Iraqi Kurdistan Economic Report 2016: Kurdistan’s Great Recession

Not long ago, the future looked bright for the Kurdistan Region of Iraq (KRI). Long an oasis of peace in an otherwise unstable region, by 2013 the three Kurdish provinces of Erbil, Sulaimaniyah, and Dohuk had become the most prosperous part of the country. Not only were they developing their own oil and gas resources but they were also diversifying into non-oil sectors such as cement, tourism, and real estate. In the major cities consumers were flush with cash—business was booming at shopping malls, car dealerships, gold shops, hotels, and restaurants. Iraq’s tallest apartment and office buildings were under construction. The region’s dream of becoming the “next Dubai” seemed to be fast becoming a reality.

By Dr. Mark DeWeaver

Not long ago, the future looked bright for the Kurdistan Region of Iraq (KRI). Long an oasis of peace in an otherwise unstable region, by 2013 the three Kurdish provinces of Erbil, Sulaimaniyah, and Dohuk had become the most prosperous part of the country. Not only were they developing their own oil and gas resources but they were also diversifying into non-oil sectors such as cement, tourism, and real estate. In the major cities consumers were flush with cash—business was booming at shopping malls, car dealerships, gold shops, hotels, and restaurants. Iraq’s tallest apartment and office buildings were under construction. The region’s dream of becoming the “next Dubai” seemed to be fast becoming a reality.

Today the KRI’s multi-year economic boom has turned to bust. Last year’s 50% drop in oil prices, the occupation of neighboring provinces by Islamic State (IS) militants, and the suspension of fiscal transfers from Baghdad to the Kurdistan Regional Government (KRG) have resulted in a government-budget crisis of epic proportions. State-sector salaries have gone unpaid for months at a time, KRG-controlled banks have no cash to fund depositors’ withdrawals, arrears to construction contractors are piling up, and billions of dollars in payments due to foreign oil companies have not been made.

The impact on the private sector has been little short of catastrophic. Consumer spending has collapsed, property prices have crashed, occupancy rates at four and five star hotels have plummeted, and work on many projects has come to a virtual standstill. Capacity utilization at cement plants is falling, car dealerships are struggling, income at banks and insurance companies is down sharply, and sales of big-ticket electronics items are slumping. Businesses that only two years ago were making record profits are now fighting for survival.

Outside of Iraq, Kurdistan’s great recession has attracted surprisingly little attention. While the war against the Islamic State continues to monopolize the headlines, the KRI economy is seldom in the news. This one-sided emphasis on the security situation is unfortunate because it obscures some of the most serious problems the region is facing. The outsider might well be left with the impression that everything in Kurdistan will be fine once enough precision guided munitions have found their targets in the IS-controlled areas south and west of the border. In this report, our objective is to fill in some of the gaps in previous coverage of the KRI by providing a comprehensive account of the region’s current economic downturn. We believe that our findings will be useful not only to those following the KRI economy for practical reasons but also to researchers interested in the business cycle dynamics of commodity exporting countries.

In many ways the KRI fits the definition of a rentier economy quite closely. The KRG relies almost entirely on oil revenues, whether from its own exports or, during periods when it has received its constitutionally mandated 17% of the central government budget, from those of Iraq as a whole. The majority of the workforce is employed by the state. The private sector is quite small and consists primarily of providers of non-tradable goods and services.

These characteristics mean that the business cycle is driven primarily by the price of oil. Factors believed to be responsible for economic fluctuations elsewhere—monetary and fiscal policy, inventory cycles, productivity growth, or even the ‘animal spirits’ of private investors—are relatively unimportant. As a result, there are few internal forces that will naturally tend to move the economy back towards equilibrium during periods of overheating or recession.

The current situation in Kurdistan is difficult to quantify because almost none of the statistics commonly published for most other economies are available. There is, for example, no monthly or quarterly time series data covering GDP, industrial production, capacity utilization, fixed asset investment, or employment. Indicators based on firm and household-level surveys, often among the most widely followed economic time series, are similarly unavailable.

In the absence of such statistical information, this report relies mainly on information about particular sectors. We interviewed people at companies and government ministries to learn about trends in prices and sales, financial conditions, investment plans, and issues affecting specific industries. The evidence they provided allows us to portray the magnitude and extent of the recession and forms the basis for our evaluation of possible policy responses.

If there were a business sentiment index for the KRI, our sources suggest that it would be at an all-time low. “Only during the civil war was the situation worse than it is now,” one told us—referring to the mid-1990’s conflict between the two main Kurdish political parties. “We had a very pessimistic business plan but weren’t able to achieve half of it,” said another. “Things are getting worse every week,” said a third. Most business people characterized this year as the worst that their companies had ever experienced.

