Al Saedan Real Estate: Leading the Real Estate Market Maintaining Top Position

Al Saedan Real Estate is one of the leading real-estate companies in Saudi Arabia. The company has a strong expertise in master-plan developments, land development, building commercial and residential centers, selling and buying local and international real estates, providing consultation in real estates, and providing valuation and estimation services. Al Saedan is an international real estate company with projects in Saudi Arabia, Tunisia and the United Kingdom.

Interview with Dr. Bader Ibrahim Ibn Saedan, General Manager of Al Saedan Real Estate

Who would you consider your biggest competitors in the real estate sector?

Al Saedan Real Estate is one of the leading real-estate companies in Saudi Arabia. The company has a strong expertise in master-plan developments, land development, building commercial and residential centers, selling and buying local and international real estates, providing consultation in real estates, and providing valuation and estimation services. Al Saedan is an international real estate company with projects in Saudi Arabia, Tunisia and the United Kingdom.

Al Saedan Real Estate is one of the leading real-estate companies in Saudi Arabia.

Each sector of Al Saedan Real Estate has a different competitor. The real estate market is one of the largest markets in the GCC, and therefore partnerships are quite common. The public sector is the most important player in the real estate market and, at times, a competitor. It is, however, very difficult to compete with the government.

For example, the King Abdullah Financial District (KAFD) is a new development under construction near King Fahad Road in the Asahafa area of Riyadh. Saudi Arabia is being undertaken by the Rayadah Investment Corporation on behalf of the Pension Authority of the Kingdom of Saudi Arabia, consisting of 34 towers in an area of 1.6 million square meters. It will provide more than 3 million square meters of space for various uses, 62,000 parking spaces, and accommodation for 12,000 residents. The project is estimated to cost 29 billion Saudi riyals ($7.8 billion). Al Saedan Real Estate cannot compete in such a large projects and it is natural.

Sometimes there is an overlap and the public sector is involved in a smaller scale project that should be the domain of the private sector, such as malls, compounds or commercial strips. That is what is, at times, unfair in the market. The government should give more space to the private sector.

You are one of the oldest and largest real-estate companies in Saudi Arabia. Your family dealt with real estate since the dawn of the century. Can you speak about the evolution of the real estate market, land and ownership?

Since the beginning of the century, there has been a significant evolution. I represent the third generation of the Al Saedan family in real estate. I’m not talking about the company – Al Saedan Real Estate — because we worked as families before. There’s an evolution within the family and within the real estate market. For example, we started early before the unification of Saudi Arabia. At that time, the most important aspect of real estate was security. That’s why the cities were secured by fortifications; they were gated cities – like a huge compound. Nobody could build outside the city’s walls. But with the birth of the new unified Saudi Arabia, the cities gradually became larger and they doubled, tripled, or quadrupled within one or two decades. Development, at that time, was the number one priority for the real estate market – buying huge plots of land outside the boundaries of the cities and developing the land.

Since the beginning of the century, there has been a significant evolution. I represent the third generation of the Al Saedan family in real estate. I’m not talking about the company – Al Saedan Real Estate — because we worked as families before.

The government started to build the infrastructure at that time. Private developers or business families involved with real estate did not have invest into infrastructure. We just did the subdivision and sold parcels to locals. The government started to organize and control the cities as they became bigger and bigger within a short time. They stopped development of the private sector without building the infrastructure. That was just to control development. The cities became what we see today but now the system is completely different. Private sector real estate developers had to build the necessary infrastructure and the real estate sector became more regulated, sophisticated and slower. As the cities grew, the emphasis shifted from horizontal construction to vertical construction.

Thus, Al Saedan Real Estate became involved in the vertical construction, building compounds, malls, and high rise buildings. The real estate market is more competitive. Also, we were now working in more than one city at the same time. The market had changed and is becoming more organized than before. The more organized the market, the slower the market gets. It’s better for the country of course, but it is slower for the business.

What about land ownership and the directory of people who own certain lands? What about land ownership in Saudi Arabia? What has been the evolution until now?

