Core Banking: Software, Solutions and Banking Systems

BML Istisharat is a Business Solutions and Information Technology Services provider. It is a private Lebanese company which has been a pioneer in the field for the last 40 years. BML Istisharat is a subject matter expert with 80+ full-time employees and acts as an architect of state-of-the-art business solutions.

About BML Istisharat

ContactBML Istisharat SAL Address: Postal Address:

|

Tel/Fax: Website: Email: |

Profile

Interview – Leader in Banking, Insurance and ERP Software Products in Lebanon

Management:

| Joe Faddoul | | Chairman |

BML Istisharat started as a consultancy company in 1972. The war in 1975 changed many things including the activities of BML Istisharat. Since then, the company has been provising the Lebanese banking sector with IT solutions. BML Istisharat began to export its products in 1980’s and became partners with IBM or HP. Today, 87% of its business lies in exports and only 13% in the local market.

Its main activity is to develop and support application software geared towards Banks, Insurances, Manufacturing and Distribution firms.

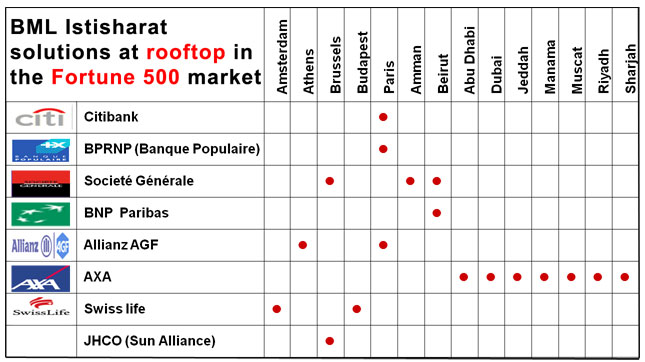

Today, proven solutions of BML Istisharat are being used by more than 300 clients worldwide, including Fortune 500 companies, in order to achieve their business goals.

BML Istisharat is ISO certified and Oracle certified and the company is an IBM business partner, too.

Mission

To be recognized as a partner of choice for financial information systems geared towards banks, insurance and manufacturing companies.

To constantly update such systems in close cooperation with users groups and industry professionals.

To share with our partners / customers a common goal for consistent achievement, mutual profits and personal success.

Team

BML Istisharat staff constitutes of full time subject matter experts and consultants with in-depth business know-how in the areas of:

– Banking

– Investment and Finance

– Life and General business Insurance

– Accounting and Enterprise Resource Planning

– System Engineering and IT Development

Know-How

BML Istisharat is architect of its products and solutions and fully own them. All products are developed in-house, Implemented on-site and supported directly by BML Istisharat.

– Investment protection

– No dropping/replacing products

– Full control on the products evolution

– Total independence from third parties

– Fast reaction/response to market trends

Partners

BML Istisharat is in forefront in providing business solutions and IT services.

Selected strategic partners:

– IBM Business Partner

– Oracle Certified Partner

– Intel Early Access Program

– Hewlett Packard

– Moody’s Analytics

Offerings

*Integrated modular solutions

Universal Banking and Finance (Conventional & Islamic)

Life and General Business Insurance (Conventional & Islamic)

ERP Manufacturing and Distribution

*Partner solutions offerings

Anti-Money laundering – Filtering and Profiling

Risk and Performance Management – B2, SOX, ALM

Document Management Solution

Loans Collection

*Professional services

*Custom made applications

*Outsourcing of IT services

Services

BML Istisharat professional services offering includes:

– Business Consulting

– Project Management

– Data conversion and Migration

– Parameterization and Customization

– System Implementation and Integration

– Training, Hands-on and Knowledge Transfer

Products

BML Istisharat state-of-the-art international and universal business solutions are operational in the United States, Canada, Europe, Africa and the Middle East.

