Investor’s Viewpoint: “Iraqi Stocks” Investment Worth the Risk

Mark DeWeaver, Principal at Quantrarian Capital Management

Iraq is set to experience rapid economic growth due to several factors including enormous untapped, low-cost oil reserves, recovery from a civil war, a transition from a state-controlled economy to a market economy, and excess demand for almost everything. Whether compared to Russia in the early 90’s or to the story of the Chinese economy, Iraq, including the Kurdistan Region, is a powerful emerging market. Mr. DeWeaver views the case of Iraq as one in which the potential reward by far exceeds the risks.

Interview with Mark DeWeaver, Principal at Quantrarian Capital Management

Why you are interested in the Iraq story and how you feel about the future of Iraq?

As a stock market investor, I think the Iraq story is really a no-brainer because it combines a number of features that have been present in many of the top performing emerging markets since the 1970’s. First of all, Iraq has enormous reserves of low-cost, untapped oil as well as natural gas, which makes it quite a lot like Russia in the early 90’s. Then there is recovery from civil war which makes it much like Sri Lanka. That market had just incredible performance from 2000 to about 2008. There is also the story of the transition from a state-owned to a market economy, which of course anybody would immediately recognize as the story of the Chinese economy.

I think it’s inconceivable that a country that has enormous untapped, low-cost oil reserves, is recovering from a civil war, is in the midst of a transition from a state-controlled economy to a market economy, and where there is excess demand for just about everything, would not experience rapid economic growth. Of course, no one really thinks Iraq’s oil production is going to go up to the ten million barrel a day level that the government initially claimed. People think maybe they’ll be lucky to get to six million but even if they get to four or five, that’s a doubling from what it was before.

There is also a tremendous investment boom going on as Iraq’s infrastructure is rebuilt. In addition to that, there is bound to be a dramatic expansion in the banking sector. I believe only about 20% of Iraqis have a bank account. In the telecom sector, I heard from Asiacell today that the penetration rates are still very low compared to the region and there is still all sorts of broadband coverage that isn’t available at all.

You’ve got this combination of extreme shortages with this amazing ability to purchase things due to the oil wealth. I don’t see how even the most inept politicians could screw that one up. So that’s why I think that the Iraq story is uniquely compelling among all of the economies of the world today. I suppose that there may be equivalent stories in parts of sub-Saharan Africa but I can’t really imagine anything quite as good as this, anything that combines all of these things in one place at one time, or any place that has such an enormous amount of untapped oil wealth and such a low starting point. It seems to me the potential for growth in Iraq should be obvious to anyone.

I think the Kurdistan region has an attraction in addition to all of this because it’s safe. That makes it a natural gateway. Foreigners doing business in Iraq will try to do it in Kurdistan if they possibly can. Of course, not everyone can but anyone that could, me for example, would do so. I’m not elsewhere in Iraq because it’s so much cheaper and easier for me to come here. That means that Rabee Securities, my broker, has to hold the conference here so I can come to it. That means that this hotel gets to host the conference. That means that they’re going to build hotels here and there will be all manner of service providers from the rest of Iraq setting up offices here so that they can service their foreign clients or customers more easily. It also means that foreign investors that want to set up offices in Iraq will probably put them here unless there’s some reason why they must be in Baghdad.

So in addition to the rest of the Iraq story, the Kurdistan region also has this “gateway to Iraq” feature that gives it tremendous potential to develop as a service sector hub.

Foreigners doing business in Iraq will try to do it in Kurdistan if they possibly can. I’m not elsewhere in Iraq because it’s so much cheaper and easier for me to come here.

You mentioned all these advantages but investments are lagging behind in Iraq. There are political reasons of course. Anything can happen in the Middle East. For example, the KRG might have a disagreement with the Federal government of Iraq and there could be a war. There are questions about Syria, Iran, Turkey and the PKK. We are in the midst of one of the most unstable environments in this world with the likely exception of West Africa.

This is true of course and I think if it weren’t for the oil wealth, those would be pretty serious problems. However, I think that the potential for the oil sector here is so enormous that somehow people will figure out how to solve these problems.

Iran has enormous oil wealth though.