Land ownership has been in existence since the beginning. It was a type of freehold ownership, so the government, with the authority of the King, gives the land to the people or to the government for public projects and then it transfers from the people to others to add value to the land. Sometimes the ownership transfers without adding value, such as when you buy raw land and transfer it as is. That’s not good for the market because it inflates the prices. Speculation with raw land is rampant. A speculator waits for someone else to buy it, which inflates the prices, without adding value to it. The best thing is to develop the land to add the value.

In Saudi Arabia, the system has been to transfer the land as freehold, except in some places like the Holy Lands, in Mecca and Medina. It’s completely different than in any other part of Saudi Arabia. For example, after the creation of the GCC, all GCC citizens can buy land in Saudi Arabia with certain restrictions, except in Mecca and Medina. That is only for Saudis. There is limited number of land ownerships in Mecca and Medina, which existed prior to formation of Saudi Arabia. These owners are non-Saudi Muslims and they still own their deeds. However if they sell it, they can sell it only to Saudis which is why most of them keep those parcels to pass from one generation to another. That’s the only change or difference – only in Mecca and Medina – but all over the rest of the country it’s always been a freehold transfer of ownership.

That’s the only change or difference – only in Mecca and Medina – but all over the rest of the country it’s always been a freehold transfer of ownership.

This is one of the main challenges in this sector. You have very high land prices and the ownership is opaque. That means you don’t know if the owner is really the owner. Is this a challenge? Has this been addressed now?

Because the fast evolution of the real estate sector, land ownership and general development the regulations did not keep pace with the development. Thirty or forty years ago there were no technologies like the GIS systems, no computer systems, and geography was only visual and not digital. Saudi Arabia is a dessert; there are no trees, rivers, or anything that would clarify the boundaries between lands.

These challenges result to frequent disputes and overlap of ownership, especially when the land was subdivided. If the neighbor was not involved in the subdivision, the other owner sometimes sold parcels that fell into the neighbor’s property. This is the most important obstacle of the real estate market currently. We understand that it is only because of the fast evolution of the market and the fast buying and selling that took place twenty years ago. But now it is a big challenge as to how to reconcile these accumulated problems together. It’s really difficult to be 100% fair to both owners; both of them have to give up some of their rights to solve these issues.

But coming back to the issue of prices; prices are relative. When you say expensive or cheap, it doesn’t work that way. If you say it is expensive, I would have to ask compared to what, or where, or to whom? When you say expensive, if you compare Riyadh as the capital city of Saudi Arabia to other capital cities in Arab countries, not in Europe, America, Asia, or wherever, it is the cheapest. Comparing prices is really a relative issue, but if you compare it to the purchasing power of people, then I would say yes, it is expensive.

Purchasing power of people in Riyadh is low, they cannot buy in any capital city, but they can buy in smaller cities. We have a problem in Riyadh. It’s the biggest city in Saudi Arabia, and at the same time, one-fifth or one-quarter of the population are living in Riyadh. The government has noticed this only in the last seven years, and that’s why they are building universities, creating jobs, building industrial centers in other cities, just to ease the demographic pressures in Riyadh.

In Jeddah, for example, the problem is that it’s much smaller in area than Riyadh and the development is limited. They have the sea on one side and the mountains on the other side, so they have to build in a strip along the sea. Nobody wants to live too far north or south; they want to be close to the city center. That’s why prices in Jeddah are higher than in Riyadh. Plus, Jeddah is the gateway to Mecca, so all non-Saudis want to live in Jeddah. They prefer Jeddah more than anywhere else because it’s close to Mecca and it is the gateway to Mecca. They have an international airport, an international seaport, an Islamic seaport, so Jeddah has more job opportunities because there is more tourism per se – Islamic tourism. Jeddah is more dependent on business. Riyadh is the capital city, and it depends completely on the government and international businesses. Jeddah is completely different.