ICBS in 65+ Banks/Finco/Invco

CIRIS/LIRIS in 46+ Insurance companies

IMAD in 110+ Firms/Institutions

ICBS

ICBS

Conventional and Islamic Versions

The Integrated Computerized Banking System (ICBS) is a Secure, Modular, Integrated, Easy to use with Standard Graphical User Interface (GUI), Web Enabled, On-line Real Time, Flexible, Interactive, Scalable, Multi-Currency, Multilingual Software System designed to support, manage and comprehensively control Financial Institution Front and Back Office activities. ICBS runs in more than 50 banks worldwide and is available on:

– Oracle multi-tier platforms

– IBM AS/400 platforms

ICBS was designed as a set of integrated modules that share a common nucleus in order to cover Retail Corporate and Investment activities.

GENERAL ARCHITECTURE

ICBS Nucleus:

The ICBS Nucleus encapsulates all other modules and provides security features, dynamic personalized menus, referential and parameter tables, user defined business rules, central customer information tables, accounting system, audit trail reports and a set of embedded engines and calculators: (Accounting, Receipts, Documents, Commissions, Charges, etc.) as well as interfaces with peripheral applications (SWIFT, ATM/POS, IVRs, CRM etc.).

ICBS Retail:

Completely user defined transactions to handle tellers and back office retail activities including current balances and checking accounts, savings accounts, time deposit, overdrafts, commercial bills, standing instructions, utility bills, cashiers/draft checks, remittances and transfers, etc.

ICBS Loans:

Personal, Consumer and Corporate financing. Dynamic scoring and user defined products. Origination and approval workflow. Follow up, settlements/collection, rearrangements and arrears management.

ICBS Trade Finance:

A set of modules offering complete workflow (maker/checker concept), follow up, generation of accounting entries and documents through a rich set of functions covering letters of credit, bills for collection and letters of guarantee.

ICBS Foreign Exchange & Money Market:

Wholesale transactions: spot, forward and swap, certificates of deposits, loans and deposits (fixed and call notice) with related transfers.

ICBS Capital Market (Securities):

Front, Middle and Back Office: Handling of Stocks, Bonds, Derivatives and Mutual Fund transactions, On-line interface with pricing systems.

ICBS Credit Facilities and Risk Management:

Credit Files, collateral management and facilities. Risk classification and monitoring.

ICBS Central Processing:

Flexible and multiple interest calculation methods. Regulatory reports and data exchange with credit bureaus. Correspondent accounts management. Batch processing including: Periodical closing, Reconciliation, Revaluation and Consolidation. Rich set of reports (Control, Statistics and MIS).

ICBS, An Open System

ICBS has built in interfaces with:

– SWIFT terminals

– ATM and POS solutions

– MICR/OCR checks handler

– Phone banking (IVR)

– Signature verification solutions

CIRIS

CIRIS

Conventional and Takaful versions

The Computerized Insurance and Reinsurance Integrated System (CIRIS) is a full web enabled enterprise system covering all general business insurance company operations including:

· Quote Generation and Rating

· Risk Assessment and Underwriting

· Policy Issuance and Administration

· Client Administration

· Claims Management

· Management and Regulatory Statistics

· Reinsurance

· Accounting and Budgeting

· Workflow

· Document Management

POLICY ADMINISTRATION

The Policy Administration module is the home base of customer activities. This area contains most immediate contact information as well being the primary customer inquiry and service area. This module is used to answer billing questions, process endorsements and most other customer service procedures.

· New Business Transactions

· Endorsements-Including out of sequence

· Cancellations

· Reinstatements

· Renewals

· Correspondence

· Individual or Group policies

· Integration with TPA

QUOTE, RATE & ISSUANCE

Lines of business handled by the CIRIS system include:

*Personal Lines

· Personal Auto (Standard and Non Standard)

· Homeowners

· Dwelling Fire

· Inland Marine

· Medical (Individual and Group)

