Lebanon Oil and Gas Sector Analysis 2013: Levantine Basin Natural Gas Muggle

Has the Levant struck it rich with oil finds; is the recession on its way out, and soon the much-deserving Lebanese will be living in Emirati style opulence?

Lebanon Oil & Gas Analysis 2013: Levantine Basin Natural Gas Muggle

By T.K. Maloy

BEIRUT – Has the Levant struck it rich with oil finds; is the recession on its way out, and soon the much-deserving Lebanese will be living in Emirati style opulence?

Well, PROBABLY NOT!

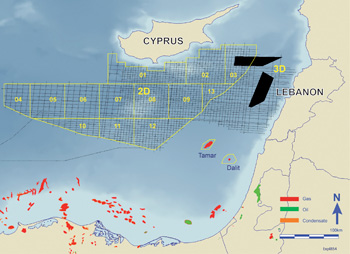

A recap on the news –large potential natural gas reserves were found several years ago in what is called the Levantine Basin. A U.S. Geological Survey said in 2010 the Levant Basin contains 123 trillion cubic feet of natural gas and around 2 billion barrels of oil.

Under maritime law, the basin region was to be shared between Cyprus (an EU country) Israel and Lebanon. Of the former two countries they were quick off the mark in getting into the bidding business, forging relationships with exploratory and drilling companies and generally preparing to do business.

Where was Lebanon during this period? The Republic was spending two years forming a six-member “Petroleum Administration” to handle tenders from companies bidding on exploration blocks. Now at last the Petroleum Administration has been formed.

Plagued by slow-motion politics and Lebanon’s well-known sectarian splits, the Lebanese government is now effectively years behind neighbors Israel and Cyprus in moving forward on exploration.

Also experts note, the regional upheavals, including both domestic Lebanese problems and the increasingly volatile Syrian war don’t make the Levant an attractive place to do business with companies that value stability and the transparent rule of law.

“Questions remain whether regional instability coupled with Lebanon’s ongoing political deadlock, sometimes deadly social conflict and insufficient infrastructure will prevent it from benefiting from resource revenues.”

Independent Middle East analyst Nicholas A. Heras, of the DC-based Jamestown Foundation, said in a recent foundation report that the “questions remain whether regional instability coupled with Lebanon’s ongoing political deadlock, sometimes deadly social conflict and insufficient infrastructure will prevent it from benefiting from resource revenues.”

He added that, “In the foreseeable future, the potential political conflict over the exploitation of energy resources off the coast of Lebanon is most likely to follow the predictable pattern of conflict between the March 14 and March 8 blocs. It will accentuate the long-simmering public debate inside Lebanon over the deficiencies of public infrastructure and services that affect the daily lives of Lebanese citizens.”

In recent comments, Lebanese energy analyst Rudi Baroudi, chief executive officer of Qatar’s World Energy Council, emphasized the importance of official transparency, particularly after the gas reserves are tapped and begin to generate revenue that can either end up in the public coffer or the pockets of officials.

Also, in a move that might concern foreign companies, Hezbollah chief Hassan Nasrallah pledged in early January to “defend” Lebanese oil claims over a dispute between the Levant and Israel regarding overlapping maritime territories.

Experts note that the Petroleum Administration and the Cabinet will have to take timely decisions at each stage in order to allow the process to move forward. Such decisions include the parameters for the tendering process, assessment of the bids, terms of contracts, award of contracts, and use of proceeds, among others.

The Petroleum Administration has the mandate for undergoing the relevant technical and legal work prior to any negotiations with the oil companies. But in adding to the bureaucratic levels of review, the Administration is not responsible for preparing the specifications for the all-important bidding process until after the Cabinet approves a criterion for the “pre-qualification” stage.

The pre-qualification round is scheduled to begin in early February.

Authorities, including Energy Minister Gebran Bassil have emphasized that after qualification, the selection of companies for bidding would be finalized by no later than 2014 and actual exploration begin by 2017, though a Citigroup report expressed marked skepticism on this and set the date at closer to 2020.

Bassil has said that nearly 30 international companies have shown interest in bidding for gas and oil exploration and drilling.