Fiscal Deficit Jordan

IIF highlights Jordan’s crucial need for fundamental fiscal reforms.

The Institute of International Finance (IIF) issued a report on Jordan in which it noted that the principal macroeconomic challenge – Jordan fiscal policy – remains the task of reining in the budget deficit and lowering the debt-to-GDP ratio.

Jordan’s principal macroeconomic challenge remains the task of reining in the budget deficit and lowering the debt-to-GDP ratio. Significant progress was achieved between 2003 and 2008. Yet, the onset of the global economic crisis and then the regional turmoil reversed this progress.

In 2011, the government had to solicit an exceptional amount in foreign grants to cover additional spending earmarked for its social safety net in an attempt to placate domestic protests. From January until September of 2011, grants totaled US$ 1,473 million, reflecting mainly a Saudi grant in the amount of US$ 1.4 billion. The increase in foreign grants, relative to the same period a year earlier, explains the 26% rise in total revenues and grants. For 2011, foreign grants are expected to reach a peak of US$ 1,833million and the fiscal deficit will be maintained at the budgeted 5.7% of GDP when grants are included, but will rise sharply to 12.1% excluding grants.

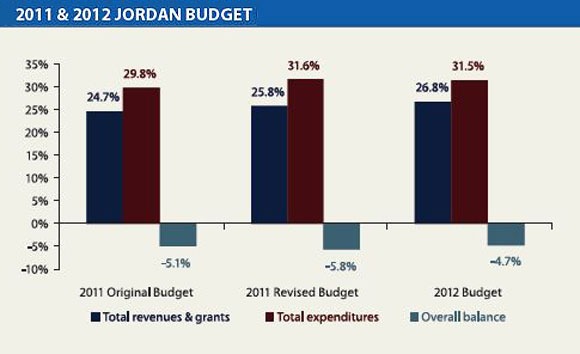

Looking into 2012, Jordan aims to lower the fiscal deficit (including grants) to 4.7% of GDP. Therefore, current expenditures would be restrained, increasing by only 0.97% from the 2011 projected level, while capital expenditures would rise by around 21%, as per the IIF. On the revenue side, the government expects to raise more from domestic sources and less from foreign grants. Based on a real growth assumption of 3% to 3.5%, domestic revenues are forecast to reach JD 4.9 billion, an 18.6% rise from 2011 projected levels. The fiscal deficit excluding grants would be 8.7% of GDP, down from a projected 12.1% of GDP in 2011.

Jordan’s principal macroeconomic challenge remains the task of reining in the budget deficit and lowering the debt-to-GDP ratio. Significant progress was achieved between 2003 and 2008. Yet, the onset of the global economic crisis and then the regional turmoil reversed this progress. To counter the fiscal deterioration, the 2010 budget sought to sharply reduce capital expenditures, while this year, Jordan is relying on an exceptional amount in foreign grants. These are short-term solutions, particularly when tax revenue is under pressure. A more efficient tax system reinforced by better compliance would help produce better revenue outcomes. Yet, the IIF noted that Jordan would become increasingly dependent on foreign grants, especially from the GCC, to whose membership it has applied.

Successive governments have adopted fiscal consolidation programs before and have managed to reduce the debt. However, whenever security issues became prominent, or during times of economic slowdown, the fiscal deficit situation deteriorated. The present time is one with both regional instability and an economic slowdown, which makes it highly unlikely that substantial improvements in the fiscal position will be forthcoming. Therefore, while the present government is making every effort to reduce the budget deficit (including grants) in 2012 to 4.7% of GDP, the IIF projects that it would not be significantly different than a year earlier.

The article above has been published as a part of Bank Audi`s MENA Weekly Monitor of Week 02 (2012). It can be accessed via Internet at the following web address: http://www.banqueaudi.com