· Umbrella

*Commercial Lines

· General Liability

· Property

· Crime

· Inland Marine

· Business Auto

· Workers Comp

· BOP

· CPP

· Commercial Umbrella

FINANCIAL SYSTEM

*Accounts Receivables

· Complete Integration With other Modules

· Receivables and Commissioning

· Direct Collection of Premium

· Lock Box Payment Facility

· Commission Calculation

· Agent/Broker Account Inquiry

· Multi-Level Commission Rates

· Standard or Negotiated Commission Rates

*Accounting

· General Ledger

· Accounts Payable

· Multiple Cost Centers

· Flexible Closing for Month and Year End

· Commission Calculation

· Automatic Cheques Production

· History

· Cash Management

*Budgeting

· Actual/Estimated according to various criteria

· Security Set up for Commissions, Forecasting and Year to Date comparisons

CLAIMS SYSTEM

Designed for comprehensive claim management the Claims module seamlessly interfaces to the policy database as well as the accounting module. This allows smooth and accurate claims handling. This module starts with claim set up and tracks the claim through to closing.

· Loss Reporting

· Automatic Assignment

· Financial Administration

· Client Administration

· Subrogation

· Salvage

· Litigation Management

· Integration with Motor Claims Assessment of a TPA

REINSURANCE SYSTEM

This module is designed to handle the most complex reinsurance issues and is available as part of the enterprise wide system or can be integrated to other vendor systems.

Features:

· Multiple Treaty Handling

· Surplus

· Quota Share

· Excess of Loss

· Facultative and Obligatory Placements

· Automatic Calculations

· Allocation of Premiums

· Commissions

· Claim Payments/Recoveries

· Retroactive Endorsements and Claims

· Real Time Issuance of Reinsurance Documents

· Calculation of Reserves for Premiums and Claims

LIRIS

LIRIS

The Life Insurance and Reinsurance Integrated System (LIRIS), was developed in cooperation with several life insurance companies and was designed from the start to handle both traditional and unit link products. The first installation dates from 1990.

LIRIS is a full enterprise system covering all company operations including:

· Clients Administration

· Policy Administration

· Actuarial

· Commissions

· Premiums and Accounts Receivable

· Units Accounting (for unit link policies)

· Loans

· Claims

· Reinsurance

· General Ledger

· Front Office

· Bancassurance

ACTUARIAL MODULE

The system handles conventional, universal life and unit link life policies. There is full support for Term, Endowment, Pure Endowment and Whole Life covers. A policy has one and only one product but under a given product we can have any combination of covers; For example it is possible to have under one policy a Term cover, a Whole Life cover and an Endowment cover.

*Value Generator

The actuarial calculations are triggered on specific events. The events are inside the LIRIS Programs but the calculation needed for the event is outside the LIRIS programs thus allowing to add new products along with their calculation formulae without changing the core system since the calculation formulae are ‘plugged-in’ and not hard coded in the programs.

*Reserves

The Commercial, Net, Expense loaded, Zillmerised and Investment premiums are calculated by cover using either user defined tables, standard calculation routines or even customized routines.

The Surrender Value at Last Anniversary, Last Anniversary profit sharing, Reserves before Alteration and Reserves after Alteration and the Guaranteed Maturity Values are calculated on-line when applicable.

*Products and Covers

Covers validation rules like minimum age at entry, maximum sum insured, cover type, period of premium payment etc. can be specified for every newly introduced cover. There are primary covers and secondary covers. Secondary covers can exist on their own on a policy (example: Accidental Death Benefit) and they can also exist as riders on primary covers (Premium restitution on a Pure Endowment).

A product will contain one or several covers and riders. Not all the covers of a product are mandatory (they may not all exist on a specific policy).

UNDERWRITING

Age and range of sum insured can define medical requirements and insurability requirements. Using the total sum insured on a given life, the system will suggest the appropriate medical examinations to be followed, showing also the exams already performed.

COMMISSIONS AND OVERRIDES

Commissions rates are defined by source of business (commission agreement), product and cover. There may be up to 9 intermediaries on a policy each having up to 4 levels of overrides.

The splitting of both the initial and renewal commission is defined on the source of business level. The initial commission can be calculated by the value generator where several parameters for a given intermediary or source of business can be taken into account.

The above system allows the full support of bank warm leads commission, where a source of business is defined for each bank deal. In the source of business, will be defined the commission percentages as well as the splitting rules between the bank and the intermediary (if any).

