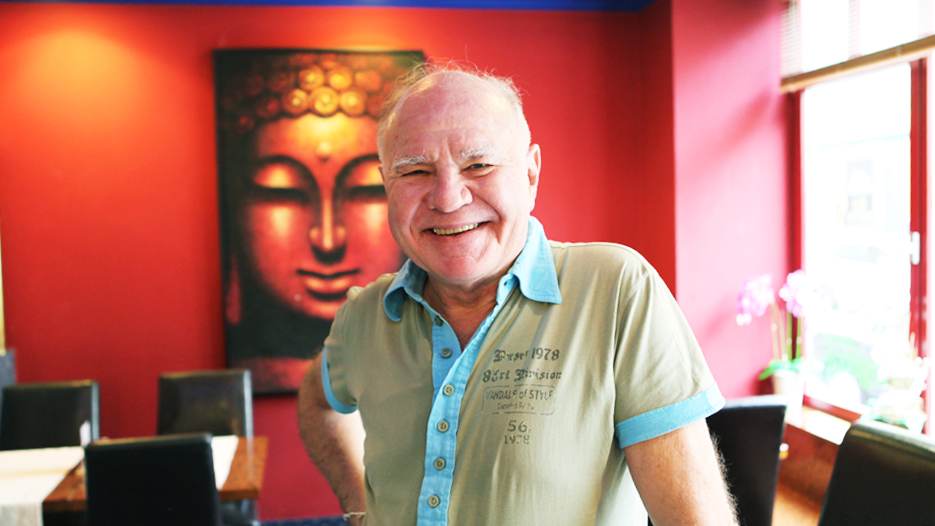

The Big Picture with Marc Faber

An exclusive interview with Marc Faber, Editor and Publisher of “The Gloom, Boom & Doom Report”.

Interview with Marc Faber, Editor and Publisher of “The Gloom, Boom & Doom Report”

By Johannes Maierhofer and Peter Matay

In this exclusive interview with Marcopolis.net Marc Faber covers it all: from commodities and China to the outlook on inflation, the Euro and gold. According to him the global economy is not healing. To the contrary, we might find ourselves back into recession within six months or a year. In that case he expects more money printing by central banks, which eventually could lead to high inflation rates and renewed strength in commodity prices.

On the bright side, he sees great economic potential in Vietnam. Also, the Iraqi stock market has good potential now that a deal with Iran has been reached. While mining stocks are extremely depressed we might see defaults before any meaningful recovery.

In your 2002 book “Tomorrow’s gold” you identified two major investment themes: emerging markets along with commodities. That was a great call. As for commodities, they had a great run up until 2008. Then they crashed sharply along with everything else just to recover strongly into 2011. Since then they have acted weakly, and recently commodities even reached a 13-years low. Is this the end of the commodities-super-cycle, as some have claimed, or is it more like a correction?

Well that’s a very good question because obviously the weakness in commodities this time is not due to, like, contraction in liquidity as we had in 2008. 2008 commodities ran up very quickly in the first half until July. The oil prices in 2007, just before they started to cut interest rates in the US were still at 78 dollars a barrel and then by July 2008 they ran up to 147 dollars a barrel. Afterwards they crashed within six months to 32 dollars a barrel and then as you said in 2011-2012, they recovered and were trading around 100 dollars a barrel. Now they have been weak again as well as all other industrial commodities and precious metals.

My sense is that this time around, commodity prices are weak because of weakness in the global economy, specifically weakening demand from China,

because if you look at the Chinese consumption of industrial commodities, in 1970 China consumed 2% of all industrial commodities, by 1990 it was 5% of global commodity consumption for industrial commodities and by the year 2000 it was 12% and then it went in 2011-2012 to 47%, in other words almost half of all industrial commodities in the world were consumed by China.

Therefore a slowdown in the Chinese economy has a huge impact on the demand for industrial commodities and on the wellbeing of the commodity producers, whether that is the commodity producers in Latin America, in Central Asia, Middle East, Australasia, Africa and Russia.