The Eastern province on the other hand depends on the oil and gas sector. Most oil in Saudi Arabia, about 90%, is from the Eastern province. Foreign and local oil companies have all the jobs in the Eastern province, but in Riyadh there is the headquarters, the government sectors, and headquarters of huge companies like SABIC or others.

So each part of Saudi Arabia has its economic specialty. The jobs and economic activity affect the real estate prices because location is very important when investing in real estate. That is how we look at it.

What is the outlook for the sector? What are the growth rates? One of the major challenges in Saudi Arabia is the affordability of units. Saudi Arabia has a very young population – 60% is below 25 years – and the house ownership is very low compared to other countries which stands around 30%. There is a 19 year waiting list to get financing. The government has tried to address the issue. They announced multi-billion dollar plans to build 400,000 units but it’s not enough given there are so many people who enter the work force every year. There are 250,000 graduates entering the work force. This creates social tension and polarization; people need housing.

Talking about the housing sector in Saudi Arabia, we have pros and cons for the market. The good news for the market is that there is a high, genuine demand unlike in other countries where they have demand, but it’s a foreign demand. In Saudi Arabia, foreigners cannot buy real estate unless they have residency. Even if you have residency, you can buy your own home but cannot invest. That makes the demand real, which is really important for the market and makes it independent of international markets. The demand is not influenced by outside events.

We have a young population that really gives us a secured future demand for the market.

We have a young population that really gives us a secured future demand for the market. The only challenge is how to supply the market and satisfy this pent-up demand. There are two factors of how to alleviate the demand. Massive construction of housing units and emphasis on affordability. The real estate industry must build houses or residential projects that really match the affordability of the demand; this is really important. The market is saturated with real estate developers that are just building houses and residential units without paying attention to affordability. The private sector cannot directly affordability as the new mortgage law or financing schemes are the domain of the government, but we can build cheaper houses sacrificing the quality. The developers do not want to jeopardize the quality; we want good quality houses.

Affordability is a government issue. The government has to boost the purchasing power per capita by introducing better regulations. No capital investment is required from the public sector. The other aspect of where the public sector can help is to create a good trust between the real estate companies and the locals. Saudis have lost their trust in real estate developers because the market is not organized as a result of weak regulation. Many inexperienced entities entered the real estate market to build cheap and reap a hefty profit. These newcomers do not focus on quality or their brand equity and goodwill because they are after quick profit, and if they lose, they leave the market. But what remains is the bad quality residential houses that have been built by so-called real estate developers. They are actually not genuine developers; they are just speculating investors trying to make money. When the regulations are enforced, not everyone can develop. Investing is okay but no one can build or develop real estate unless they are really experts.

The other problem the industry is facing is self-construction without any experience. The negative aspect of this type of construction is low quality and high cost. When it is only a single house you are building, you lose the economies of scale. When you build in mass, it is less costly.

Now we are coming to the mortgage law. This issue has been a priority for the government for the past 15 years. Unfortunately, the law is still under discussion. The market needs the new law in order to increase the purchasing power of the Saudis.

There have been attempts to create self-sufficient financing schemes from the private sector real estate developers; if you build houses, you need a finance institution to finance your clients to buy your houses so we had to create a financial institution according to the new mortgage law. We created this financial company to finance house buyers in 2007 because the mortgage law was very close. In 2008, they announced the mortgage law would be released that year. Then the global real-estate market was shaken by the financial crisis of 2008 in the United States triggered, in part, by unsecured real estate mortgages. This event stopped the progress on the mortgage law in Saudi Arabia. The officials want to wait and observe the effect of the financial meltdown in the U.S. and learn from the mistakes before advancing. So, we ended up with a staffed company ready to work with no business. After initial losses, as a result of idleness, we dismantled the company.

I’m sure so many people or investors had the same problem at that time. Mortgage law is very important for the affordability of citizens if we really want to solve the housing issue in Saudi Arabia. Now we have a housing ministry and they are committed to building 500,000 units and they’ve been working for seven years and not one single Saudi until today has received a unit.

You have one of the largest land banks as a private sector real estate company and you are a master developer. What makes you one of the leading real estate companies in Saudi Arabia?