The initial commission and overrides can be paid and earned in several ways. As a matter of fact, the initial commission and overrides can be paid and earned by user-defined schedules.

The payment and earning of the initial commission overrides can and also be defined by type of intermediary.

BANCASSURANCE

Liris has being extended to operate in a Bancassurance environment.

This resulted in a definition of the Front Office functions at Bank Branch level, the Bank Office functions and the exchange of data between the Banking & the Insurance system.

The end result is that LIRIS can be integrated in a banking environment, in a way that the same bank employee can handle banking & insurance products on the same workstation.

CLAIMS

LIRIS supports different claims types: Death, Maturity, Critical Illness and Invalidity claims. The user can define as many claims nature as needed but each claim nature must have one and only one of the following types: Death, Accidental Death, Suicide, Maturity, Critical Illness (dread decease) or Invalidity Settlement of claims can be done by lump sum or annuities.

REINSURANCE

The reinsurance is done by product/cover using the aggregate retention on a life insured. There can be a quota share treaty followed by several surplus treaties or an automatic treaty.

Facultative and Financing Reinsurance are also supported. There can be an unlimited number of reinsurers on a treaty. For each product/cover the following can be defined:

· The first year commission rate

· The renewal commission rate

· The exception by insurance risk code

· The way the premium and ceded amount should be calculated

Reinsurance risk premiums can either be calculated by using formulae or tables and they are defined in the value generator (described earlier).

IMAD

IMAD

The Industrial Manufacturing and Distribution system (IMAD) is a modular software package supporting the financial, administrative, production and distribution activities of Manufacturing and Distribution Firms.

The first version of IMAD was implemented in 1981. Today, IMAD modules are successfully running at 100+ firms operating in both Manufacturing (Cement, Furniture, Fertilizers, Cosmetics etc.) and Distribution (Car dealerships, Home Appliances, Heavy Machinery, Pharmaceuticals etc.).

IMAD is available in two versions:

Oracle

IBM AS/400 /DB2

GENERAL FEATURES

User friendly, modular, integrated, secure, flexible, parameterized, multi-currency, multi-lingual, multi- ompany, multi-branch, on-line, real time, RDBMS based and fully documented.

Modules can be installed on a stand – alone mode.

CORE MODULE

The core module (nucleus) includes:

· System tables and parameters

· User defined dynamic GUI menus

· User defined profiles and group profiles

FINANCIAL AND ADMINISTRATIVE MODULES

*General Ledger

· User defined hierarchical chart of accounts

· Multi-entity consolidation levels (Company, Branch, Department, Cost Center etc.)

· Multiple currencies with two base currencies

· Cash Management

· Analytical reports

*Accounts Payable/Receivable

· Suppliers information management

· Checks management

· Aging reports

· Customers information management

· Credit facilities

*Budget Control

· Budget setting

· Actual v/s Estimated figures

· Comparison with previous years

· Analysis by account, cost center, department etc.

*Vehicle Management

· Vehicle records

· Maintenance and insurance schedule

· Vehicle daily transactions (Reparation, Lubricant and Battery Exchange etc.)

*Drafts/Notes Management

· Automatic issuing of drafts

· Interest calculation

· Diaries by department, bank, region

· Complete reporting

· Past due, unpaid bills

*Payroll

· User defined payroll items

· Taxes management

· Social security and family allowances

· Flexible high-cost of living changes

· Loans management

*Human Resources

· Applications, interviews, assignment and contract management complete workflow

· Personal information, education, experience (in and out), training (in and out)

· Leaves record

· Medical and life insurance

· Termination/separation

· Schooling

*Fixed Assets

· Assets records

· Depreciation

· Maintenance history of asset record

· Multiple transactions (Purchase, Transfer, Sale etc.)

DISTRIBUTION MODULES

*Purchase Orders

· Order preparation

· Follow up: Placement, Reception, Situation etc.

· Quotes comparison

*Inventory Management

· Bar code facility

· Multi-level criteria (Group, Category, Sub-Category, Brand)

· Sub-item capabilities (Color, Size, Season etc.)