And so because of the reduced demand from China, the prices have been very weak and I think that may last for quite some time because the Chinese economy will not go back and grow at 10% per annum any time soon. My view is that at the present time, there is hardly any growth in China. In some sectors there is a contraction and in some sectors, and don’t forget China is a country with 1.3 billion people, so some provinces may still grow and other provinces may contract, as well as some sectors may grow and others may contract. But in general I think the economy is weak.

My estimate is that at the very best the Chinese economy is growing at the present time at say 4% per annum and not at 7.8 or 8% as the government claims. We have relatively reliable statistics like auto sales and freight loadings that are down year on year, electricity consumption, exports, imports and so forth. So there has been a remarkable slow down and to answer your question about commodity prices, if the global economy slows down as much as I do believe, because other economists predict an acceleration of global growth, a healing of global growth, my sense is that it is the opposite, that within 6 months to one year we are back into recession and then it will depend on central banks and what they will do. Up until now, they have always printed money and I suppose they will continue to do that.

within 6 months to one year we are back into recession and then it will depend on central banks and what they will do. Up until now, they have always printed money and I suppose they will continue to do that.

Now from a longer term perspective, commodity cycles last 45 to 60 years roughly, from trough to trough or peak to peak. In other words we had a peak in 1980 and then commodity prices were weak throughout the 1980s and 1990s, then in 1999 they started to pick up and went and made a peak for most commodities in 2008 and for the grains 2011-2012. Since then everything has been weak. I could argue that well, maybe this is a major correction in the commodities complex within still an upward wave of commodity prices and that the final peak prices are not yet seen.

As for Chinese stocks, they went up very strongly over the last year, but recently they crashed just as hard. Is this a precursor to something worse or is it merely a bump on the road towards a still ascendant China?

Well I think that a year ago in June/July 2014, Chinese stocks were very inexpensive compared to other markets in the world. They had been going down relative to the S&P since 2006 and compared to other Asian markets like the Philippines, Indonesia, Thailand… they had performed very poorly.

So a year ago my view was that a) because of the crackdown on visitors to Macau and more importantly because the property market in China was beginning to show cracks, prices were no longer going up and many markets were over supplied so my sense was that domestic money would shift out of the property market or de-emphasise property investments and go into equities, at the same time international investors were grossly underweight Chinese stocks and my sense was that as an international investor you look around the world and see all of these markets, the S&P is up at an all-time high last year already and then you see a market like Japan that two years ago was very depressed compared to other markets, so money went into there.

A year ago what was very depressed relative to everything else was the Chinese stock market. So money flowed also internationally into Chinese stocks and the market in China is relatively illiquid. You have to see. Because most blocks of shares are owned by the government or by large Chinese groups so what is available for trading is not that large.

Then the money flowed into Chinese stocks and they went up by more than 100% within a year and the whole thing became very speculative because in China people borrow a lot of money against what they buy whether it is properties or stocks and so the margin accounts increased dramatically and the margin debt reached almost 4% of GDP whereas in the US it is around 2% of GDP and it is at its highest level ever. So 4% was a very big figure. I think the government´s measure to support the market will largely fail and that eventually there will be more selling pressure and stocks will retreat somewhat more.

Do they go back to the levels of a year ago, to the 2014 lows? I don’t think so. I think this may be the beginning of a new bull market in China, but after a 100% rise we could have, like, from peak to trough a 40% correction. Or even 50%.

I think this may be the beginning of a new bull market in China, but after a 100% rise we could have, like, from peak to trough a 40% correction. Or even 50%.

China has established the Asian Infrastructure Investment Bank (AIIB) and went ahead with plans for a so called “New Silk Road”, a huge infrastructure project, connecting China with Europe via a new land route and a maritime equivalent. Steen Jakobsen from Saxo Bank mentioned a while ago that this could be a game-changer – particularly in regards to the demand for commodities as much of the work and investment needed is in infrastructure, buildings and railroads. What do you think?

Well I think there may be some euphoria about this infrastructure building and the ´New Silk Road´. My sense is that yes, some investments will take place but we have to recognise that first of all it will take time. It is not going to be built overnight. Whether it will be really so profitable is another question and the other question is will China have the money to do it?

