to reduce physical interactions in the workplace. We are still running a shift system where we have critical staff in the office physically, and the others working from home. This is key for us in making sure that we reduce the spread of the disease. We have also aggressively improved our online presence. You find us on Twitter, Facebook, Instagram, constantly informing on what we are doing and putting out some of our marketing clips out there, and therefore getting a lot more attention.

But beyond that, we are also rebranding, we are moving to an A+ standard office to ensure that when investors come to visit, they are more comfortable and we can have better access to information. We are actually putting in place technology in house to ensure that we have data available to investors wherever they are. We are working with many other agencies to improve facilitation and ability to access the market in a COVID and post-COVID era. And I believe that one of the major things that we are doing is a reform of the GIPC law. But we had to put it on hold with the advent of AFCFTA (African Continental Free Trade Area) to ensure that whatever rules and covenants we put in are consonant with ECOWAS (Economic Community of West African States) and AFCFTA. But right after this year, we believe that the new law will be passed and it will remove many of the bureaucratic barriers that may be a disincentive to investors. So, we are very clear that we need to take advantage of the new normal and bring in efficiency and effectiveness in the way we do our business.

What is your personal goal post-pandemic?

What truly is in my heart is that once we have really stabilized the economy and we have put in the structure for rapid growth, I expect that maybe for the next three to four years, we will see FDI increase significantly. I mean, some of the opportunities that we have outlined at GIPC in itself would mean that we should be looking at and marketing for FDI of about average 10 billion a year for some three years after 2021, 2022. Ghana is still a resource rich country. We have significant amounts of gold and diamonds, oil and gas, bauxite, iron ore, lithium and manganese, amongst other ornamental minerals, and these have not been optimally exploited. So those opportunities are there. But to the extent that we are moving our economy away from one of just export of raw materials and resources to one of value addition means that we are now going to a new engagement where we are going to add value to all those resources before we export. We are going to level up the value chain and become an export country.

Beyond that, we have a 10-point industrialization plan, where we are going to create many hubs in Ghana for the sub region, in sectors such as pharmaceuticals and automotive. We already have Volkswagen and Sinotruk assembling plants here. We have seen Nissan, Toyota, Suzuki and Renault investigating the possibility of setting up here. We have spoken to quite a number of Mexican investors who are in the spare parts segment to actually come manufacture in Ghana. On the pharmaceuticals side, we are engaging the big players to give them the necessary support to actually manufacture in Ghana. We are also looking at textiles on the value addition side to define how Ghana can facilitate a major textile industry in West Africa. Besides, as a new entrant into the play field of oil and gas, we still have 40% of our landmass which has not been exploited at all apart from an offshore deposit. So, we are seeing great potential going forward. GIPC will play a major role in ensuring the enduring partnerships that are there.

On a more holistic approach, the two most important parts of our development are SDGs (Sustainable Development Goals) 1 and 17. SDG 1 is eradicating poverty. We are going to do that, first of all, by moving up our economy, creating jobs, making Ghana the best business experience in Africa and making it an attractive place to do business as well. That is one tracker on which we are going to do it. But we are also looking at the future where we will continue to attract investors. Not just resource seeking investors, but market seeking and efficiency seeking investors. That for us is very important. And so, we are looking at quite a number of things. And we are supporting it with infrastructure development, as I mentioned before; new road networks, new railway, new schools, new hospitals, making sure that the citizens also have a great social system and social support to create a much greater experience of the country. Then we will go to SDG 17, which really is about partnerships and linkages. Although we say “Ghana Beyond Aid”, which will discourage gifts and handouts in a budgetary process, we will still embrace partnerships with the international community, ensure that we have a great experience together and that there are mutual benefits in whatever we do. So, we have a game plan and we just have to go through the elections and execute that game plan without flinching because we believe that it’s going to put Ghana on a much higher level and Ghana would be the country to watch in the next century.

FAIR USE POLICY

This material (including media content) may not be published, broadcasted, rewritten, or redistributed. However, linking directly to the page (including the source, i.e. Marcopolis.net) is permitted and encouraged.