Banking Sector Côte d’Ivoire : 3rd Largest Bank

Philippe Attobra, Managing Director of BIAO-CI

BIAO is a Côte d’Ivoire bank which belongs to NSIA Group and it is one of the oldest banks in Côte d’Ivoire. BIAO has 40 subsidiaries in Côte d’Ivoire and over 500 agents. BIAO has the abilities of answering the needs and demands of big companies, SME’s and individuals.

Interview with Philippe Attobra, Managing Director of BIAO-CI

What is the current state of the banking sector in Côte d’Ivoire and what is the current situation in the country?

There has been a lot of uncertainty in the banking sector due in part to the political environment, but most of the uncertainty is a direct result of the post-electoral crisis. Now the situation has improved. The banking sector and the economy are ready for recovery after this period of downturn.

How does the Ivorian banking sector compare to the banking sector of Europe? How is it different?

This is a very good question. Even though one would think the two countries are similar regarding the banking sector, they are completely different. Consider the banking services penetration rate as an example. In the WAEMU region in Côte d’Ivoire, the rate is close to a very poor 8%. Compare that statistic to a developed country such as France and one can see that the banking services penetration rate hovers above 100%. This is one major difference between the two countries.

Accordingly, the sophisticated banking products that are normal in Europe are not offered on the Ivoirian market. In Côte d’Ivoire, the banking products are still very basic, and even when the banks offer sophisticated products, the demand is very weak. These poor results may exist because clients currently have products that are enough to meet their simple needs, but it is still a flagrant difference to note.

By comparing the two sectors, one can say that Côte d’Ivoire has a considerably lower savings rate than Europe. The last major difference is the role played by the banks themselves in the country. In Côte d’Ivoire, financial intermediation is still very strong as opposed to Europe, where access and development of market operations is much higher.

The private sector in Côte d’Ivoire suffered losses of approximately 1 billion Euro. How do banks support the private sector?

Some estimates calculate the country’s losses to reach around 1.4 billion Euro. The banking sector was also severely hit by the crisis and suffered losses of about 114 million Euro. Of course, these losses occurred in many different ways. The private sector suffered material damage and burglaries. Sixteen out of 23 banks remained closed during the crisis, so the sector has come to a complete standstill for almost three months. Finally, the banks’ own clients were affected along with their portfolio.

BIAO’s clients were of the greatest concern. Our clients went through bad times because of the crisis. Since the end of 2010, we could already feel the economy slowing down and investment projects were put on hold due to the uncertainty of the elections.

Our strategy is to turn the bank into a strong, durable, profitable, modern establishment that is aligned with international standards. Roughly, those are our objectives. To achieve that, we want to place the client at the very core of our strategy.

Some of BIAO’s clients were hit head-on by the crisis, either because of sanctions or the disturbance of their own financial activity. Ivorian ports, particularly those in Abidjan and in San Pedro, were subjected to an international embargo. Some of our clients who were exporting coffee and/or cocoa were affected because exports were completely frozen. At the highest peak of the crisis in the first semester of 2011, many of BIAO’s clients either had to temporarily close business or suffered material damage, thieveries, etc.

As soon as the situation became stable, BIAO’s emergency strategy included assessing the state of affairs, having an emergency support, and helping clients who were hit the hardest. In all truthfulness, our fears were greater than the actual damages. There were very few companies that lost everything or went bankrupt. Nevertheless, there was substantial damage.

BIAO dealt with the harsh reality and provided an emergency credit window for the companies who needed the company’s help the most.

SIFCA’s new CEO, Bertrand Vignes, said that the biggest challenge lies in convincing banks to provide credit and support to out growers. How does the bank approach this question?

There are things that need to be clarified. The sector of agriculture has been supported by banks, and that includes BIAO. A great part of Côte d’Ivoire’s past economical success is actually attributable to agriculture, which benefited from our financing, whether from coffee, cocoa, or even cotton. As a result of regulation and the system, it wasn’t possible for banks to directly finance small farmers. On the other hand, small farmers always received financing via big investors who were given funds by the banks.

However, there is something else that should be brought to attention; there is a need to find new economic actors who wish to buy a piece of land, to grow a new plantation, and to replant where it is needed. Our bank needs to look at what it can do right now. A partnership between big investors and small growers needs to be established. As for BIAO, we are already working on that.

Please, tell us more about the bank as it is today.

BIAO is an Ivorian bank that belongs to NSIA group, an African financial group operating in many countries. It is one of the oldest banks in Côte d’Ivoire. BIAO is present all throughout the country and has one of the widest branch networks in Côte d’Ivoire with forty subsidiaries and more than 500 agents. BIAO has the means to offer universal banking services. BIAO has the capability to meet the needs of big companies, SME’s, and individuals.

What is BIAO’s development strategy? What are the challenges?

We cannot really talk about our ambitions. BIAO’s strategy is to turn the bank into a strong, durable, profitable, modern establishment that is in accordance with international standards. Those ideals are BIAO’s main objectives. To reach these goals, BIAO wants to place the client at the very core of its strategy. BIAO intends to meet the needs of its clients as best it can in terms of proximity, quality of service, and durability of products. These standards are what BIAO thinks is the most important.

What sets BIAO apart from the other 22 banks on the market?

After many years of market observation, BIAO’s conclusion was to focus on quality of service and proximity with our clients. This conclusion may sound simple, but in fact, it is extremely difficult to achieve. When we talk about proximity, we mean to develop a branch network and technological support to allow us to get closer to the client. Today, we believe that BIAO has the manpower, equipment, and money to achieve this goal. It is something we can do.

What has been the bank’s financial performance?

The bank ranks third in the market as of June 30th, 2011. Also as of June 30th, BIAO’s assets are close to 450 billion CFA, which is around 700 million Euro. BIAO has become profitable again in the aftermath of the post-electoral crisis. During the last three fiscal years, the company has had a steady revenue, a fact which was very satisfying for our shareholders. The growth rate is also quite high. The numbers that the bank has recorded since the end of the crisis have been highly positive.

The interest rate in Côte d’Ivoire is around 8%, which is somewhat high compared to Europe or the US. How does BIAO compete with strong well-capitalized foreign banks?

This question actually concerns the entire sector. For BIAO, some factors are completely exogenous. The reason why the bank needs to charge a specific interest rate to its clients is because the cost of their own resources is relatively high as opposed to what BIAO can see in Europe or in the United States.

The main development banks in the region are the most active on the market. They are the most active because they manage to raise funds at a low cost which they can in turn lend and generate revenue. As far as the WAEMU zone is concerned, the leaders should encourage the development of market operations, which unfortunately hasn’t been the case until now.

Is BIAO currently looking for international or local partners?

After what BIAO went through in Côte d’Ivoire because of the crisis, foreign investors are welcome in the country. The environment is more secure now and there are business opportunities in diverse sectors. Whether in agriculture or energy, there is a lot of things that BIAO can do. The banking sector is also able to support the financial needs that investors may have.

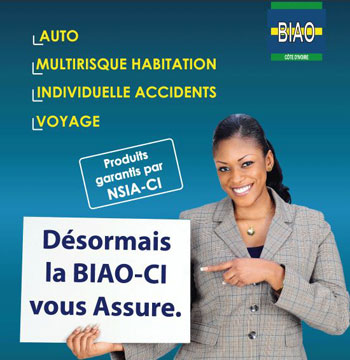

Because of BIAO’s relationship with NSIA group, our ambition is to become leaders in terms of bank insurance activities in Côte d’Ivoire.