We are moving here into geopolitics, basically, because of the antagonism of the Western world towards Russia specifically Mr Putin, whom they portray as a villain when in fact he wasn’t the aggressor, it is NATO and the Neocons that essentially pushed the existing government out in Ukraine and began to create the whole problem that we have. If you look at the map of Europe and Eastern Europe it is very clear that Russia will not allow NATO to be east of the Dnieper River, in other words in eastern Ukraine nor will they give up the Crimea, this is strategically of great importance for Russia, has no strategic value for anybody else except for Russia. So the tensions have arisen and because of this hostility of the West towards Russia, Russia has been pushed closer to China.

They share very substantial borders areas with each other and because of the proximity of the two countries and the nature of their economies, Russia possessing the resources and China largely technology and consumer goods which Russians don’t necessarily produce, there is a symbiotic relationship going on. The Chinese and the Russians want to exploit this strength, what they call the hinterland essentially and the rim land in geopolitics.

Of course the US is completely against it because the containment policy was precisely directed against the major power emerging again in Central Asia and Far East Russia and in Russia. So this Silk Road initiative in my view is far from being a certain thing that it will succeed because there are also political obstacles and you know, when the Americans want to create trouble, that they excel at, they are very good at doing that.

When the Americans want to create trouble, that they excel at, they are very good at doing that.

Instead of building nations they destroy nations, from Libya to Egypt to Syria to Iraq and Afghanistan. Whatever they touch, they mess it up or in good English F* up!

What about Europe and Russia? E.g. many German industrialists don’t seem too happy with the current sanctions regime.

Not at all. Actually, you ask ordinary people in the whole of Europe about the policies of the governments towards Russia, 90% of ordinary people disapprove of the politics and policies that have been implemented and with the way European governments behave as if they were feudals of the United States and vassals of the US.

The reality is that Europe should be very close to Russia as it was in the 19th and 18th century, with very few exceptions like for example when Napoleon attacked Russia or when Hitler attacked Russia, but ordinarily the two regions, western Europe and Russia were much closer than say western Europe and the US because of the proximity and also culturally they were quite close.

You already mentioned commodity cycles. Economists have long debated the existence of long term waves in economics – the most prominent concept of which is the so called Kondratieff cycle. In your 2002 book you pick up on the idea by guessing where we might find ourselves in the current Kondratieff wave. If you did the same today, what do you think? Are we still in a falling wave? What are the important characteristics to look at? And most importantly, what does it mean for the medium to long-term outlook?

I mean, Irving Fisher the economist who essentially became famous because of his book Booms and Depressions in the 30s, said well this is a very difficult issue with knowing where in the cycle you are because basically it is like you are sitting on a ship and there are waves that will move the ship but then there is also wind that may come from another direction and the waves are not all regular and so forth, so the ship can have many different motions.

My view regarding the Kondratieff is that first of all it is important to understand that it is not really a business cycle but a price cycle. The price cycle obviously in the 19th century when economies were much more commodities related because agriculture until the beginning of the 20th century was the largest employer, so when agricultural prices went up, the farmers had more money and it benefitted the farming population and so the economy picked up and when the farm prices went down especially in the US with cotton obviously the economies that were producing these commodities suffered.

So in the 19th century we had several cycles, upcycles and down cycles. Basically the last down cycle as I mentioned would have been in essentially 1980 to around 1998-1999, so approximately twenty years. The up cycle before was between the 1940s and 1980s. You can’t measure it precisely. My sense is that one missing element in the Kondratieff in the late 1990s and early part of 2000-2005 was that normally when the Kondratieff bottoms out, Schumpeter, he built his business cycle theory around the Kondratieff and he explained that usually in the trough of the Kondratieff, in the depression, you have a massive liquidation of debts, and that hasn’t happened, it hasn’t happened.

And so it is conceivable that we were in a downward wave of the Kondratieff after 1980 and then we had within the downward wave this upward wave because of the opening of China, between 2000 and 2008. And as the Chinese economy weakens and as the debt level today is globally as a percent of the global economy 30% higher than it was in 2007.

So we can´t say that there has been deleveraging, on the contrary! The debt level is even more burdensome today than it was in 2007. Therefore it is possible that the big debt deleveraging is yet to occur and when it occurs then obviously commodity prices will still be weak for a while.

Therefore it is possible that the big debt deleveraging is yet to occur and when it occurs then obviously commodity prices will still be weak for a while.