I think production is peaking in Iran. I suppose it’s true that there would be potential to increase production if Iran’s oil industry were modernized. But as for the story that there’s a risk of war between the Kurdistan region and the rest of Iraq, I believe that is very much less likely than you might gather from what is often reported in the papers simply because it’s not in anyone’s interests. The Kurdish region is going to prosper as part of Iraq; it stands to lose more than it would gain by separating from the rest of the country. I can’t recall the details, but if you look at the Kurdish region’s share of the Iraqi budget, it is a very big number and it’s much larger than what the Kurdish region could earn by selling its own oil as an independent country.

The share stated in the Constitution is 17%.

I think 17% is right, yes, and that it is in the Constitution.  But the Kurdish region really has nothing to gain by separating from the rest of Iraq. The only scenario in which Kurdistan could separate from the rest of the country would be one in which Kirkuk was incorporated into the area controlled by the KRG. If the KRG were to get its hands on Kirkuk’s oil it would be an entirely different story. Then, as I understand it, they would have enough oil to generate a larger amount of oil revenues than their share of the Iraqi budget. But I don’t think there’s any realistic prospect of this happening.

But the Kurdish region really has nothing to gain by separating from the rest of Iraq. The only scenario in which Kurdistan could separate from the rest of the country would be one in which Kirkuk was incorporated into the area controlled by the KRG. If the KRG were to get its hands on Kirkuk’s oil it would be an entirely different story. Then, as I understand it, they would have enough oil to generate a larger amount of oil revenues than their share of the Iraqi budget. But I don’t think there’s any realistic prospect of this happening.

They haven’t held the referendum for the Constitution.

To me that seems far-fetched. I don’t think that’s something that is going to happen.

But they have the right according to the Constitution to have a referendum in Kirkuk and this could happen.

Yes, but Iraqi laws and regulations say all kind of things and they never seem to happen. It seems to me that the status quo works very well for the Kurds at the moment. Also consider the Kurdish role as king-maker in the Iraqi central government. They’re in a very strong position when it comes to, for example, deciding who’s going to be the Prime Minister. They have a very strong block in Parliament. They have a lot of advantages from the present arrangement and it’s very hard to see what the advantages would be of the Kurdish region fighting a civil war with the rest of Iraq or declaring independence. What advantages would outweigh the extraordinary advantages that they enjoy under the present arrangement? However, I think that you are correct in saying that this kind of risk makes investors hesitant.

When you read the 100 year history of the Kurdistan region, every ten years there is a rebellion, a civil war, or a foreign occupation. It’s never been stable so why should it be stable now?

It’s more stable now I think than it ever could have been in the past. I guess I have the naive business person’s idea that wars become less likely the more money there is at stake. But that logic might really apply to this particular case. I doubt there’s ever been a time in the history of Kurdistan when there was so much to be gained by keeping the peace. Of course, these are all risks but they are worth taking simply because the potential is so vast. There is the potential growth of the rest of Iraq, and Kurdistan is kind of a leveraged play on that growth.

Another factor is that there are enormous amounts of money in the region, in the Gulf states for example, that naturally could be expected to flow to Iraq even if Americans and Europeans never quite manage to feel that the country is secure enough. In the long run, investors within the region are unlikely to have such extreme qualms because they are just naturally going to know more about the reality of the situation. So this is a story that doesn’t even need to convince everyone. Unlike many other emerging markets Iraq is surrounded by fantastically wealthy neighbors and it’s only necessary for those guys to be convinced. In fact, there is already a lot of investment coming in from Turkey and the Gulf.

Let’s talk about the banking sector. Of course, the majority of the listed companies are banks. This is a traditional emerging or frontier market situation. You said the market covers around US $4 billion, right?

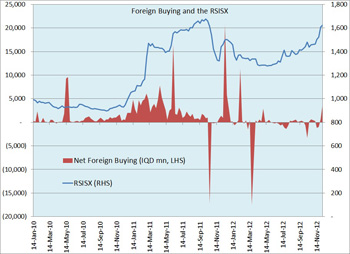

I believe that’s what I saw in the stock exchange presentation yesterday. Of course it’s going to depend on the index but it’s certainly not more than that and I think a lot of the time it’s less than US $4 billion. A typical day is only going to have trading of about US $1 million so this is really miniscule.