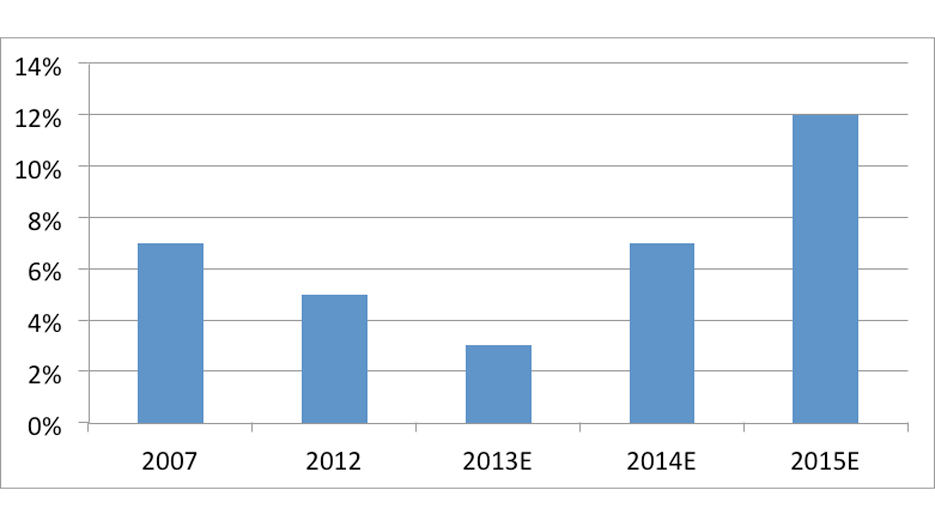

For households, these are hard times indeed. The Kurdistan Region Statistics Office told us they believe the poverty rate has risen from a low of 3% in 2013 to 12% at present, reflecting both worsening conditions for long-time residents and the recent arrival of hundreds of thousands of destitute internally displaced people and refugees (Figure 1). KRI annual per capita meat consumption has fallen from a pre-crisis level of 45 kg to 23 kg (AUIS Roundtable, 2015).

This is truly a great recession by any definition of the term.

The remainder of this report examines the KRI’s transition from boom to bust in detail. We begin with a brief account of the origins of the crisis (Section I), then examine key sectors of the economy including oil and gas and construction (Section II), consumer demand (Section III), property development and hotels (Section IV), and private investment (Section V). We conclude with a discussion of possible directions for government policy (Section VI).