The question is then, if we follow through and say ok, the price of copper went from 60 cents a lb to over 4 dollars a lb and now we are around 2 dollars a lb, if it goes back down to 60 cents a lb, which I don’t believe it will, but say if it did, or if gold went back to 300 dollars and oz., if it did, what about financial assets?

Where would they be? Because that decline in commodity prices would signal a huge problem in the global economy and under those conditions I doubt that financial assets would do well, there would be massive bankruptcies among governments and massive write offs in sovereign debts. Greece should write off at least 50% of their debts and even then the debt would probably be too burdensome for an economy that hardly produces anything! So these are signals that I take very seriously and I quite frankly given the recent weakness in commodity prices, I can´t see how the global economy is getting stronger. I just can´t see it.

What was still in place until recently is this long term down trend in interest rates.

Yes, sure. You see, traditionally the Kondratieff is a price cycle and interest rates follow the Kondratieff very closely. So if you take the last cycle, the peak 1980 for commodity prices and at the same time you had the interest rate peak in September 1981 when long term US treasuries were yielding over 15%.

Then we have the down trend in the Kondratieff until 1999 -2000, the commodity prices start to go up but interest rates continue to go down. So that would again suggest that there is a possibility that this entire boom in commodities in 2000-2008 was actually a bull market within still a downward wave in the Kondratieff, it is possible.

In regards to the colossal amounts of debt there are two major schools of thought: Inflationists and Deflationists. According to the first, all the money printing will lead to high levels of inflation, devaluing the currency and with it the debt will be inflated away. Deflationists would hold against, that, even if central banks wanted to, they ultimately cannot stop deflation. Where do you stand in that debate?

Well you know it is like in a bubble. The bears are right and the bulls are right but at different times. Every bubble will go up and then eventually the bubble will burst and then you know prices collapse. So during the bubble stage the bullish people are right and during the collapse the bears are right, but at different times. This is the same with deflation and inflation; I think both will be right, but at different times. I believe that most people have a misconception of what inflation is. In other words most people, they think of inflation as an increase in price of goods they go and buy in the shop over there and over there, at the butcher and at the baker and in the grocery store and so forth when in fact this is just one of the symptoms of inflation.

You can have inflation that manifests itself in sharply rising wages, this hasn’t taken place but if you look globally, say in China, wages have gone up substantially or you take Thailand, wages have gone up substantially. Or it can manifest itself in rising commodity prices. Well I mean commodity prices have been weak lately but the oil price is still close to 50 dollars a barrel and it was at 12 dollars a barrel in 1999 and gold is still around 1000 dollars and it was at 300 dollars and below in the 1990s, the low was at 255 dollars. You understand? A lot of things have been weak recently but they are still up substantially compared to the past.

Or you take bond prices, in other words bond prices go up when interest rates go down. Bond prices in the last hundred years have never been this high; in other words interest rates have never been this low on sovereign debts. Or you take equity prices, ok some markets are down, mostly the emerging markets whether it is Russia or Brazil or the Asian markets, they are down from the peak but they are still much higher than say ten or fifteen years ago. Or you take property prices, it depends which properties but most property prices, for example if you look around here in Switzerland, the prices are much much higher than they were fifteen, twenty years ago.

Even in some areas, they may have come down a bit but in luxury areas there are record prices. Or you take the Hamptons, or Mayfair in London, or Chelsea in London, Kensington and so forth, prices are very high compared to say twenty years ago. Or you take paintings, art… I mean when I grew up and I started to work in 1970 in New York, in New York at that time a Rothko painting was offered to me for 30,000 dollars. I didn’t buy it because I thought why would I pay 30,000 for something like this! Now a Roscoe is maybe ten, twenty, thirty million dollars and I have a Warhol, it is not a big painting but nevertheless I bought it for 300 dollars in the 1970s. You understand? Prices have gone up dramatically, so if someone says to me, well there is deflation, I tell him, well tell me in what? You know, Hong Kong property prices, Singapore property prices, even Bangkok, Jakarta and so forth, all have been grossly inflated.

