Ecobank Ghana

Ecobank Ghana is one of the commercial banks licensed by the Bank of Ghana, the national banking regulator. The bank is a subsidiary of Ecobank Transnational Incorporated (ETI), a bank holding company which is currently present in over 33 countries across Africa, dealing in 22 currencies. The Ecobank Group is thus in more countries in Africa than any other bank, making it the leading regional banking group in Middle Africa.

About Ecobank Ghana

ContactEcobank Ghana Limited (Ecobank) 19 Seventh Avenue, Ridge West Tel: +233 302 680 437 |

Email: Website:

|

Establishment

Ecobank Ghana Limited (Ecobank) was incorporated on January 9, 1989 as a private limited liability company under the Companies Code to engage in the business of banking. Ecobank was initially licensed, to operate as a merchant bank, by the Bank of Ghana on November 10, 1989 and commenced business on February 19, 1990.

Network and Affiliations

The bank is a subsidiary of Ecobank Transnational Incorporated (ETI), a bank holding company which is currently present in over 33 countries across Africa, dealing in 22 currencies. The Ecobank Group is thus in more countries in Africa than any other bank, making it the leading regional banking group in Middle Africa.

Ecobank has grown consistently over the years to become the biggest bank in Ghana and a well-recognised corporate brand in the Ghanaian banking industry. Ecobank acquired a universal banking license in 2003 and got listed on the Ghana Stock Exchange (GSE) in July 2006. The Bank has embarked on a medium term strategic shift from a predominantly Wholesale Bank to a Universal Bank with 78 branches and over 200 ATM’s across the country.

Subsidiaries

Ecobank has three subsidiaries – Ecobank Investment Managers, Ecobank Venture Capital and Ecobank Leasing Company – and one associate company, EB Accion Savings and Loans Company.

|

More information about Ecobank Ghana Interviews: Video: Biography: Article: |

Strategy, Vision & Mission

Strategy

In line with its strategy of providing tailored solutions to customers in a timely and efficient manner, the bank segmented its Business units into Corporate Banking and Domestic Banking in 2010. The Corporate bank focuses on multinationals, regional corporates, public (state-owned) companies, international organizations, development finance institutions and international businesses while the Domestic Banking division is responsible for the Consumer, SME and local corporate customers, including local and central government.

Vision

To build a world class pan-African bank and contribute to the economic development and financial integration of Africa.

Mission

To provide our retail and wholesale customers with convenient, accessible and reliable financial products and services both locally and regionally.

In line with the above, Ecobank seeks to create a unique African institution characterised by a determined focus on customers, employees and shareholders and an absolute commitment to excellence in the financial services industry. The bank seeks to pursue this mission and uphold its values by applying the following principles to its business decisions and conduct;

• Treat each customer as a preferred customer.

• Invest in the training and development of its staff.

• Deliver product and service quality which exceeds customer expectations.

• Develop markets and products in which it can reach and maintain competitive advantage.

• Deliver appropriate returns to its shareholders.

• Maintain high standards of ethics and compliance at all times.

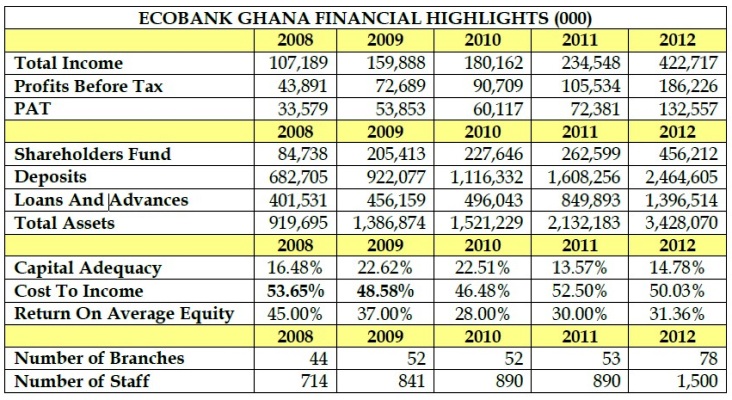

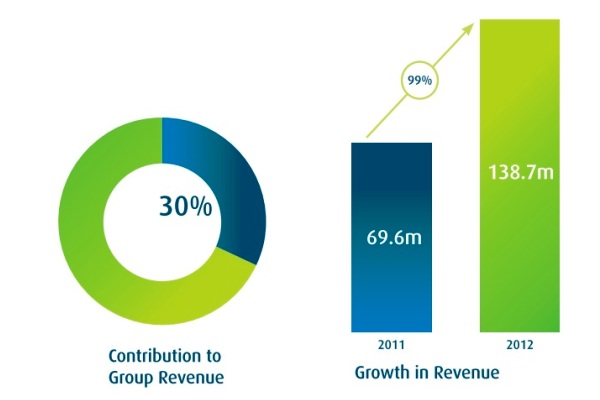

Financial Highlights

Business Segments & Information

Ghana Business Segments

Ecobank’s services are delivered by three customer-focused business segments.