I. Origins of the Crisis

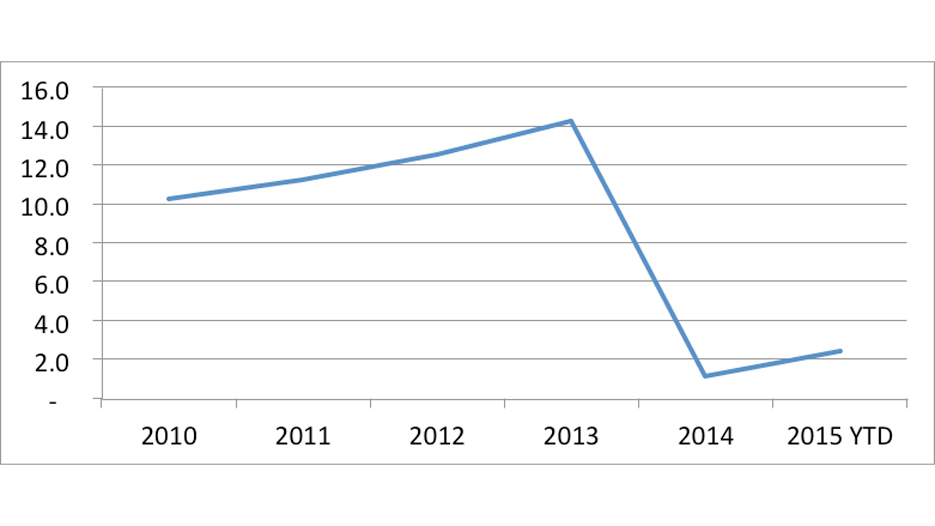

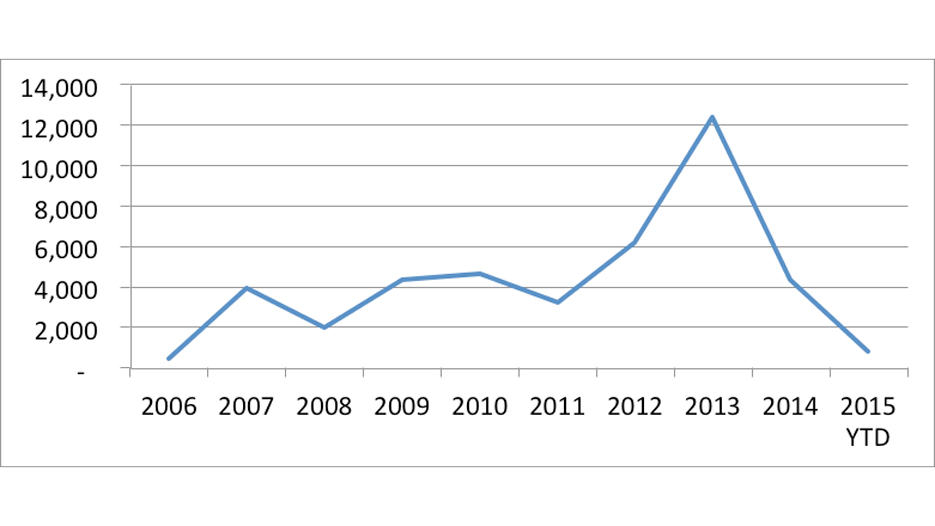

People in Kurdistan tend to date the start of the crisis to June 2014, when the Islamic State took over several neighboring provinces and briefly threatened the KRI capital of Erbil, thereby triggering a massive influx of refugees and disrupting transportation to the rest of the country. The region’s troubles actually started earlier in the year, however, when Baghdad cut off the KRG’s share of the national budget following a dispute over Kurdistan’s right to export oil independently. Central government payments fell from IQD 14.3 trillion in 2013, when they accounted for 77% of the KRG’s revenues, to just IQD 1.1 trillion in the first half of 2014 and nothing in the second half (Figure 2).

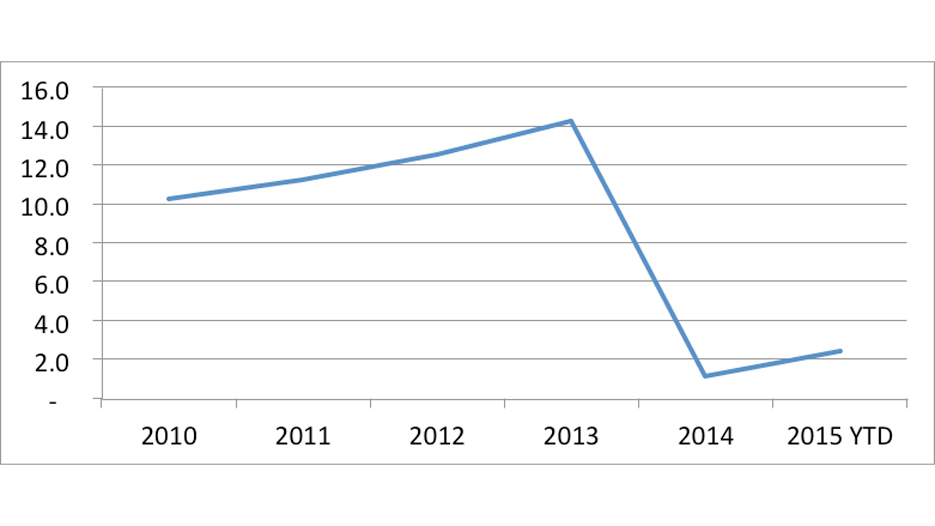

The KRG Ministry of Natural Resources (MNR) responded by selling oil directly to foreign buyers through a new pipeline network connecting fields under its control to a pipeline linking Fishkabur, just across the border from Turkey, to the Turkish port of Ceyhan. This strategy kept revenues from collapsing during the first half of the year but government finances came under severe stress in the second half, when the IS crisis coincided almost exactly with the start of a precipitous drop in oil prices (Figure 3). Oil fell by over 50% from mid-2014 until the end of the year, even as military spending jumped and the population of internally displaced people rose from 250,000 to over a million, significantly increasing demand for public services (World Bank Group, 2015, 2).

A rapprochement with the new government of Prime Minister Abadi led to Baghdad restarting payments to the KRG at the beginning of this year. This proved to be short-lived. For the first five months, the MNR alleges that the central government turned over only a third of what had been agreed upon. Since June, Erbil has been relying entirely on its own oil export revenues (MNR, August 20, 2015, 2), which totaled $3.3 billion YTD as of mid-November (MNR, December 1, 2015).

Under the MNR’s initial projections, which were based on a price of $55/barrel, these independent exports were expected to generate $850 million per month (MNR, August 20, 2015). This would have been enough to cover KRG public sector salaries, which are equivalent to approximately $750 million per month (Zhdannikov, 2015), but have fallen far short of the additional amount needed for state-sector investment projects and the repayment of debts including the equivalent of $8 billion owed to local lenders and $3 billion to international oil companies (Mahwy, 2015).

To make matters worse, exports have fallen short of expectations and since June oil prices have fallen another 20%. As a result, average monthly export revenues have been $160 million below target (Osgood et al, 2015). Due to circumstances largely beyond its control, the KRG has been left without sufficient revenue even to cover all of its salary expenses.

II. Running on Empty

While the KRI resembles an independent country in many respects, the KRG lacks three important policy tools that would be available to most sovereign states in a similar situation. As it does not issue its own currency, it cannot increase the local money supply. Given the limited scope of its tax base, it cannot hope to solve its budget problems by raising taxes. And while it might in theory be able to borrow externally, in practice it has so far been unable to do so at an acceptable rate of interest.

The KRG has instead been forced to resort to much less satisfactory stopgap measures. These have included borrowing from local banks, postponing payments, and paying creditors with un-cashable checks. As a result, the region is now experiencing a severe liquidity crisis, depressed consumer spending and investment, and a wave of bankruptcies at construction contractors.