Therefore I think we have to re-examine the definition of inflation whereby maybe we have some sectors of the economy that are deflating, like if we measure wages inflation adjusted, they are all going down in the western world because a) the consumer price inflation that the Federal Reserve and Europeans report has nothing to do with the cost of living increase, the cost of living increases and we have studies about this, in most American cities are rising at between 5 and 10% per annum and if you include insurance premiums, health care costs, education costs and so forth.

So these prices are going up strongly. Or taxes, indirect taxes like tunnel fees or bridge tolls and so forth, all that is going up much more than the CPI and this is where people have to pay for to actually go to work and live. This is then reflected, this kind of inflation is reflected in a diminishing purchasing power of people, that’s why retail sales are relatively poor in the US despite of the fact that we are six years into an economic expansion. I am always telling people, you know when I started to work I didn’t have to be smart because if I put my money on deposit with the banks or bought government bonds they were yielding 6%.

Then from 1970 to 1981 interest rates continuously went up, so the compounding impact was very high. Now if I am a young guy, say your age; then I want to put my money on deposit, I am being F*d essentially by the banks because they are not paying me anything. If I buy ten years US treasury notes I am getting a yield of less than 3%; 2.3% at the present time and it was below 2% six months ago. So how can I really save? How can I make money? I want to buy a house ok?

Then you have to pay a huge price and the mortgage rate may still be around 4% you understand? So it is still relatively high interest rates on mortgages and one of the reasons that new home sales are not particularly strong is that young people just don’t have the money to buy it because a) they are also burdened with student debts. So I mean these are all issues that are very complex.

My sense is that knowing the central banks, and knowing the way that they think, what will come up when they realise that the global economy is not healing but actually back into contraction under the influence of the neo-Keynesians like Krugman, they will say, you know what?

We haven’t done enough, we have to do much more, and then they will print again and that is why I think that eventually we could have high inflation rates and a renewed increase in commodity prices.

… they will print again and that is why I think that eventually we could have high inflation rates and a renewed increase in commodity prices.

A major argument by deflationists is that ultimately social mood might change. So while in 2008 everybody applauded the Fed for having saved the system, next time around it could be different. All the extraordinary measures might become too controversial, and all of a sudden we could see defaults happening in earnest. Is that a real possibility?

Yes. I mean I have read a lot about inflationary periods in history which we have experienced from time to time, under John Law in France and then later during the French revolution and in Latin America. I also experienced periods of high inflation myself in the sense that during the very high inflationary period in Latin America in the 1980s I visited most Latin American countries because I was interested in the fact that when you have high inflation in a country, usually the currency tumbles and so although there is high inflation in local currency, in a strong currency unit, like in the 80s the dollar was strong, the price level actually went down very substantially so investment opportunities were fantastic.

You could buy buildings in Buenos Aires, the stock market in the late 1980s in Argentina… the whole stock market was worth 750 million US dollars, 750, less than a billion. So you could essentially have bought the whole of Argentina for less than a billion dollars!! What happens in these periods of high monetary inflation is it is highly beneficial for a few families and a few well to do people because they know how to move their money between local currency and foreign currency and they know how to accumulate assets.

The people that get hurt are the masses, the middle class, the lower classes because their wages go up much less than the cost of living increases. Then what usually follows is a kind of political change of wind and you have new governments coming in and sometimes you have revolutions and sometimes you have an entire new leadership.

We had hyper-inflation in Germany and by the way there is a very good book out about the economics of inflation during the Weimar period, but in each instance it led to a polarisation of wealth and this is precisely what is happening now. You have huge merger and acquisition activity and you have stock buy-backs and if you look at the wealth inequality it is not between 1% of the population and 99, it is between 0.01%, the Carl Icahns of this world and the big assets holders and then the masses that do not have assets so they don’t benefit from rising asset prices.

In my view, you know you look at Trump, Donald Trump is no genius or anything, and he is not a particularly honest person either because his investors that bought bonds that were issued by his companies, most of them lost money, but he touches on one point, and this is a great dissatisfaction of the American of the typical American with his government.