Corporate Bank

Ecobank provides a wide range of financial products and bespoke solutions including pan-African credit, trade and commodity finance, cash management and payment solutions to multinationals, regional corporates, government parastatals, international organizations and financial institutions.

Outlook:

• Providing a comprehensive suite of online Cash Management and Electronic banking solutions to multinationals, regional corporate, parastatals, international organizations and financial ins titutions doing business in and with Africa.

• Providing world class Customer Service experience, embracing technology to offer convenient, accessible and reliable banking services to our clientele.

• Increasing our primary banking relationships by using our existing customer base to help establish broader transactional banking relationships.

• Leveraging on our strong footprint in middle Africa to support companies operating in these countries and those planning to set up business operations in other African countries.

Treasury

Ecobank Ghana’s treasury is a leading market maker in the foreign exchange and money markets. Our experienced team of professionals remain committed to ensuring that our customers always have access to our expertise and market knowledge not only in Ghana but in the 34 other countries that Ecobank is present in. We are focused on efficient balance sheet management to ensure optimal balance between liquidity and profitability.

We are committed to offering our valued customers:

• Customized Treasury Solutions

• Competitive Pricing

• Investment Advisory Services

Domestic Bank

Ecobank provides convenient, accessible and reliable financial products and service to individuals, local corporates, public sector and SME customers by leveraging on the bank’s extensive branch and ATM network as well as mobile, internet and remittances banking platform.

Outlook:

• Continue to delight our customers by providing efficient and timely services.

• Leverage the value chain of corporate customers and key local corporate and public sector customers by serving their staff, suppliers and distributors.

• Provide products and services that make banking convenient for customers through offerings on our alternate channels.

General Information Ghana

Geographical Data

• Area: 238 537 km2

• Capital: Accra

• Principal cities: Kumasi, Tamale, Tema, Takoradi, Cape Coast

• Official language: English

• Independence Day: March 6

Demographical Data

• Population: 23,887,812 (CIA July 2010 est.)

• Demographic growth: 1.787% per annum (CIA 2011 est.)

• Life expectancy: 61.45 years (CIA 2011 est.)

• Literacy rate: 57,9% (2000 census)

• Religion(s): Christian 68.8% (Pentecostal/Charismatic 24.1%, Protestant 18.6%, Catholic 15.1%, other 11%), Muslim 15.9%, traditional 8.5%, other 0.7%, none 6.1% (2000 census)

Economic Data

• Currency: Cedi

• GDP: $38.6 billion (CIA 2011 est.)

• GDP per capita: $ 3,100 (CIA 2011 est.)

• Growth rate: 14.4% (GSS 2011 est.)

• Rate of unemployment: 11% (CIA 2000 est.)

• Rate of inflation: 8.8% (CIA 2011 est.)

• Net budgetary position: -5.4% of the GDP (CIA 2011 est)

• Balance of payment: 546.5million dollars (BOG 2011 est)

• Export partners: Netherlands 11.7%, UK 7 %, France 5.7%, Ukraine 5%, Belgium 4.6% (CIA 2011)

• Import partners: China 16.6%, Nigeria 12.7%, US 8.4%, Cote d’Ivoire 6.2%, France 4.2%, UK 4.5% (CIA 2011)

• Contribution of various sectors to GDP: Service: 48.5% Industry: 25.9%; Agriculture: 25.6% (GSS 2011 est)

The Ecobank Group

Mission and Vision

The dual objective of Ecobank Transnational Incorporated (ETI) is to build a world-class pan-African bank and to contribute to the economic and financial integration and development of the African continent.

History

ETI, a public limited liability company, was established as a bank holding company in 1985 under a private sector initiative spearheaded by the Federation of West African Chambers of Commerce and Industry with the support of ECOWAS. In the early 1980’s the banking industry in West Africa was dominated by foreign and state-owned banks. There were hardly any commercial banks in West Africa owned and managed by the African private sector. ETI was founded with the objective of filling this vacuum.

