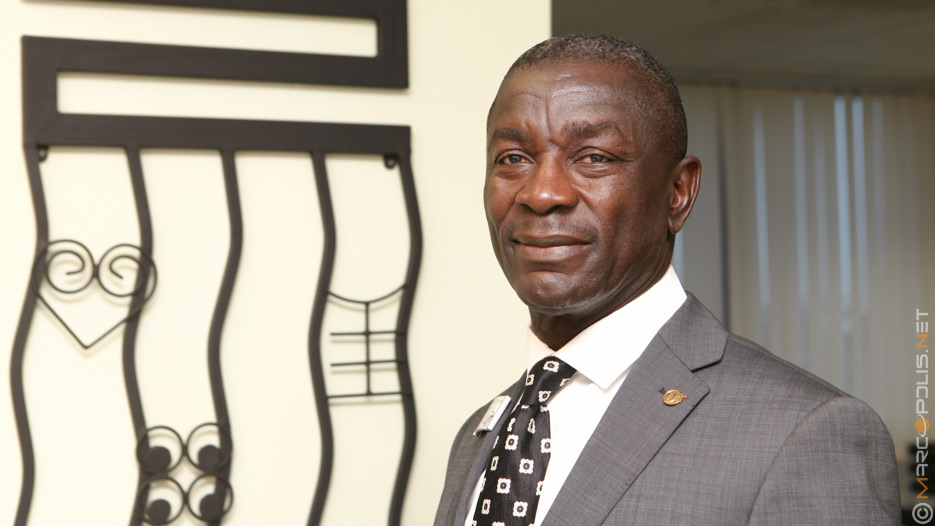

Exclusive Interview with Prince Kofi Amoabeng about His Leadership And Passion to Drive Ghana Forward

The life and career of Prince Kofi Amoabeng are entwined with remarkable achievements. What is his advice for rising, future entrepreneurs of Ghana?

Interview with Prince Kofi Amoabeng, CEO of UT Bank

Your life and career are entwined with remarkable achievements, whether in terms of entrepreneurship, innovation or marketing to name a few. In addition you have been voted Ghana’s most successful businessman in our anonymous survey. Where does the success of your leadership lie? What ingredients does one have to possess to succeed in Ghana or in the region in general?

That is a tough question. What really makes anyone do the things they do is the passion to impact people’s lives positively and probably because they think they can change the way things are done if they think they have a solution.

For us, what we started, was to change the way SMEs were served when it came to lending; we devoted ourselves to that and we enjoyed the changes that it brought to SMEs and the unbanked sector. That is what pushed us to do what we have done.

I find that people start a bit too early and they can be a bit too ambitious and they want to make it too quickly.

To start with, there was a feeling of frustration with the system, for me personally at least, in terms of the difficulty in trying to raise or obtain some kind of lending or to borrow money from the banks. I realised that if I was going through that, then a lot more people might be going through it too. I am not blaming the banks for not doing the right thing; I came to understand the banks and understand why they couldn’t do it: basically because the SME sector is supposed to be a very risky sector, especially as most are in the informal sector. One has to spend more time to be able to analyse and evaluate how you can serve them. However the SMEs don’t have the leisure/luxury of time because the more you spend time with them, the more they lose on their business. Invariably the banks were not comfortable with them and they were also not comfortable with the banks. There was also the obvious disconnect between the SMEs or the informal sector and the banks, something which still persists but I think we will be able to remove some of that disconnect. This disconnect comes from the fact that the banks come as the elite with all of the MBAs, the suits, the huge edifices, the banking halls etc. that are intimidating and most of the people in the informal sector probably can’t speak English properly or at all, and they are relatively simple people who are trying to get money from these so called elite—the banks! There is definitely that disconnect. So what we brought was simplicity, speed and a lot of responsiveness to their needs. The other thing is that the banks did not seem to fully understand the real needs of the informal sector. In trying to help them, you must really understand what they want and establish trust so that the two of you can work hand in hand. These are some of the things that we brought to really change the way things are done for the informal sector and the SMEs.

Talking about Ghana, what particular talents does this country display nowadays?

Certain talents were thought to be lost but we are finding them once more especially in the theatres. Because there are not a lot of jobs, younger people are finding the means of becoming entrepreneurs. You find people coming out of school and trying to team up together, maybe two or three people trying to grow their own businesses. That unearths talents but they do need a lot of assistance because they don’t have the structure, funding, experience or qualities that are required for them to be businessmen overnight.

What we have done and a lot of people have assisted with, is to set up NGOs that empower these young people to become businessmen. We sponsor Enablis, Ghana which is an NGO which started in Canada; it trains young people and we give them support in peer mentoring to make sure that they are able to withstand the pressures and uncertainties in business life. There are a lot of talents but they need a lot more support and mentorship from the businesses that exist now. We play a big role in unearthing these talents and in supporting them to grow.

We have to assist the individual Ghanaian, indigenous companies and give them the necessary funding, support, mentoring, education etc. for them to own a part of the economy, otherwise too much goes away.

Apart from Enablis, are there any other community activity programs that you are running?

We do a lot. We have some NGOs that help handicapped children. As that is not our speciality we just give them donations every year and we make sure that they function to help the communities and reduce underdevelopment. When it comes to business, we tend to play a more direct role. At times I go and meet young business people to inspire them and things like that. When it comes to community work and helping the underprivileged and the handicapped, we fund the NGOs to do that more effectively. Additionally, we organise financial literacy programmes to educate our clients and potential ones on sound business practices. We also collaborate with the Cancer Society of Ghana to champion a crusade on reducing breast cancer cases in Ghana, as well as provide free medical screening in the communities with the support of GIZ.