I can tell you also that here in Switzerland, 90% of the people, they think the government is no longer looking after the interests of the people but after their own interests. It is the same in Europe. I think this is a huge failure of democracy, that democracy instead of having been able to elect leaders that look after the interests of the people, they actually look after their own interests. I mean you look at the Clintons, the Bush families and so forth, do you think they care about the ordinary Americans? They don’t care, they care about themselves, it is a power game. They care about money that is for sure.

When the German finance minister recently proposed a temporary Greek exit from the Euro it was perceived as a breach of what was long held as the sanctity of Monetary Union. For the first time a leading European politician departed from the line “to save the Euro no matter what”. Could this have been a watershed moment? What do you think, five or ten years from now, will there still be a euro, will it still be in the same composition or will it simply fall apart?

Nobody knows that. We don’t know how the world will look in five or ten years´ time but I would say that I believe the euro will survive. Now the question is, in what form? Maybe there will be a euro like a US dollar, we have a US dollar, and maybe some countries like Greece, Italy, Portugal, Spain will no longer use the euro and will have essentially gone back to their local currencies. It could be, maybe not. Because you understand, the typical Italian, Spaniard and Greek, he knows very well: we leave the EU, our pensions will be paid in local currency and that will be much less than what we get now.

So on the one hand, from a nationalistic point of view, most Europeans would like to leave the EU but when they look at their pocket book, it is like when Scotland, when the vote came up to exit Britain, Great Britain, the young people, most of them voted for the exit, but the elderly people, the pensioners, they were threatened, again because as you say the media said well you leave the EU, your pensions will be cut… so if you are an elderly pensioner, what do you prefer, to get your pension and be part of the UK or leave the UK and get lower payments?

This is one reason I think the EU may stay together but of course if the economic conditions in the southern countries, Greece, Italy, Spain… do not improve, if they actually worsen again then maybe the move towards leaving the EU will become very strong. Number two, I have been writing about this, you know if you look at history, we had great empires, the Greek empire and the Roman empire and the Ottomans and the Spanish empire and the British empire and now we have the supremacy of America that I probably waning but it was certainly there after the Second World War, the point is usually if you had empires in the past, it was very costly because you had to keep armies in the so called colonies in your territories, and if there were problems you would have to send in the troops and the ships and so forth to essentially enforce your empire.

In the modern empires, like the EU, you may have to pay. It is not sending armies to Greece but basically you have to pay so that Greece stays in the empire and then comes the questions the Germans ask, how long are they going to be willing to pay for it? Because it comes out of tax payers´ money, you understand, the politicians, they don’t pay it. Most politicians don’t even pay taxes because they are with the EU in Brussels or with the IMF or the OECD, all these clowns they don’t pay tax and then they go and propose wealth taxes on the others, on us, who work. They don’t work, they don’t pay tax but the others should pay tax.

Basically the tax payer in Germany one day he will say well we don’t like the policies of Mrs Merkel and this is happening in America, they don’t particularly like Donald Trump but they like the fact that he points the finger at all these others that have abused the system so badly. My sense is that we could have not necessarily revolutions in the sense that you have armies fighting against each other in Germany and France like in the French revolution and so forth but what we could have is through the democratic process people saying we are just fed up with these bureaucrats in Brussels and the ones in Berlin and the policies that always lean on America. We are sovereign nations; we want to be free, even if it costs us something.

We in Switzerland, we are not part of the EU but de facto, through the back door, Switzerland has essentially become an EU member.

Via regulations…

Yes. Absolutely. The Swiss fought for independence for the last 800 years and now suddenly they accept everything! They have no fighting spirit anymore!

But let´s assume some countries are ready to leave the euro zone. In the case of Greece this would go along with a major haircut or an outright default…

Yes, but a haircut and the default will occur regardless. I mean, even the IMF accepts the fact that the Greek debt has to be reduced somewhat. What they have done lately is the EU lends money to Greece and Greece then can pay the ECB and the IMF. It is a complete joke! It is a complete joke! It is like if you borrowed money from me, a thousand dollars, after one year you say, Marc look I can´t repay you and I can´t pay the interest, but if you lend me another thousand, then I can pay you the interest on the first thousand. But then you owe me two thousand!

And after the third year you come back and say Marc I´m very sorry, I can´t pay you the two thousand maybe you will lend me another thousand so I can at least pay you the interest on the two thousand! And so the game goes on. When you look at Greece objectively, private investors would never have lent all together 300 billion dollars to Greece, never! But governments are the peoples´ money you understand?