Repeated delays in paying government salaries have been the most visible sign of the budget crisis. This is a particularly serious problem given that the KRG employs approximately 70% of the workforce. Since the fourth quarter of last year the majority of KRG employees have been paid only every few months, often only after public protests and generally not the entire amount of back wages they are owed. As the MNR itself has admitted, the international oil companies have received “hardly any payments” since May, 2014 (MNR, August 3, 2015, 2). Only in September of this year did the ministry finally authorize payments to the KRI’s three main producers: $30 million each to the Genel Energy/TTOPCO consortium and DNO, and $15 million to Gulf Keystone Petroleum. It also pledged to make “additional revenue available to the exporting IOCs [international oil companies]…as oil export rises in early 2016” (MNR, September 7, 2015, 2).

Failure to pay these companies poses a series threat to the future of Kurdish oil production because without regular payments they do not have sufficient cash flow to invest in field development. Gulf Keystone, for example, has indicated that “in the absence of a regular payment cycle” it will be unable to carry out the second phase of the development plan for its Shaikan field, which is expected to expand production from the current level of 36,000 – 40,000 bpd to 100,000 bpd. Instead, “future production will decline” (Gulf Keystone Petroleum, 2015, 8).

Similarly, DNO, which is owed almost $ 1 billion, produced over 150,000 bpd in the second quarter of this year at its Tawke field but noted in a recent press release that without regular export payments it “will not be in a position to make further investments.” “Without further investments,” it warned, “production from the Tawke field will decline” (DNO, 2015). Genel, which reduced capex by 70% in the first half of this year, in October revised down its full-year 2015 production estimate from 90,000 – 100,000 bpd to 85,000-90,000 (Adams, 2015).

Uncertainty about future cash flows has brought oil exploration in the KRI to a virtual standstill. The rig count for the region has fallen from a peak level of 36 before the crisis to only 3 today. The last time there were so few rigs operating was ten years ago, when the region’s very first exploration and production contracts were being signed.

The potential revenue loss for the KRG is thus considerably greater than what would result solely from insufficient investment at existing fields. The present value of the revenue that might be lost over the next decade would in fact almost certainly exceed the $3 billon now owed to the oil companies.

Following a multi-year expansion, government investment in infrastructure projects has also come to a halt. From 2010 to 2013, annual KRG investment spending rose at a compound annualized growth rate of 28% per annum to reach IQD 3.8 trillion ($3.1 billion) (World Bank Group, 20). This year work on all but the most essential projects has been suspended, leaving roads half-done, power transmission networks unfinished, and contractors not only without new orders but also unpaid for work they have already completed.

Since the beginning of this year, the KRG has been paying contractors with checks that can be deposited in a bank account but not cashed. The payee can, however, transfer the funds to someone else’s account. It has thus become possible for investors to purchase these “blocked checks” at a discount and this discount rate has become something of an unofficial indicator of the government’s perceived creditworthiness. Around the end of last year, when many individuals and even some banks were buyers, it is said to have been 10-15%. By October, it had risen to 40-50% and demand had reportedly all but disappeared.

If individuals and companies had significant obligations to the state it is conceivable that blocked checks might start to circulate as money. People would be willing to hold them simply because the government accepted them as payment. Even those without any taxes or fees to pay would always be able to find someone else who could use them.

But the rentier economy is an unlikely place for such a “chartal” currency to originate because government revenues come almost entirely from oil exports. While the KRG is reportedly accepting blocked checks as payment of taxes such as customs duties, the amounts involved are too small to generate much demand for these instruments. In recent years, average annual tax receipts have been the equivalent of only about $600 million, a mere 5% of total revenue.

The contractors’ difficulties are compounded by the fact that they generally have to have a letter of guarantee (L/G) from a bank in order to bid on government projects. L/G’s are a means of ensuring that the contractor will complete the work specified in its contract. If it fails to do so, the bank pays a fine to the government and takes title to the contractor’s collateral. Companies applying for an L/G must generally put up a percentage of the amount guaranteed as a security deposit.

Surprisingly, many contractors have found that they are still bound by the terms of their L/G’s even though the government has failed to pay them or has paid with a check they cannot cash. They may thus find themselves in a situation in which they must choose between working without pay and forfeiting their collateral. Technical considerations may also make it difficult to abandon uncompleted projects. If left in an unstable condition, they may later have to be redone at the contractor’s expense.

To make matters even worse, one contractor told us his company had been required to get the L/G for a government project it was working on from a KRG-controlled state bank. Even if it finished the job, the company would be unable to recover its security deposit because the bank has no cash to pay depositors.

Contractors finally got some good news at the end of November, when the KRG’s Council of Ministers announced that companies will now be allowed to cancel their contracts (Ekurd Daily, 2015). While the details have yet to be made public, this new policy will presumably eliminate the contractors’ L/G obligations as well.

Hundreds of contractors and sub-contractors are said to have gone out of business this year. In many cases the owners have been financially ruined. Some have even committed suicide.