How are the banks in Iraq regulated? What sort of accounting systems do they use? Are you confident there is no risk to investors when it comes to internal banking risks? They are not using the international reporting standards and they do not comply with the Basel II standards.

No, I’m certainly not confident that there’s no risk in these banks. I think that they are very risky. They are certainly not compliant with Basel II and are also not reporting according to international financial standards. However, these are not really the main issues with the banks. With regards to the Iraqi accounting system, I believe that although the manner of presentation of the accounts differs somewhat from international reporting, the bottom line is essentially the same. The presentation format is different but as for the accounting standards that they are applying—in other words what counts as revenue or how assets are depreciated—these are generally compliant with international financial standards. There are exceptions; for example, I understand that Iraqi companies are supposed to be consolidating subsidiaries but that they routinely fail to do so.

You’ve got this combination of extreme shortages with this amazing ability to purchase things due to the oil wealth. I don’t see how even the most inept politicians could screw that one up.

So exceptions do exist but I don’t believe these are the real problem. The real issue with the banks is not how they’re reporting but what they’re really doing. And a lot of what they’re really doing involves related party transactions, in which the majority shareholder family is using bank funds for projects of its own. An interesting example of this is that majority shareholders apparently sometimes will get a line of credit from their own bank to subscribe to the bank’s rights issues. In other words, when their bank has a rights issue, they’ll take up the rights on the shares that they’re holding by borrowing money from their own bank to pay for them. That means that the capital base of the banks is not quite what it seems. If those majority shareholders don’t pay back these loans the new capital disappears. As long as everything’s going fine for the majority shareholder family, such capital is real capital I suppose but it is very contingent on the majority shareholder’s ability to repay the bank.

It’s a bit like the situation with the Japanese banks and it’s certainly a phenomenon that we find all over the world. Somehow we often find that bank loans are being turned into bank capital. This problem is by no means unique to Iraq.

You could also argue that related party transactions sometimes make sense because at least the bank knows what the related parties are doing with the money. If the bankers lend to someone they don’t know, they have less control and may have little in the way of legal remedies if the loan isn’t repaid. But I think that really it would be fanciful to say this was not a risk. In fact, I think that is the number one risk that I’m aware of.

There are a lot of banks listed on the stock exchange. Which ones do you think have the most potential and have the most favorable risk-reward ratio for investments?

I really don’t feel that comfortable with any of them. The only thing that I’m comfortable doing is spreading out investment over all the listed banks. But if I’m going to overweight any banks, I’m going to overweight the ones that have a large foreign bank as a controlling shareholder. Even that is no guarantee because those foreign banks may pull out.

There’s really no way to pick stocks in the Iraqi market because no matter how much you like the story, there’s always going to be idiosyncratic company risk. This has nothing to do with the growth potential. It has to do with some funny thing the chairman is doing that you never find out about until it’s too late. What will happen is that one day, the Securities Commission will announce that trading in one of your companies is suspended and then you won’t even really know why. Months later, you’ll find out that the company in question is bankrupt. Finally, the stock will get delisted and you’ll be stuck with a bunch of worthless shares.

What is the stock market potential? What kind of growth do you predict?

I think the potential for anyone buying in the Iraq stock market today, with a horizon of maybe three to five years, to make several times the initial investment is very clearly there.

In analogous cases like Russia, Sri Lanka or China, the market went up by anywhere from five to ten times. That doesn’t mean that any particular person is going to make five to ten times their money because people are going to sell at all different points. Not everybody is going to make that increase. The early investors may chicken out way before the top. Reckless people will hold beyond the top and maybe sell here. Some people may ride it all the way back down again and then all the way back up again.

Maybe nobody’s actually going to make ten times their money but there’s no reason not to expect that you might triple or quadruple your money simply because in the process of the index going up ten times, you’re going to have lots of chances to sell at many times what you paid for the stock. I think the potential for anyone buying in the Iraq stock market today, with a horizon of maybe three to five years, to make several times the initial investment is very clearly there. This is a case in which the potential reward far exceeds the risks.