What message would you have for rising, future entrepreneurs of Ghana?

Ghana is still a destination that is intriguing for a lot of people because we still have a lot of potential, we have always had potential but we haven’t yet taken off in a big way. For those who are up and coming, they should take their time to acquire knowledge, especially when they are young. I find that people start a bit too early and they can be a bit too ambitious and they want to make it too quickly. Most importantly, before you are 25 your main focus should be on acquiring knowledge and learning how to deliver a service and bringing everything to bear. Even up to the age of 30 or 40 you will still be learning.

When we started this financial institution I was 45 years old. That was not too late, I was still able to create and build what we have. The young people should take their time because the level and quality of education now has actually gone down a bit so they need to improve themselves. Luckily there is the internet where everything is available and they can learn, find mentors and get proper coaching so that they can take their time to develop properly and when they get the right opportunity, they can sustain it and grow it to be what they want it to be.

Let’s touch upon your institution, UT Holdings. How have the holdings evolved since our 2013 interview?

It is interesting; we still have UT Logistics, UT Properties, UT Life Insurance, UT Private Securities and we still have UT Nigeria. I no longer personally run the holdings, we have a CEO of the holdings company and it is now more like an investment vehicle to empower the subsidiaries to grow on their own and to compete within their own industries. So UT Holdings doesn’t run its subsidiaries like small outfits trying to support the financial services as it used to, but it tries to empower them to grow and compete in their own space. For example, we have the Life Insurance company which is about the sixth strongest life insurance company in Ghana and it has come from virtually nowhere. We have UT Logistics which is also serving all kinds of institutions including some renowned embassies. Then we have UT Private Security which provides private security services to all sorts of institutions. The holdings company holds the biggest share in the bank and then it owns a lot of these other subsidiaries. It is more like an investment group. We allow the companies to be governed by their boards so that the ultimate decisions lie with the companies and their boards while the boards are controlled by the holding company.

What about the UT Bank? What are the developments?

The economy has had a bit of a glitch. Over the last two years the power outages, the instability of the cedi and the government’s own problems with the economy have impacted the SME and the informal sector very seriously and thereby impacted the bank’s performance. Unfortunately we positioned ourselves as lenders to the informal sector and SMEs and when they are hit, it hits the bottom line of the banks also.

The problem is not just with the macroeconomic environment, it is also with our own strategy. We have to look at our own strategy to see that if the economy goes through a downturn, we can withstand it and be able to generate good profits for the shareholders. We have had to have a rethink in terms of our processes and structures and also put in a change management structure to ensure that we become more robust and can respond more positively to the needs of the SME sector.

Are there any new products or services that you will be introducing?

The bank had to catch up really fast because as we are a new bank, just about 5 years old, we had to catch up with the electronic platforms and such, but I would say that we now have one of the most sophisticated e-products. We have the phone bank, we have GhIPSS’ e-zwich which is the government platform, we have Visa and more, so basically we have all of the e-banking products. That is where we have paid a lot of attention. Banking is no longer brick and mortar; people want to do their banking from home so we have shifted to that. We have more branches to put out more e-products and that is serving our customers well.

What is your vision for the UT BankBank for one or two years’ time?

Our vision will not change. In developing countries about 70 to 80% of the economy resides in the informal sector. So we have the SMEs sitting in the informal sector and we have banks having difficulty touching these people. I believe we have what it takes to serve these people who form the bulk of the economy. We will deepen our knowledge of the SMEs and informal sector and we will also put in the structures and procedures to ensure there is more inclusiveness. Luckily with mobile banking you can actually reach a lot of these people in the informal sector who are formally unbanked. Our focus and vision will be the same, to serve the unbanked and to provide the necessary services in a very responsive and respectable way to improve these people’s lives.

Lastly, what is your vision for Ghana? What message do you have for the business community?

There are a lot of business opportunities but we also have things that we really have to address. Unless the Ghanaian business community put their act together we will tend to lose out on most of the big businesses. Certainly oil exploration and mining requires much capital and technology so naturally you find that the big foreign companies will dominate those sectors, but apart from that there are a whole lot more businesses in which Ghanaians must take the lead. Therefore we have to assist the individual Ghanaian, indigenous companies and give them the necessary funding, support, mentoring, education etc. for them to own a part of the economy, otherwise too much goes away. Luckily the government is introducing a local content bill to ensure that at least a portion of the business stays with Ghanaians. Even with that, they need support from the financial services and from some of us who are seen to be leaders in the economy, to encourage them, to mentor them and to support them to be able to win a lot of the businesses so that their profits stay in Ghana.

What would be your advice to a young entrepreneur to become a successful leader?

They need to take their time to learn. They need to understand that they will make mistakes. They need the ability to make mistakes and recover. I worked in all sorts of businesses; I probably started about 20 different businesses. The underlying thing is that you need to have the knowledge and resilience and patience to actually try your hands at various businesses. Depending on where your talents are and where you fit, you will find your level. You must also know how to serve before you have people serve you. You should work for other people, especially for small companies where you understand the culture of building a company, as that will help when you have to run your own company. Basically youth must take their time to learn properly, to be grounded properly and not be in a rush. They need to be resilient. A lot of people want to go into e-products and e-services but not everyone is going to succeed. It is just like boxing, there are a few people that are making millions but not everyone, some will just be battered around and they won’t make it. They need the fighting spirit to stay, make decisions and move on and keep walking.