Top telecom infrastructure developer announces strategic plans

The telecom industry in Indonesia is dominated by the main incumbent Telkom and Telkomsel. The other main players in the market are Indosat, XL Axiata, Three, SmartFren and STI.

Interview with Michael McPhail, CTO of Moratelindo

What is your overview of your sector?

The telecom industry in Indonesia is dominated by the main incumbent Telkom and Telkomsel. The other main players in the market are Indosat, XL Axiata, Three, SmartFren and STI. There has been recent consolidation in the market and I would expect this continue, there are also international companies looking to invest in this sector. There is a large push by a number of player into Fiber infrastructure, with companies launching FTTH solutions. Investment into fiber infrastructure is likely to accelerate with the introduction of LTE services and greater demand for internet services.

What are the investment opportunities (for the sector and Moratelindo)?

Moratelindo are investing to extending our submarine and terrestrial backbone network infrastructure in Java, Sumatera. We have recently won two government tenders to extend the submarine infrastructure in line with the countries broadband plan.

Can you tell us more about Moratelindo?

The core activity of the company is to provide wholesale connectivity for telco companies and internet services for enterprise customers. We currently have a large IP transit from Jakarta, Batam to Singapore, together with backbone networks in Java and Sumatera. We are in the process of deployment FTTH and FTTB, with a view to move into the consumer market, together with IPTV services. (This development is currently ongoing).

Are you looking for investors?

Currently Moratelindo is 100% owned by Indonesian shareholders, however, with our large expansion plans we would consider options for other investors.

What are your plans for the market leadership?

Moratelindo has a Singaporean subsidiary, who focus on international peering, together with our IP transit we believe that we have an advantage over most players in the market because we can offer an end-to-end service. We have also recently started a local internet exchange so that we can consolidate our position in the market and extend our local peering arrangements. Despite our capabilities we are not a large organization so we have the ability to move quickly to address or customer’s needs.

How do you approach CSR?

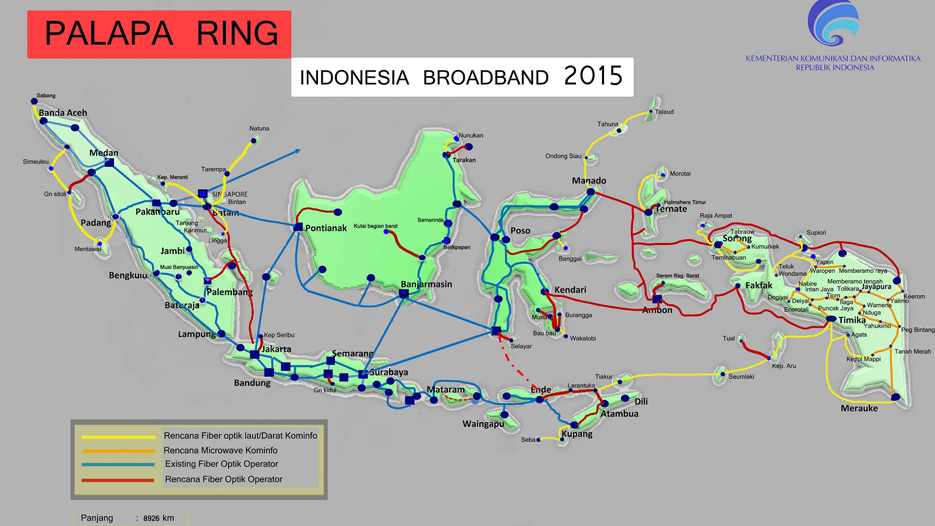

The Palapa Ring West and East projects, which we recently won are fundamental to the Indonesian’s government broadband plan. We are truly grateful to be awarded these projects as this will strengthen the current internet infrastructure and extend the reach of internet services across the country.

What are the main challenges for the company?

The main challenge we have is a good challenge, being able to scale-up to meet the ever growing demand of our customer and significant expansion plans.

What are your expansion plans and the vision?

As mentioned above, we have significant expansion plans for our submarine and terrestrial backbone networks which will be executed from 2016 to 2018. In addition, we will continue to invest in FTTH and FTTB solutions to grow our enterprise market reach. The company vision is “To be the prominent Broadband Company in Indonesia”, this is something we are working towards.