Al Saedan family has been working in real estate for generations. Our company has faced the crises in the real estate market before and we know how to deal with any crisis, whether in the prices, the market, or political instability. First of all, the real estate cycle is a long cycle. Every 7 or 10 years you see the change comes back. In any cycle, sometimes between the bottom and the top there is time to plan for the next downturn. Many newcomers that have not faced any crisis might get overexposed. If these companies feel over-optimistic about the future and do not plan for the rainy days, they lose everything. That’s why we see newcomers in the market failing with any crisis because they don’t have plans for the future.

The real estate market is like any other market – it has ups and downs. The only difference is that it’s a longer cycle market, unlike the capital market. In the real estate market, as an expert I can predict from today what is going to happen next year or in the next two years. In the capital market, they cannot do that. Their market is faster.

In the Kingdom, oil prices will generate cash in the country on the government side and the government will spend at least some of it locally. The liquidity generated by petrodollars will spill into the real estate sector. The real estate market in Saudi Arabia is completely different than other markets such as Dubai. Dubai is a very wide open market and foreigners come by; it’s a single city state so government there is really focused on one city.

Saudi Arabia is the largest economy in the region and every city has its dynamics. Even if you learn and have experience in the U.S. market, for example, when you come to Saudi Arabia it’s not the same and vice versa. When you go from Saudi Arabia to the U.S., you cannot use your experience without having knowledge of the local market. You need to have the knowledge of the local market.

The real-estate is a solid asset-based market that really depends on something that you can see with your eyes and the life of an asset is decades. It’s unlike the capital market. Especially in the U.S. market today you can see a company that’s worth a lot and then maybe next year you don’t see it on the market; it disappears. Real estate is asset-based; it will never reach zero. There are no zeros in real estate. Whatever you buy, you can lose money, you can gain money, and you can earn whatever, but you can never reach zero. All people depend on the real estate market – shelter is one of the basic human need. For example, you are here in this country and you need a place to live in, whether it’s a hotel, apartment or whatever. The owner of that place you are living in is an investor in real estate.

As one of the oldest real-estate company in the Kingdom, we have in-depth experience proven and tested by decades. If you live through one complete cycle and you survive it, I think you can go forever; however, you have to transfer it to the next generation.

As one of the oldest real-estate company in the Kingdom, we have in-depth experience proven and tested by decades. If you live through one complete cycle and you survive it, I think you can go forever; however, you have to transfer it to the next generation. For example, I have been working in real estate since I was 10 years old, so I have more experience than the majority of people my age. In a family business in Saudi Arabia, before – not at this time, we used to work at an early age with our fathers or grandfathers or whoever else in our family.

The Saedan family always moved with the market, changed, morphed and followed new trends. We built our own houses; we didn’t have neighbors but we attracted neighbors to the development. Today, the developer must develop the infrastructure, utilities, electricity, power, water, ICT. Preparing for the cycles and moving with the market as well as cultivating in-house expertise makes Al Saedan Real Estate one of the leading companies in the Kingdom.

We mentioned before that you are now restructuring the company. How do you position yourself? How do you structure your strategy, vis-à-vis your competition? You are now moving more into master development so you will be the master developer of the infrastructure and you will invite individual developers to build on this land. What is your strategy to be successful?

Master development is very limited now in the market; a lot of competition is coming in master development. Therefore to continue doing the same thing, you have to create a very well-organized company. We have to transfer old knowledge and experience onto paper and not keep it in our minds as we did before. We have to build policies and procedures for the company, to make it work for the next generations to continue. Now, the market is becoming more organized than before and the competition is becoming stronger than before. For example, 20 or 30 years ago we didn’t have a lot of competition so our name was enough.