III. Empty Showrooms, Falling Margins

The government budget crisis has had an immediate impact on practically every business that deals directly with consumers. Households at all income levels are cutting spending in any way they can, switching to the cheapest available options and eliminating non-essential purchases altogether. Sales are falling fast and for many companies profits are falling even faster as their product mix shifts toward lower-margin items.

These trends are apparent in sales of both big-ticket items and ordinary consumer goods. A distributor of Samsung televisions, for example, told us monthly unit sales for the KRI had fallen 70% since the first half of 2014. High-margin big screen TV’s, which formerly accounted for 60% of KRI unit sales, now account for only 30%. The owner of a stationary shop had a similar story. Sales were down 60%. High quality products remained on the shelves while their low-end equivalents were sold out.

A goldsmith at the Sulaimaniyah bazaar reported that he formerly had a one-year backlog of orders. Last year this fell to only six weeks, now it is less than a month. He also noted that many shops that once sold jewelry on an installment basis are facing financial difficulties, estimating that about three quarters of these payments are now in arrears.

For auto dealers, the slowdown in sales to consumers has been exacerbated by a sharp drop-off in sales to the state sector. At one Sulaimaniyah Toyota dealership, monthly unit sales are down 35% compared to the pre-crisis period. In early 2014, 40% of sales were to government ministries. This has fallen to just 10%— only the Ministry of the Interior still has money for new vehicles.

At this point only small car sales are rising. The dealership used to sell 3-4 Corollas a month; now it sells ten. Meanwhile, revenue from the service center, generally the most profitable part of a dealership’s operations, is down 10%.

The situation was much the same at the other dealers we visited. Sales of Mercedes were down 50%. A multi-brand outlet had seen a decline from 18- 25 units/month to only 1-2. A Land Rover/Jaguar dealer that used to sell 100- 150 units/month now sells 90—a major setback considering that in 2013 the KRI was Land Rover’s biggest market in the entire Middle East.

At the same time, car loans are becoming almost impossible to come by. The Toyota dealership, for example, formerly provided financing through three local banks. Of these, only one is still lending and its credit terms have become much stricter. In the past customers could get a car loan for up to 50% of the value of their collateral (generally real estate) with no income-related questions. Now the loan-to-collateral ratio is only 25% and the buyer must be able to document income covering three times the monthly payment. As a result only about 1% of the dealership’s cars are now sold on credit, compared to 10-15% previously.

Lenders are right to be cautious. There have been numerous defaults by state employees who could no longer make their car payments after they stopped receiving their salaries.

IV. A Different Kind of Crash

Kurdistan’s great recession has had a major impact on the property market. Prices and rents in Erbil and Sulaimaniyah have dropped sharply, work on major projects has slowed dramatically, and planned developments have been postponed or cancelled.

There are, however, two key differences between this real estate crash and similar episodes in other emerging markets. First, much less credit has been available for real estate speculation than would have been the case if the KRI had a well-developed financial sector. While developers were often able to get bank financing, their customers generally paid with blocks of US hundred dollar bills. Second, there is considerable demand for apartments from new arrivals from other parts of Iraq. These two mitigating factors have limited the number of bankruptcies and kept residential occupancy rates high.

Before the crisis, Erbil was in the midst of a major property boom. Unlike Sulaimaniyah, where the terrain is hilly and large lots of land are relatively difficult to acquire, Erbil’s topography is quite flat and the city contains many sites suitable for property development. It is also the biggest population center in the KRI and home to the regional government.

Over the last ten years, the skyline has been completely transformed as numerous residential, office, hotel, and shopping mall projects have been completed. Erbil is now home to more modern built-up space than any other city in Iraq, including grade ‘A’ office and apartment blocks, gated communities of single detached houses, and several five star hotels.

One of the earliest of these developments was Italian Village, a community of two-story 100 square meter villas that first went on sale in 2009. Located at one apex of Erbil’s toney “golden triangle” in the northwest quadrant of the city, these units have been much in demand both as residences and as office space. Corporate tenants have included international oil service companies, Turkish furniture makers, the Chinese telecoms company Huawei, and the Iraq Stock Exchange broker Rabee Securities.

In 2012, the second phase of this project seems to have set a local record for presales, selling out 1,760 units in just three days. Demand was so high that people who sold a week later are said to have made ten thousand dollars in profit just by putting up a five thousand dollar down payment on what was still only an empty lot. MRF Towers, which now includes a total of 880 units in eleven towers just opposite from Italian Village, was another legendary property. In 2011, the first two towers sold out in just three days. Speculators reported putting $25,000 down on day one and selling on day four for a $30,000 profit.

Little wonder that some investors were known never to go out without tens of thousands of dollars in the inside pockets of their suit jackets. In those days, one might miss the deal of lifetime in the time it took to run home for some cash.