Palapa Ring paket Barat is a major milestone for the company and for Indonesia. Regions such as Sumatra, Java, Kalimantan, Nusa Tenggara, Papúa, Sulawesi y Maluku will have fiber optics which should allow them to develop at a faster rate.

Add 10% penetration on broadband triggers economic growth: 1,38% in developing countries (Source: Worldbank, 2010)

Add 10% broadband access in a year has correlation with increasing 1,5% work productivity in 5 years (Source: Booz & Company, 2009)

Increasing 1% broadband penetration in household will decrease unemployment 8,6% point (Source: Katz et al, 2012)

What are the needs you see in the Telco industry in Indonesia? What are the challenges the sector is facing today?

The largest challenge for all operators in Indonesia is the cost to deliver their services in relation to the current ARPU levels. Plus there is still quite large competition in the market with still around 7 players, so unless companies reach a certain scale they are unable to survive in the market.

Telecoms have proven to be key in uniting countries and even continents and we have seen in Africa, Asia and Latin America. It gives everyone the chance to communicate and to be informed of what is happening in the world around them. What are the benefits Telecoms have brought to Indonesia?

Indonesia has one of the largest FB users in the world currently standing at number 4 globally. The appetite for social media in the country is very large, so telecom players are helping support this ever-growing demand by allowing individuals to keep in touch with their friends/families and be even more aware of the current global condition.

Moratelindo is a major player, that has diversified into wholesale, public and private sector, education, O/G, Hospitality and more, What will be Moratelindo´s next step in diversification?

Our plans are to strengthen our reach in the current sectors we address by continuing to improve our quality of service and introduce new products to support SOHO and SMEs in the country. We will also extend our reach into the consumer market by offering FTTH/IPTV services.

Palapa Ring paket Barat is a major milestone for the company and for Indonesia. Regions such as Sumatra, Java, Kalimantan, Nusa Tenggara, Papúa, Sulawesi y Maluku will have fiber optics which should allow them to develop at a faster rate. What is the social and economic development impact this project/infrastructure will have in these regions?

Below are extracts from the broadband plan:

Add 10% penetration on broadband triggers economic growth: 1,38% in developing countries (Source: Worldbank, 2010)

Add 10% broadband access in a year has correlation with increasing 1,5% work productivity in 5 years (Source: Booz & Company, 2009)

Increasing 1% broadband penetration in household will decrease unemployment 8,6% point (Source: Katz et al, 2012)

What can you tell us about this project? Is Moratelindo in the look for foreign investors to partner in this and in other projects?

We are currently finalizing lending at the moment, however, would also consider an option to review with potential investors.

Is Moratelindo looking for technology partners?

We are also in dialog with various technology partners regarding the solutions required for this project.

Where do the strengths of Moratelindo lay? Do you foresee better investment opportunities for the company to expand locally or regionally?

Given the current infrastructure penetration in Indonesia, we see significant opportunities in the country itself, without the need to extend overseas. However, with our subsidiary in Singapore we will continue to reach out to peering partners so that we can optimize the services that we offer.

The government has informed that infrastructure is going to be built all over the country in the coming years, from roads, to ports, airports and more. Will Moratelindo play a key role in the development of ports and airports, as these two need to have top of the line telecommunication equipment and services?

In line with our vision we expect to be a key player in the market and involved extensively in the infrastructure development in Indonesia. We believe that we can offer economic and high quality services and will naturally be present in key locations.

In line with our vision we expect to be a key player in the market and involved extensively in the infrastructure development in Indonesia.

We are seeing new projects developing all over the region. The last we heard about was the new KK – Brunei underwater cable. Should we expect to see connectivity in the region increase among the ASEAN members?

Yes connectivity in the region will continue to develop and the interconnection between countries directly will improve. We are also considering options beyond connection to Singapore and Malaysia.

Will Indonesia soon have the capacity to become a IT hub in the region? Can Indonesia become this hub? What does Indonesia need to become a IT hub?

Given Indonesia’s geographical footprint in the region, there is no reason not to consider Indonesia as a potential hub. The country is already making progress towards this goal with the development of the broadband plan, this should continue over the coming years to strengthens Indonesia’s position in the market.

Indonesia is going through tremendous changes since last year, and many more are to come. Why invest in Indonesia?

Indonesia has a large untapped potential, which will be released with the development of infrastructure across all sectors. Development is accelerating at an incredible pace, the country is going through significant governmental changes which makes doing business in Indonesia more open and transparent.