The ECB and the ESM and so forth are other peoples´ money, they don’t care.

When you say the defaults will come anyway, it would have huge implications, after all over the last 40-50 years it was inconceivable that a Western country would actually go bankrupt.

Well actually Greece has defaulted before and repeatedly.

Greece is relatively small compared to, let’s say, Italy. For a country like that to go bankrupt it would have huge consequences…

Yes sure, I agree with you that’s why we were discussing before that the debt liquidation hasn’t occurred yet. I mean I am less concerned about say Spain, Italy, France, and Greece defaulting than a big one defaulting. You understand? The US is not in a very good position either, if you look at their unfunded liabilities.

In America many cities are basically bankrupt as well as some states or semi states like Puerto Rico. Then, have a look at Japan, the Japanese situation is very serious in the long run because if interest rates, they are now on 10 years JGBs 0.03% but already at these very very low rates, Japan pays, I think close to 45% of tax revenues go to payment of interest on the debt. Now if the interest rates went up on JGBs to say 1%, all the tax revenues would have to be used to pay the interest on the debt! In my view, Japan has no other option but to print money or default and that will then imply that the Yen will then become weaker and so forth.

In my view, Japan has no other option but to print money or default and that will then imply that the Yen will then become weaker and so forth.

I mean the whole system in the world is in a complete mess.

But so far the central banks and the authorities were able to paint fresh paint on the cracks and so they are not that visible. And don’t forget; who actually has something to say in economics? Most of the people are university professors but they are somewhat linked to the Federal Reserve or to another central bank through consultancy arrangements and so forth.

Basically they are bribed to support the system. Number two, the financial system consists of money managers, hedge funds, the large long bonds, long equities funds like Fidelity and PIMCO and so on,

all these guys are interested in money printing because it lifts the asset values and with rising asset values the fees go up and the performance fees go up so nobody has interest actually in an honest economic policy, they all are in favour of Bernanke´s bailout of problems that occurred in 2008.

What about QE being counterproductive in the sense that it actually increases deflationary pressures? The premise is that by keeping rates artificially suppressed, central banks make it impossible for the market to purge itself of inefficient actors. As a result, otherwise insolvent companies remain operational, adding even more to excess capacity. What do you think?

Yes. I think that is a very good point. That if you print money, the money will not flow evenly into the economic system and this has already been observed by Copernicus who wrote about money and it was later also observed by David Hume and by Irving Fisher that when you print money, the money flows do not benefit all classes of society and all industries equally at the same time.

What then happens is that you look for instance at commodity prices, ok, we had money printing and then prices rose but not only because of money printing, they rose mostly because of the incremental demand from China, but the Chinese boom came to some extent from money printing in the US which led to rising trade and current account deficits until 2008, until the crisis. Since then actually in terms of goods, the trade balance in the US has worsened again, further, but because of the oil industry the overall trade and current account deficit has been diminishing.

The point is simply this, the over capacities that we have in some industries like steel in China, cement and in resources, iron ore, this was made possible by money printing. I am not saying only, by to some extent money printing was responsible. The housing bubble, the housing inflation in the US was made possible by money printing and keeping interest rates artificially low. Now we have a bubble in sovereign debt and we have a bubble in equities, certainly in US equities.

Now we have a bubble in sovereign debt and we have a bubble in equities, certainly in US equities.

When that bubble deflates eventually in sovereign debt and in equities, what the impact will be on the economy will be interesting to watch because the markets are not prepared for rising interest rates.

You already mentioned shrinking trade deficits in the US. As for the US dollar, it has considerably strengthened and at the same time treasury yields are really low…

Yes.

… and, if we understand correctly, you have been relatively positive on treasuries recently…

Yes.

… at the same time you mentioned that the long term outlook for the US is very bad…

Yes. Well you know it is like you have a wife and you have girlfriends! And the wife is maybe permanent but the girlfriends come and go! Optically, long term I would say ten years treasury or thirty years US treasury is of course unattractive, that we all agree because interest rates have been trending down since 1981 so we are more than 35 years into a declining interest rate structure, so we must be close to a low in interest rates.