This golden age is now a distant memory. In Italian Village I, units that originally sold for $100,000 in 2009 and peaked at $385,000 in the first half of 2014 are now going for only $220,000, a 43% drop. Rents have followed the same trajectory, starting at $1,000/unit per month, rising to as high as $3,000 per month, and then falling to $1,200 per month. For the city as a whole, realtors say residential prices have fallen 30-50% with transactions down 80% (Abdullah, 2015).

If Erbil’s speculators had relied heavily on borrowed money, most of those who bought after 2012 would now probably have negative equity in their properties. Those whose mortgage payments were just covered by the rents prevailing at the time they bought might also be facing bankruptcy.

As most paid with cash, however, bankruptcies are relatively rare even with rents down by as much as 60%. The main problem for all-cash buyers is that they may now be unable to make timely prepayments on new projects in which they have recently invested. But as the developers of those projects are unwilling to lose clients in a down market, they are generally willing to allow their customers additional time to pay. As a result, construction on their new buildings doesn’t stop; it simply slows down to match the slower rate at which cash becomes available.

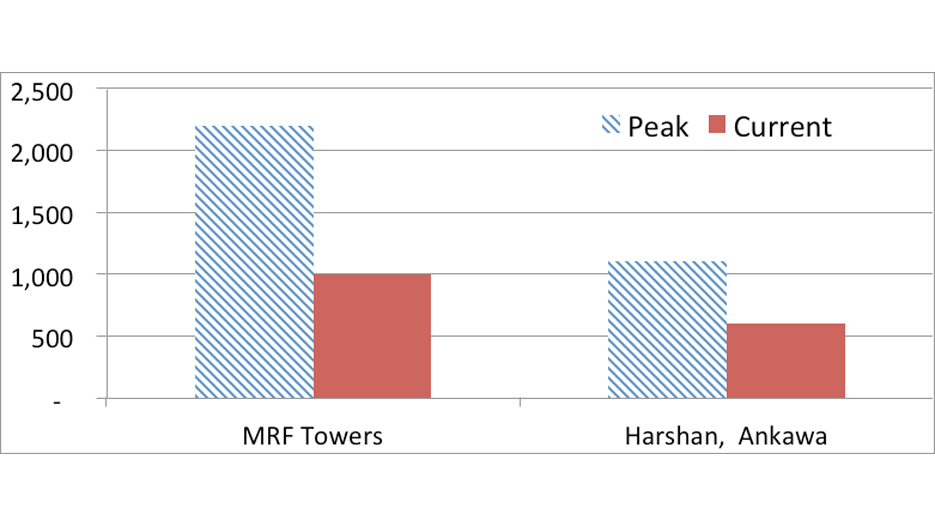

There are also surprisingly few vacancies thanks partly to migration from other parts of Iraq. Consider the situation at MRF Towers, where rents have fallen from $2,200 to $1,000 per unit per month. At these lower rates, tenants who might formerly have paid $1,100 a month for an apartment in the predominantly Christian suburb of Ankawa are now able to move into a much more exclusive address and save $100 a month in the process. Meanwhile, rents in their old building may have fallen to only $600, a price which many new arrivals from the South can afford (Figure4).

Two and three-star hotels have similarly benefitted. Many are full of Arab Iraqis from IS-held areas even as tourism has fallen sharply due to the difficulty of travelling to the KRI and the economic downturn in the rest of the country.

For the four and five-star hotels, it’s a different story. There occupancy nosedived in June of last year, when foreign companies pulled out their staff in response to the IS advance. Properties like the Erbil Rotana and the Sulaimaniyah Grand Millennium, which had formerly been fully booked, were almost empty. Subsequently IS was pushed back, but the foreigners did not return. Hotel staff we contacted reported occupancy rates ranging from as low as 28% to no higher than 80%, with room rates down by 25% or more.

Last year’s foreign company exodus is also bad news for Iraq’s most ambitious grade ‘A’ office complex, the Empire World, located in the heart of the Erbil golden triangle not far from the Rotana. This includes a 30-story, 127 meter high, office tower—Iraq’s tallest—surrounded by four 22-story, 79 meter high, mixed-use towers. These five buildings will have a total floor area of 76,446 square meters. All are due to be completed in 2016. (A detailed site plan is available at http://www. empireiraq.com/.)

In front of these and on either side of the main entrance is the Empire Business Complex, which consists of six 25 meter high office buildings. These buildings, which have already been in use for some time, contain 30,600 square meters of space. The development also includes numerous residential blocks, some already occupied, the rest in various stages of completion. A Marriott hotel is also on the drawing board.

At the time the Empire World was conceived, it would have been reasonable to expect strong demand from international corporations seeking business opportunities in the KRI or with plans to use the region as their “gateway to Iraq.” Large local companies might have been buyers as well.

Today it is not clear who is going to fill this space. The oil companies that formerly occupied much of the Empire Business Complex have almost all either left the country entirely or moved into smaller, cheaper premises. Other foreign corporates are leaving as well, few are arriving to replace them, and not many local businesses are likely to be moving in.

Unlike Erbil’s apartments and villas, where there are relatively few vacancies, many of the Empire World’s offices may be empty for years.

