Abu Dhabi Report Abu Dhabi future metropolis of the UAE

Within the UAE, Abu Dhabi owns the lion’s share of oil and gas– 95 percent and 92 percent, respectively. As a result, with US$ 63,000, Abu Dhabi is ranked third in the world in terms of GDP per capita (ahead of Switzerland, but behind Luxemburg and Norway). “I think the appeal of Abu Dhabi is that it represents about 60% of the economy of the UAE”, says Michael H. Tomalin, Chief Executive (CE) of National Bank of Abu Dhabi (NBAD), the largest bank in Abu Dhabi . NBAD’s major shareholder is the state. Only 30 percent of NBAD-stocks are listed at the Abu Dhabi Exchange and this is representative for most UAE banks.

| The story of two unequal brothers | |||||||

|

|

Dubai, in recent years, has emerged as a prominent hub for trade, tourism, business and shopping. So what does Abu Dhabi stand for? “Abu Dhabi is more tribal, life is more traditional there” is the common answer given when Dubai-tourists ask what they can expect from a trip to the capital, which is not more than an hour’s drive away from Dubai. Besides being the capital and therefore the residence of the UAE governmental institutions, Abu Dhabi is also one of the most important centres of the global oil industry. Being home tof a tenth of the world’s proven reserves of the black gold and 5 percent of the world’s proven gas reserves, the emirate does not feel that big pressure to diversify its economy. This has been the case particularly over the last two years, when prices of hydrocarbons sky-rocketed to astronomic values.

|

||||||

|

Within the UAE, Abu Dhabi owns the lion’s share of oil and gas– 95 percent and 92 percent, respectively. As a result, with US$ 63,000, Abu Dhabi is ranked third in the world in terms of GDP per capita (ahead of Switzerland, but behind Luxemburg and Norway). “I think the appeal of Abu Dhabi is that it represents about 60% of the economy of the UAE”, says Michael H. Tomalin, Chief Executive (CE) of National Bank of Abu Dhabi (NBAD), the largest bank in Abu Dhabi . NBAD’s major shareholder is the state. Only 30 percent of NBAD-stocks are listed at the Abu Dhabi Exchange and this is representative for most UAE banks. |

|||||||

| World hub for the oil industry | |||||||

|

|

Moreover, “AD”, as the capital and its 900’000 people is known for short, is reaching out to the world. In 2001, Abu Dhabi National Oil Company (ADNOC) signed a 10 year contract with Colorado School of Mines (CSM) to set up a joint educational initiative called the Petroleum Institute. The giant, Taqa (Arabic for energy), created in 2005 and led by American CEO Peter Barker-Homek invests 10 billion dollars in Canada where he recently bought the oil and gas exploration company Pioneer Canada. |

||||||

|

Will TAQA also ride on the global green wave? “Yes, there is a green agenda to it, there is a responsibility agenda, there is an energy security agenda. For example, we are building one of the largest gas storage facilities to serve continental Europe and the idea there is to provide for energy security not only for the continent but for the United Kingdom.” |

|||||||

|

On the contrary, in Dubai oil contributes no more than three percent to the GDP; the real estate boom serves as a formidable pillar for Dubai’s future. This is the missing piece in Abu Dhabi’s jigsaw and this missing piece is being created now. As a direct result, real estate projects in the capital must not hide behind its nemesis.

While Dubai is rushing at a breath-taking pace from crane to crane, life in Abu Dhabi goes more “shwaie, shwaie” (which is Arabic for “slowly” or ”slow down”). “The capital is a quiet place”, Dubaieens used to say when explaining the difference between these two unequal brothers to tourists. But those times are over. Cranes and baggers became well-known objects in the landscape of Abu Dhabi. Insiders even say that Abu Dhabi is stealing more and more of Dubai’s thunder. “The plans for Abu Dhabi 2030 are very ambitious, even if only 70% of them are achieved – and we hope 100% will be achieved – then Abu Dhabi will be transformed into one of the great cities of the world”, says Tomalin. |

|||||||

|

The impact of the global financial crisis also seems to be minimal. “We are resilient in this part of the world”, NBAD’s CE Michael H. Tomalin is convinced. “We have a high oil price which helps a great deal, and the economy is growing fast and firmly.” Despite robust growth, the UAE does not run away from global standards. ”We are already Basel II compliant; we report all our numbers in a Basel II compliant way”, says Tomalin. Countries adopting Basel II demand higher transparency from their banks in terms of reporting results and a more strict policy when granting loans. The UAE adopted Basel at the beginning of 2008. |

|||||||

|

|

But how will the capital’s windy marine coastline look in ten years? Take the Saadiyat Island, which lies in front of the capital just a twenty-minute car drive from the city centre’s Khalifa Street. Saadiyat Island, the island of happiness, is NOT an artificial piece of land, as many are on Dubai’s coast; Saadiyat is completely natural The construction of a megacity began in 2006. Engineers were astonished when they found thousand year old houses and fireplaces when digging there. And in terms of art, culture lovers will be soon able to visit the second Louvre museum in the world, the “Louvre Abu Dhabi. The French parliament, Assemblée Nationale, had to approve the 700 million euro licence fee for the emirate of Abu Dhabi. France will provide expertise and art work available from its prestigious museum. There are also close relations in the educational field: the Université Paris Sorbonne Abu Dhabi, a branch of the famous, 750 year old institution in the French Capital, has been teaching students since 2006. Diplomas issued are recognized by all states of the European Union.

