2012 Economic Outlook for Middle East by HSBC

HSBC views better 2012 economic outlook for Middle East especially for regional oil producers with expansive fiscal stance.

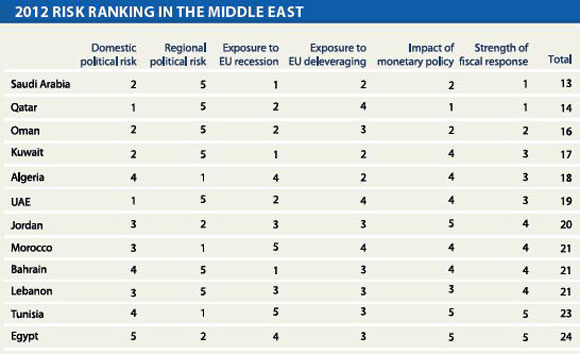

HSBC issued a report on the Middle East in which it perceived Egypt as the riskiest in terms of the economic and political outlook for 2012. The Bank remains more comfortable towards the general situation in Saudi Arabia. The 2012 economic outlook for Middle East is especially good for regional oil producers.

The near-term economic outlook is best for those regional oil producers able and ready to maintain, or even widen, already expansive fiscal stances. Qatar, Saudi Arabia and Oman lead this group, with the outlook further supported by HSBC’s view that their banking systems are placed to maintain lending growth to both the public and private sectors.

The post-conflict states of Middle East are primary concern of HSBC for 2012. Such economies are held back by the risks hanging over due to incomplete political transition. They face external account shortfalls, strained public finances and weak funding outlook. The trade and service exports also tie them closely to debt stricken Europe, which adds more to economic concerns.

Middle East countries with few or no hydrocarbon resources face a difficult year as they have limited room for manoeuvre. Jordan, for example, increased spending in response to widespread unrest across the region and sporadic local instabilities while also facing higher subsidy payments to offset elevated prices of imported food and fuel. The result was a marked rise in the budget deficit which would have proven very difficult for the government to fund without access to aid. HSBC expect this dynamic to result, at best, in only very modest increases in overall spending in Jordan in 2012, or even necessitate real-terms spending cuts. The spending outlook for the other non-oil producing economies such as Lebanon and Morocco appears equally subdued. Also, several of the aforementioned economies are on watch for local instabilities as they remained tied to political tension at the domestic and neighboring countries level. Therefore, any access to external funding to enhance the private sector would be weak in 2012 as investors are not keen on exposing themselves to risky situations.

Although all of the larger oil producers have the resources to weather another turbulent year, HSBC is not persuaded that each will use their wealth to promote faster growth over 2012. This includes the UAE which may also be held back by difficult access to European funding, and whose banking system looks unlikely to effectively channel loose monetary policy into the real economy. Middle East regional tensions and global economic strains will also weigh.

The near-term economic outlook is best for those regional oil producers able and ready to maintain, or even widen, already expansive fiscal stances. Qatar, Saudi Arabia and Oman lead this group, with the outlook further supported by HSBC’s view that their banking systems are placed to maintain lending growth to both the public and private sectors. Even here, however, the Bank is anxious that reduced access to European capital flows would weigh on performance. Their exposure to any increase in tensions between the West and Iran is also likely to weigh on sentiment, while any outright conflict would push growth into reverse.

The article above has been published as a part of Bank Audi`s MENA Weekly Monitor of Week 03 (2012). It can be accessed via Internet at the following web address: http://www.banqueaudi.com