V. A Dream Deferred

A natural consequence of the dismal state of the KRI economy is an exceptionally bleak outlook for private-sector investment. KRI Board of Investment approvals have fallen from a peak of $12.4 billion in 2013 to only $793 million for the first nine months of this year (Figure 5). Even these alarming statistics understate future declines in actual investment because much of what was approved in 2013 and 2014 is unlikely to go ahead under current conditions. Examples include the Erbil Downtown, a development by Dubai’s Emaar Properties valued at $2.4 billion; over $2 billion dollars in approved cement plants; and Arbat Industrial City, worth $2 billion. These projects alone account for about 40% of the 2013-2014 approvals total.

Patterned after Emaar’s well known Dubai Downtown development, the Erbil Downtown might be considered the ultimate confirmation of the KRI’s status as the next Dubai. The plans call for 11 residential towers, 10 office blocks, two high-rise hotels, a shopping mall, restaurants, schools, and swimming pools, all to be built on a 550,000 square meter site close to the center of Erbil. After the Empire World, this is probably the most ambitious such scheme in Iraq today.

But so far none of this new city center has been built and there seems to be little urgency about starting work. Erbil certainly will not need any more offices and hotels for the foreseeable future and the residential space is not priced to sell. One broker told us Emaar is asking for $2,700 per square meter in cash upfront even as comparable flats in the MRF Towers are going for $1,500 per square meter payable in installments.

Arbat Industrial City, just east of the city of Sulaimaniyah, is yet another victim of the economic downturn. This 6.75 million square meter site is supposed to be developed into Iraq’s premier industrial estate. About 40% of the space is reserved for Iranian companies while the rest is expected to attract both local and foreign investment. Investors have expressed interest in setting up factories for products such as building materials, pharmaceuticals, processed foods, and bicycles.

Development is supposed to proceed in phases, with the first starting in 2014. Almost all of the $2 billion project value is expected to come from the factory owners, who are responsible for site preparation and construction. The government has undertaken to provide power, water, and sewage connections, which will require a total of $180 million over a five-year period.

So far only four companies are present. Iralex, an Iraqi producer of sandwich panels, aluminum sections, and coated window glass, is investing $80 million. A Chinese company and an Iraqi company each have $20 million projects—the former to manufacture steel sections, the latter, power cables. A Turkish furniture factory, which has so far only completed site preparation work, is supposed to put in $10 million.

All four face the same problem—the government has no money to set up the high-voltage towers required to reach the existing power lines just 1.4 kilometers away. As a result, Iralex told us they have been forced to use two backup generators to power their sandwich panel line, which has just started production. (Sandwich panels are partitions with a foam interior ‘sandwiched’ between two galvanized steel sheets. Iralex’s biggest customers for these are expected to be camps for internally displaced people and refugees.)

Using these generators requires switching from one to the other every five hours, each acting as a backup for the other when not in use. This arrangement is far from ideal. The added fuel and maintenance expenses make the cost five times higher than power from the grid. The result is an approximately 40% increase in total cost, making the product uncompetitive.

Clearly Arbat Industrial City will not be able to attract any more investors until this power issue has been resolved. A scheme to attract $2 billion into the KRI’s manufacturing sector thus appears to have stalled for want of the few million dollars the government would need to provide the electricity for Phase I. Where there might be numerous world-class industrial facilities one instead finds little more than a huge open field connected to the main highway by a single unpaved road.

The province of Sulaimaniyah is also home to the famous Bazian “cement valley”, the center of an industry whose total installed capacity has grown from zero in 2007 to 14 million tons per annum today. Bazian’s cement plants supply the whole of Iraq and are thus affected not only by the recession in Kurdistan but by the slowdown in the rest of the country as well.

In Bazian things have been steadily getting worse since ever since the depreciation of the Iranian riyal in 2012, which resultedA in a jump in low-cost imports from Iran. Since then capacity utilization—formerly 100%–has fallen to 60-70%. The cement price peaked at $160/ton in the late 2000’s, when demand was high and local capacity was still relatively low. It is now only $60/ton.

The KRG budget crisis has hit the industry particularly hard, eliminating an annual 2-3 tons of demand that formerly came from government projects. At the same time, producers that had been providing vendor financing to Kurdish contractors are now owed tens of millions of dollars.

It is unclear what plans local business groups may have for the cement projects they have gotten approved over the last three years. But it seems safe to say that nothing remotely like the $2.5 billion in investment that these would jointly require is going to be forthcoming. With demand collapsing not only in the KRI but in the rest of the country as well, there could hardly be a worse time to enter this sector.

VI. What is to be Done?

It might be argued that the nature of the rentier economy precludes any possibility of effective counter-cyclical government policy. If the business cycle is entirely driven by oil, perhaps there is nothing else to do during recessions except wait for the oil price to bounce.