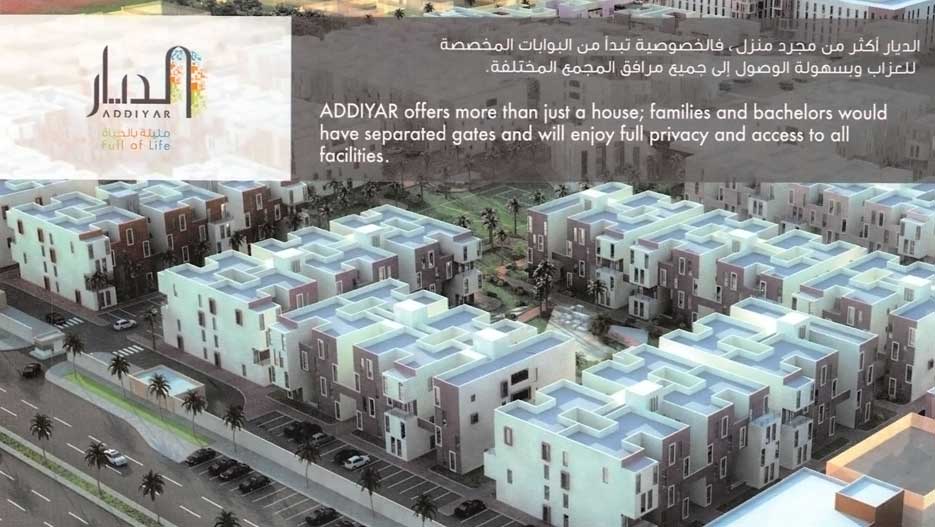

Now, competition is growing and the market is changing. Al Saedan Real Estate needs to shift from master development to project development. We are currently working on some state-of-the-art real-estate projects. The nature of the demand has also shifted from standardization to being unique. People expect the higher standards and creative ideas. This is our strategy to come up with unique and different projects.

Detailed market studies and analysis are becoming a standard at Al Saedan Real Estate. These detailed studies help us to understand the customer behavior and tailor-make our offer. Data collection, feedback gathering and market research have become an integral part of our business development strategy. For example, what are foreign companies looking for when they want to work in Saudi Arabia? They can go anywhere and rent their offices. Maybe they have different demands and they work differently than the way we work in Saudi Arabia. Also, maybe foreigners who work in the city or in Saudi Arabia have different ways of looking at their houses or apartments or whatever. Also, locals have changed and we have different segments. We have the new generation who have lived abroad and have come back here with new and different ideas.

Today, Saudi Arabia has a relatively large generation accustomed to the Western style living and require a different standard. The market is more sophisticated than before. We need the best talent in our finance department that really works out the feasibility of projects and deals with project finance and consumer finance.

Another area of business development is the project department. Al Saedan Real Estate is currently undergoing a transformation that should upgrade each existing department. Best international practices are to be integrated into our standardized policies and procedures and followed up with quality control by all the managerial departments. Best practices are important because of the capital markets.

Transparency could be a double edged sword. If the competition knows our plans, they can easily use this knowledge to their advantage and get an unfair advantage. If they know what you are doing, they can do the same thing. Maybe they will reach the end goal before you, because it’s a very long process as I mentioned. For example, if my plan is to build compounds it has to be a 5, 6 or 7 year plan. Doing the feasibility studies, finding the locations, studying the market, getting the permits, finding contractors, doing the engineering work, building the project, and marketing the project is a very long process. Transparency is something new and challenging. Balancing disclosure and openness whilst keeping our competitive advantage is our great next challenge.

Transparency could be a double edged sword. If the competition knows our plans, they can easily use this knowledge to their advantage and get an unfair advantage. If they know what you are doing, they can do the same thing.

You have many projects. Please tell us about one of your projects, either future or current.

Currently, the company is involved with multiple projects. First, Al Saedan Real Estate is one of the leading companies building residential compounds, with three projects. In one of them, phase one is completed, phase two will be completed within three months, and phase three possibly by the end of 2014. That’s a huge compound and is oriented to the industrial city. Second compound is due to be completed in July 2014, about four months from now. Third compound is starting this year and it should be completed in about two years. On the master land development front Al Saedan Real Estate is currently developing one million square meters land development starting 2014. We are now in negotiations with sub-developers to develop houses on that land, along with commercial strips and some other developments. Probably 50% will be land to be sold to end users.