· Multiple unit-of-measure by item

· Distribution of quantities over batches and expiry dates

· Flexible cost price calculation

*Customer Orders

· Complete orders follow up (Reservation, Delivery and Order Situation)

· Item reservation follow up

*Invoicing and Sales Statistics

· Issuance of invoices and delivery orders

· Flexible selling price selection and discount calculation

· Flexible terms definition

· Issuance of Debit/Credit notes

· Sales commissions calculation

· On-line update

· Statistical reports

*Van Distribution

· Deliveries scheduling according to customer’s orders

· Door-to-door direct sales and collections

· Trucks loading and return back from sales monitoring

AUTOMOTIVE DEALERSHIP MODULES

*Auto Showroom Management

· Multi-brand & multi-location/showroom capabilities

· Car code data with multi-level capability

· Color, interior and options capabilities

· Full entire process from commission order through vehicle preparation, ship, receipt, offer, deposit, delivery and sale

· Offers and sales follow up including multi trade in capability

· On-line stock, costing and accounting update

· Possibility to interface to car manufacturers

· Can be applied also to machinery’s line of business

*Garage & After Sales Management

· Multi-garage capability

· Multi-invoice type capability/repair order

· Multi-spare part, sublet and technician capability by labor charge

· Technician’s productivity based on time sheet

· Search facility by customer/vin/plate

· Call center & repair order management

· Warranty claim, campaign & quality control capability

· On-line stock, costing and accounting update

· Possibility to interface to car manufacturers

· Can be applied also to machinery’s line of business

MANUFACTURING MODULES

· Finished products definition: Raw materials, components, labor, machine time (Costs and Quantities)

· Time sheets (Labor and Machinery)

· Multiple products by Job Order

· Costing: actual v/s estimate by batches, order nbr, product (Cost and Quantities)

· Master production planning: Production load, delivery dates, delayed batches

· Production/Productivity statistics

Strategy & Achievements

Joe Faddoul, Chairman of BML Istisharat, reveals the strategy for his company: “We want to consolidate our new markets and continue to be up to standard on a technical level.”

|

loading the player….

|

Lately, BML Istisharat has signed its first deal with a local bank in Malaysia. The software from BML Istisharat has been already implemented in more than 30 countries to more than 300 clients. Mr. Faddoul wants to focus on Russia, the CIS countries and Asia over the next 5 years.

BML Istisharat is an example of a boutique company. Not being a global heavyweight has its advantages though. Thanks to its small size, BML Istisharat more reactive, agile and can adapt more easily and flexibly.

Mr. Faddoul describes the company in the following way: “We are an equivalent of a boutique hotel in the world of IT, banking and insurance: we pamper our clients and build a personal relationship with them.”

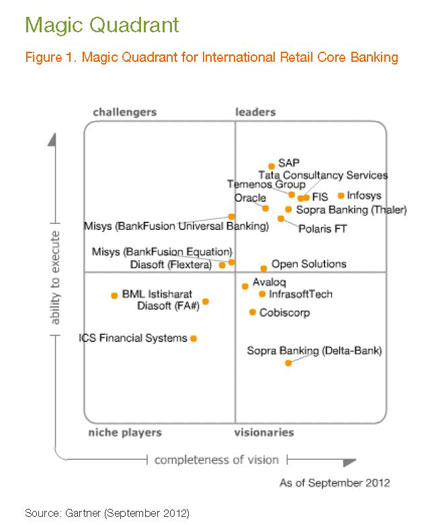

Gartner’s Magic Quadrant affirms the reputation of BML Istisharat.

“What you need to know: ICBS is a complete core bankingy system, the main characteristics when compared to competition are ist flexibility, its wide functional coverage and its simplicity of usage. It is also worith mentionintg that ICBS is available on two platforms IBM-AS/400 on DB2 and different Oracle platforms.”

International Ranking

IBS Ranking: ICBS as 8th

The latest annual rating of International Banking Systems – United Kingdom (IBS Sales League Table) for the year 2011 ranks ICBS, the banking system of BML Istisharat, as 8th out of 34 systems selected for Universal Banking, and 14th out of 78 in all categories.