|

||||||

| Aldar Properties leads the boom | |||||||

|

“Abu Dhabi has been developed on a stable economic growth model which means you have developing business that need to be populated; people need to move in to the country”, says Ronald S. Barrott, CEO of Aldar Properties, the largest Abu Dhabi-based development company, which is listed at the local Abu Dhabi Exchange ADX. At conferences like at Cityscape Abu Dhabi in May 2008, Mr. Barrott’ models of real estate projects are always a magnet of attraction for architects, brokers and investors. “Abu Dhabi is expanding from 1.3 million to 3 million in the planned period of 2030.” This expansion requires flats, villas, offices, skyscrapers and a thorough infrastructure designed by humans for humans. When Aldar listed its shares two years ago, it raised US$ 102 billion. Some of the pearls in the Aldar’s portfolio, which CEO Ronald S. Barrott says is worth US$ 70 billion, are: |

|||||||

| • Motor World: |

• Yas Island: |

||||||

|

|

|

||||||

|

|

||||||

| • Al Raha Beach: | |||||||

|

|

A multi-billion dollar development for 120,000 people. Located on the beach side of the main highway leading into Abu Dhabi from Dubai, the development consists of eleven precincts, each with their own distinct personalities and appeal. “We will also relocate with our firm’s headquarter to Al Raha Beach”, says Ronald S. Barrott, CEO of Aldar Properties. “Some 50 percent of our projects are open for foreign investments”,the British man says with atone of optimism in his voice. An estimated US$ 463 billion are being used for new buildings in Abu Dhabi. |

||||||

|

The ongoing influx of expatriates is certainly pushing up prices. “Although the average price last year for an apartment was around US$354 per square feet, now we are talking about US$873 –USS$972”, says Sulaiman Al-Fahim, CEO of Hydra Properties in Abu Dhabi. So there is much more than 100% appreciation there as per Colliers and Moody’s.” This is why many believe that their huge projects are not just luxury but also the back bone of the GCC economy. “Even if oil prices dip because of a US recession, we believe that vast infrastructure projects in the Gulf region would mitigate losses in the carbon sector,” said Deutsche Bank-CEO Joseph Ackermann on 23rd February at the international banking conference, IIF, in Dubai. With tons of building materials used and the extensive use of cranes and trucks, questions about an impact on the environment are certainly justified. |

|||||||

| Masdar as a symbol for the environment | |||||||

|

|

|

||||||

|

The good news that the ruling family, Al Nahyan, has taken steps to transform the capital into an enlightening example of research in development for the environment. In April 2006, Abu Dhabi took the bold and historic decision to embrace renewable and sustainable energy technologies. The green city, Masdar (Arabic for resource), located in the desert of Abu Dhabi, is planned to be the first zero-carbon community with huge photovoltaic installations and green buildings where water is recycled. Ronald S. Barrott: “There is a lot of interest they have had in Masdar from all major corporations around the world involving looking at these new industries and new sciences, and that in itself will generate more population, more jobs, and more income into the economy because the whole city is being expanded based on a sustainable economic growth model.” |

|||||||

| “Traveller’s welcome” | |||||||

|

|

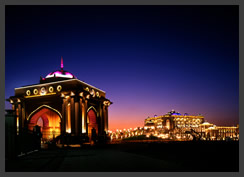

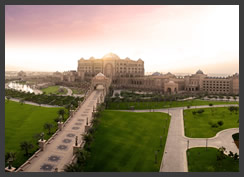

Regarding the aforementioned projects, the authorities took steps in promoting the capital as a brand globally. With the slogan “traveller’s welcome”, Abu Dhabi brand aims to present the emirate as different to Dubai, with more sightseeing, in terms of cultural heritage, and a fascinating tribal tradition. Whether it is the old souk in the city with the sweet smell of Turkish coffee and the vast choice of golden souvenirs, or the white Sheikh Zayed Bin Sultan Al Nahyan Mosque, travellers have endless reasons for visiting “the father of the gazelle”. Some even see the capital as ahead of Dubai, as Hydra Properties-CEO Al Fahim: “Actually I am from Dubai but I believe that Abu Dhabi will take over, because the capital is not in a hurry.” Al Fhaim himself was born in Dubai. People from all over the world shall certainly witness Abu Dhabi’s achievements with Etihad Airways, which flies to 48 destinations worldwide. Etihad, meaning unity, was launched in 2003 and plans to break even in 2010. There are no classes on board of the Etihad planes but instead zones: the Coral (economy), Pearl (business) and the Diamond zone (First class). The relatively tiny Abu Dhabi airport will be expanded to increase passenger capacity from today’s 7 million people to 12 million by 2009. A new midfield terminal for 20 million passengers will open in 2012. To sum up the city’s initiative, Abu Dhabi brand aims to sell sun, sand, sea and stability. With the iconic six-star-hotel Emirate’s Palace, Abu Dhabi is already regarded as a place for breathtaking luxury and the highest kind of Arab hospitality. “Abu Dhabi has wonderful coastlines and watersport activities, everything has been delivered”, says Hans Olbertz, General Manager of the Emirates Palace. “Abu Dhabi has instituted itself as one of the world’s favourite tourism destination and the Abu Dhabi Tourism Authority is projecting to attract 2.7 million tourists by the end of 2012, which is 12,5 % more than initially predicted.” The features of the palace, which is surrounded by palm-high fountains are breathtaking. Hans Olbertz: “Normal rooms have the size of 55 square metres. We have 92 suites in total out of 42 palace suites which is the palace part and these are more for the official delegations. We have 49 different nationalities speaking almost over 60 different languages. Out of 394 rooms we are talking about a workforce of 1600. Over the last 6 month we have been hosting over 16 state visits of presidents, kings and queens.” |

||||||

|

|

And from time to time, Mr. Olbertz welcomes guest with a “We will rock you!”, the German hotel manager tells us: “We had culture and rock concerts on the beach with performers such as Elton John, Bonjovi and Justin Timberlake.” | ||||||

| Al Qudra The ability to diversify | |||||||

|

|||||||