In this case, however, the government is not entirely without options. Certainly the KRG cannot solve its budget crisis with money it does not have. But the KRI’s state employees, contractors, banks, and oil companies have more than just a cash flow problem. Most of their claims are in the form of overdue receivables, which have no formal terms or any definite maturity date. This makes it difficult for them even to plan or to hedge risk.

The KRG could do a lot to improve visibility regarding when and how much it is eventually going to pay its creditors. The first step might be to generate detailed and transparent budget forecasts based on a variety of oil-price and production scenarios. For each of these, it could then provide guidance on what the status of its various obligations would be.

It might even go a step further and replace its obligations with government bonds having payoffs explicitly linked to those scenarios. Contractors holding blocked checks, for example, might be given the option of exchanging them for a note linked to the price of oil. If the average price rose above a certain level for some pre-specified period of time, the payoff could be set above the face value. If the price fell, the holder would get less. Other creditors could be offered similar alternatives. Restructuring the KRG’s debts in this way would not necessarily imply any change in the total amount owed. In practice, the holder of an unpaid receivable is already holding an oil-linked instrument because the amount he or she is likely to receive is almost entirely dependent on growth in KRG oil revenues. The advantage of swapping receivables for bonds would simply be to make future cash flows more predictable. In addition, if the bonds were tradable, default risk could be transferred to those most willing and able to bear it.

Depositors at the KRI’s illiquid banks have similarly been left holding claims without any definite terms. A resolution mechanism is urgently needed to deal with this problem. Here, a complicating factor is that the Central Bank of Iraq (CBI) branches in Erbil and Sulaimaniyah have never been properly integrated with the CBI headquarters in Baghdad. In fact, the CBI does not even consolidate the results of these branches in its annual financial reports. Yet bailing out the banks is going to require an injection of new cash, something only the headquarters can provide given that the Kurdish CBI branches do not issue their own currency.

Proper integration with the central bank system might thus be another step to consider. In addition to financial consolidation, this will also require harmonizing prudential supervision with the rest of the country. Otherwise, CBI headquarters is unlikely to go along. It will not want to be responsible for rescuing institutions that it lacks the power to regulate effectively.

Reform of the public sector is also an important part of the solution. In effect, the KRG is already cutting civil service salaries simply by not paying them. A more orderly and predictable reform process would clearly be beneficial from the point of view of both the government and its employees.

Reducing the government payroll will not be easy without a larger non-state sector to absorb laid-off workers. Cutting government spending must go hand in hand with promoting private enterprise. Some of the possibilities include improving water management for agriculture, protecting local industry through tariff barriers—which would also widen the tax base, strengthening contract enforcement, and clarifying vague and incomplete regulations (AUIS Roundtable Discussion, 2015).

Some readers may dislike the idea of tariff barriers because they are usually held to be economically inefficient. This objection would certainly be valid in an ideal world. But in a real economy, where there are generally multiple inefficiencies, things are less straightforward.

In the case of cement, for example, a tariff might actually enhance efficiency by increasing capacity utilization at Bazian’s cement plants. The revenues raised could be used to eliminate inefficiencies elsewhere in the economy. They might cover the cost of providing Arbat’s factories with electricity, for example. (Here again, closer cooperation with Baghdad would be required. Tariffs will not work if they are collected at some Iraqi border crossings but not others.)

To facilitate the migration of government employees to the private sector it will also be necessary to provide social safety nets to replace state-sector benefits. Some form of social security system might be an option. The insurance sector can also play a role by creating private-sector solutions, which might have the added benefit of stimulating the local hospital industry (AUIS Roundtable Discussion, 2015).

Naturally none of these measures is going to end Kurdistan’s great recession. Only a spike in the oil price would do that. The goal should rather be to mitigate the short-term effects of the crisis while beginning a longer-term process of eliminating the booms and busts of the rentier economy altogether.

Acknowledgements

The author would like to thank Azheen Ifuad, Hakar Elias , Manesht Saadoon, Salam Ali, and Sara Jabbar for their invaluable help as research assistants for this project, Luzan Baban for her tireless efforts as interpreter, and the AUIS Institute of Regional and International Studies, without whose support this report could not have been written. The following people also made significant contributions to the information included on various economic sectors: Aga Ismaeel (AUIS), Aryan Sofi (Aryan Goldsmith), Bayad Ali (Bayad Inc.), Choman Ibrahim (SAS Automotive Services), Jennifer Breckon (Naphta Consulting), Mahmoud Ma’ruff (Kurdistan Region Statistics Office), Mehdi Taj (Lafarge Iraq), Mohammad Zebari (OiLSERV), Muhamed Amin Abdullah (International Development Bank), Muhammad Abdul Aziz (Baghi Shaqlawa Real Estate), Rami Yassir (Rabee Securities), Rawaz Rauf (Fanoos Telecom), Rebaz Ibrahim (Erbil Rotana), Reni Saputri (Sulimaniyah Grand Millennium), Saad Hasan (Qaiwan Group), Saman Sadiq (KRG Board of Investment), Sherzad Fareq (Iralex), Shwan Baban (Iralex), and Stephane Hallou (Lafarge Iraq).