Gartner’s Magic Quadrant

Moreover, BML Istisharat has been selected by Gartner Inc. in the Gartner’s Magic Quadrant (MQ) for International Retail Core Banking. Positioning was based on the BML’s completeness of vision and its ability to execute.

International Support

BML Istisharat is supported and recognized by International Public Institutions such as:

– The World Bank awarded BML Istisharat the contract for the computerization of the Land Registry Office.

– The European Union selected ICBS for a major bank in the Middle East.

References | Rooftop

Latest Accomplishments:

Malaysia-based Bank Simpanan Nasional (BSN) has signed for a new core banking system, ICBS, developed by Lebanese vendor, BML Istisharat. BSN has over nine million accounts and around 400 branches. ICBS’s coverage at BSN will include conventional interest calculation and Islamic profit calculation, loans management, Islamic financing, transfers and payments, branch operations, integration and delivery channels…

Incomplete lists of different international banks and other institutions who are currently using (or were using in the past ) the products of BML Istisharat:

ICBS

“ICBS required powerful, sophisticated hardware technology with strong overall performance, large memory capacity and disk space. The hardware had to handle larger file sizes and additional functionality. We needed a reliable, scalable, easy-to-use solution that would deliver a good return on our investment. The AS/400 platform gave us the powerful solution we knew we could trust. With BML and AS/400 technology, we now have a state-of-the-art network computing systems that allows us to compete with any bank in Saudi Arabia.”

– Tom Delves, Head of Information Services at Saudi Cairo Bank

| Citibank | Paris |

| BLOM Bank | Paris, London, Bucharest |

| Limmat Investment AG | Geneva |

| BSN Bank | Kuala Lumpur |

| Commercial Bank of Kuwait | Kuwait |

| Capivest | Manama |

| Oman Development Bank | Muscat |

| Bank of Jordan | Amman, Damascus |

| Central Bank of Iraq | Baghdad |

| Bank of Lebanon (Central Bank) | Beirut |

| Société Générale | Beirut, Amman, Nicosia |

| Crédit Libanais | Beirut, Limassol |

| Gazprombank (Invest) | Beirut |

CIRIS | LIRIS

“I want to express my positive appreciation for your cooperation and my satisfaction for your services”

– Azzam Zaghloul, IT manager at AXA Gulf

| Allianz Marine Aviation (AMA) (Allianz AGF) | Paris |

| Methodist Insurance | London |

| Kosmos (Allianz AGF) | Athens |

| Pafco Insurance | Indianapolis (IN) |

| Grain Dealers Mutual | Indianapolis (IN) |

| Superior Insurance | Tampa (FL) |

| General Insurance Co. of Cyprus (Bank of Cyprus) | Nicosia |

| Axa Insurance | Nicosia |

| Axa Insurance | Abu Dhabi, Dubai, Sharjah |

| Gulf Life Insurance Company | Kuwait |

| Islamic Insurance Company | Amman |

| Sogecap (Société Générale) | Beirut |

| Libano Suisse | Beirut, Doha |

IMAD

“I am writing you this letter to thank you and congratulate you for the excellent job you have done in developing for us the new software requested by La Redoute. We are indeed lucky to have you in our team and I am sure that I will be able to count on you whenever the need arises.”

– Joumana Baini, Manager at Starlight Express

| Auto Z Group | Doha |

| Jordan Business Machines (JBM) | Amman |

| Industrial Commercial And Agricultural Company (ICA) | Amman |

| Casino Du Liban | Beirut |

| Pharaon Holding | Beirut |

| Sleep Comfort | Beirut |

| Sadco – Sami Dandan & Co. | Beirut |

| Lebanon Chemicals | Beirut |

| Folda | Beirut |

| Raidy Printing Press | Beirut |

| Interbrand | Beirut |

| Joseph Eid & Co. | Beirut |

| Impex | Beirut |

| Ets. F.A. Kettaneh | Beirut |

| Sigma ME | Beirut |

| A. N. Boukather | Beirut |