The Federation of West African Chambers of Commerce promoted and initiated a project for the creation of a private regional banking institution in West Africa. In 1984, Ecopromotions S.A. was incorporated. Its founding shareholders raised the seed capital for the feasibility studies and the promotional activities leading to the creation of ETI.

In October 1985, ETI was incorporated with an authorised capital of US$100 million. The initial paid up capital of US$32 million was raised from over 1,500 individuals and institutions from West African countries. The largest shareholder was the ECOWAS Fund for Cooperation, Compensation and Development (ECOWAS Fund), the development finance arm of ECOWAS.

A Headquarters’ Agreement was signed with the government of Togo in 1985 which granted ETI the status of an international organization with the rights and privileges necessary for it to operate as a regional institution, including the status of a non-resident financial institution. ETI commenced operations with its first subsidiary in Togo in March 1988.

The Group Today

Today, Ecobank is the leading pan-African bank with operations in 33 countries across the continent, more than any other bank in the world. It currently operates in countries in West, Central , East and Southern Africa, namely Angola, Benin, Burkina Faso, Burundi, Cape Verde, Cameroon, Central African Republic, Chad, Congo Brazzaville, Democratic Republic of Congo, Côte d’Ivoire, Equatorial Guinea, Gabon, Ghana,The Gambia, Guinea, Guinea Bissau, Kenya, Liberia, Malawi, Mali, Niger, Nigeria, Rwanda, Sao Tome & Principe, Senegal, Sierra Leone, South Africa,Tanzania, Togo, Uganda, Zambia and Zimbabwe. The Group also has a licenced operation in Paris and representative offices in Beijing, Dubai, Johannesburg, London and Luanda.

Business Segments

The Ecobank Group is a full-service bank focused on Middle Africa. It provides wholesale, retail, investment and transactional banking services to governments, financial institutions, multinationals, local companies, SMEs and individuals.

Ecobank’s services are delivered by three customer-focused business segments, Corporate Bank, Domestic Bank and Ecobank Capital all of which are supported by an Integrated IT platform operated by eProcess, the group’s technology subsidiary.

Corporate Bank provides financial solutions to global and regional corporates, public corporates, financial institutions and international organizations. Products focus on pan-African lending, trade services, cash management, internet banking and value chain finance.

Domestic Bank provides convenient, accessible and reliable financial products and services to retail, local corporate, public sector and microfinance customers, leverages an extensive branch and ATM network as well as mobile, internet and remittances banking platforms.

Ecobank Capital provides treasury, corporate finance and investment banking, securities and asset management solutions to corporate and governmental customers. Ecobank also operates within Ecobank Capital a Research team based on the ground in key markets, provides unique information support capabilities.

Our Brand

Ecobank operates as “One Bank” with common branding, standards, policies, processes to provide a consistent and reliable service across its unique network of 1,251 branches, 1,981 ATMs, and 5249 POS machines servicing over 10 million customers. We have an integrated information technology platform, with all of our operations successfully migrated onto a single core banking application: Oracle FLEXCUBE. With 18,698 employees as at end of May 2013, the Group is the largest employer of labor in the financial sector industry in Middle Africa.

Sustainability

Sustainability is at the core of our mission and vision of building a world-class pan-African bank that contributes to the integration and socio-economic development of the continent. We take the view that the long-term success of Ecobank is intertwined with the sustainable development of the economies, societies and environment that we operate in.

In 2012, the Group adopted an integrated and comprehensive approach to sustainability and created a common framework. The framework depicts sustainability such that our business operational model ensures effective, efficient and sustainable utilization of economic, social, human and natural capital. This framework reflects our commitment to drive economic transformation in Africa while protecting our environment by being a socially responsible financial institution with a world class professional. Each strand forms the building block for our integrated sustainability.

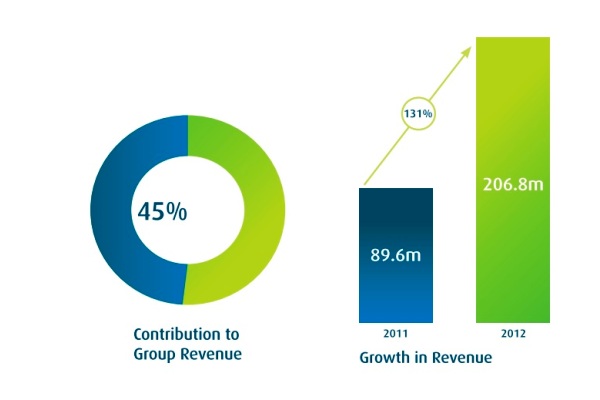

Key Figures

‘