Regarding our vertical developments, we are building a 30 stories high rise tower, currently the project is on schedule to be completed in March or April of 2015. We have two other towers and the permits and design are completed but we will not start now; we will start after we secure the other tower. The other two towers are completely designed. The two towers will be our flagship top-of-the-line developments. They will be high-cost, so they are oriented to the high-end users. There may be some offices and apartments and possibly a hotel. There are two towers and they are not identical but I would say they are integrated. You can build one and then the other one later one, or you can build them together to have a complete image together. They make a nice shape together.

We have five projects in Mecca. We have started construction on one of them and the other one will start this year; three others will continue and we are waiting for the permits. In Mecca it is completely different; the market is booming. There is a very high demand in Mecca because of expanding the Grand Holy Mosque; the government has to demolish old buildings. That is why there is a lack of projects in Mecca in terms of hotels and residential. Residential market in Mecca is being cornered by the demolition of housing and the housing shortage will continue for the next three or four years. Just to reach those negative figures, we need maybe three or four years to do construction in Mecca. We are participating in this and so many other real estate developers are re-building in Mecca, but we need more developments.

Mecca is really a huge market for the next five years. When the Grand Mosque and the surrounding government projects are completed, the capacity of Mecca will be increased which means more residential compounds and hotels are needed in Mecca for pilgrims to find places to spend a few days time during the pilgrimage days, Ramadan, and all other seasons. Mecca is a seasonal market but the season is becoming longer. It was only two months a year but now it is becoming four, five or six months a year which really makes the market more stable.

Also in Medina, there are huge developments. The government has demolished many buildings and they have plans to demolish more. That means more space for new projects. With Mecca, Jeddah grows as well. The future market over there in the Western province will really be a much bigger market than what it is now in Riyadh or the Eastern province. That’s the announced plan but we have other plans that I cannot mention now.

What is the value of all of these investments that you are doing?

Real estate in Mecca is very expensive, so we are talking about billions of Saudi riyals for our projects in Mecca alone. In Riyadh, in the next five years, there will be maybe more than two billion riyals.

In terms of growth of the real estate sector, what are the growth rates? 6, 7%? Double digits? What is your estimate?

In real estate in Saudi Arabia, the growth for the last five years was more than 10% and it will continue close to that figure. It may be a little bit less. Most of it will be in the Mecca and Medina regions – most of it. Secondly, it will be in Riyadh. Riyadh is the capital city so most commercial movement and financial movement is in Riyadh. Growth in the population in Riyadh is more than the population growth in the country itself. That means people are moving to Riyadh.

Which subsector do you think is the most dynamic, such as housing, retail, industrial real estate, land, etc?

At the moment, it’s housing and that will continue for the next three or four years. Commercial goes after housing and hotels are really important. We have a lack of hotels in Riyadh city but I can see many hotels under construction today and maybe in the next two years we will have five more 5-star hotels opening. Maybe ten or fifteen 4-star hotels will open in Riyadh. That means it will be saturated within the next few years in terms of hotels. Demand is high nowadays but I think the supply is good enough to meet the demand in hotels.

In office spaces, we have plenty of projects in that and it will be more than saturated within the next, maybe, two years. There may be an overflow of office spaces in Riyadh city itself, especially with those three huge projects we have. We have the King Abdullah Financial Centre and the technology park and we have another business park in the east of Riyadh. All three of these huge projects are due to complete by perhaps next year. At the technology park they are already renting some spaces out but at the King Abdullah Financial Centre, they cannot start renting before April 2015 because they are building towers with infrastructure. So they have to complete the infrastructure first to allow accessibility to those towers inside. It’s a huge complete project together.

King Abdullah Financial Centre will boast the highest tower in the Kingdom more than 80 stories tall. This will be taller than the Kingdom Tower. There is a tower in Jeddah that is going to be the highest in the world – they say 1 km. But now, it’s been announced in Dubai that they will build higher than that.