The only question here is, the economic recovery in the US began in June 2009, so we are six years into an economic expansion, and this is historically the third longest expansion. We have been six years, March 2009 low S&P 666, where it went over 2100 so we are over 6 years into bull market, then I say to myself, I see the global economy weakening and I see French, Italian and Spanish bond yields lower than US treasury yields so with the view that most people have that the US dollar will remain relatively strong, I say to myself everybody is bullish about stocks in the US and everybody is bearish about bonds.

I say to myself maybe treasury notes, the ten years and the thirty years as an investment for the next 3 to 6 months is maybe not so bad. Then I also advocate in my investment strategy, always diversification between real estate, equities, bonds, cash and precious metals. And if someone comes to me and says Marc you are bearish about the world, shouldn’t you be all in cash?

I say yes, maybe that is correct except if I put all my money in cash with the banking system I take a huge risk because we have seen it in the case of Greece, we have seen it in the case of Cyprus and now they have announced that basically investors if there is again a crisis they will also have to pay something so if you have say 20 million dollars with the banks, and they have a problem, maybe you will only get 50% back. So I say to myself, rather than have the money in the banks I would have it in treasuries.

What about gold? Being in a correction mode for a couple of years already, it recently has broken down some more.

Well as you know there are so many explanations ranging from manipulation to essentially Chinese selling which could have been the case you know that margin calls went out for stock accounts, the margin buyers may not have been able to sell their shares because still about 20% are not trading.

Number two, they can’t sell their properties because you can’t sell overnight the properties so the margin call has to be met the next day and property transactions may take, I don’t know three months until you close and maybe there were some corporations or individuals that were holding gold and so that they could liquidate, that is an explanation that I could sympathise with.

Or you could say because of the strong dollar people became, or had hesitations of owning gold because they said if the dollar is strong why would I own gold? I mean there are lots of explanations. The simple explanation is of course that there were more sellers than buyers at that particular time. Now if you look at the pole market in gold, 1999 255 dollars went to 1921 dollars in September 2011 and then we had this correction which now we are in 2015, four years on and the price was always holding around 11 or 12 hundred and now it looks like it has broken down on the downside and then you have to ask yourself well is it a breakdown that will lead to further selling in other words, prices would move lower and find the low at, I don’t know, maybe 700, 800, 900 dollars, a thousand or is it a final liquidation from which prices will start to move up.

I really don’t know, all I know is that I own gold and it doesn’t worry me that it went down because as I mentioned to you I have this diversification, the bonds in US dollars and the cash in US dollars has been a good investment essentially over the last twelve months. Then I own equities and I own properties in Asia that have been reasonably good investments so the fact that gold is going down doesn’t worry me and I buy every month a little bit but I think on this weakness I will increase the position substantially because I had maybe say 25% in gold but because equities and properties went up, the dollar went up and gold went down, the allocation to gold is no longer 25% but maybe only 10 or 15%.

So then I have to stock it up again. But I would say an individual should definitely own some physical gold.

But I would say an individual should definitely own some physical gold.

The bigger question is where should he store it? because I think if we think it through, the failure of monetary policies will not be admitted by the professors that are at central banks, they will then go and blame someone else for it and then an easy target would be to blame it on people that own physical gold because they can argue, well these are the ones that do take money out of circulation and then the velocity of money goes down, we have to take it away from them.

That has happened in 1933 in the US. With our brilliant governments in Europe that follow US policies and with the ECB talking every day to the Federal Reserve, they would do the same in Europe, take the gold away from people.

Back to where we started: major investment themes. Which ones are you seeing on the horizon, if any at all?

Yes, I mean first of all some investment themes are not easy to implement for individuals. In Asia, one country that stands out as having great economic potential is Vietnam.

In Asia, one country that stands out as having great economic potential is Vietnam.

And by the way the whole Indochinese region with Vietnam in the east and then north west with Laos, south west with Cambodia and then Thailand, Myanmar, India, Bangladesh and in the north China, and in the south Malaysia, Singapore… that whole region with over 500 million people has tremendous growth potential and Cambodia at the present time is a boom town, a boom country because it is also politically related, the Japanese and Koreans invest a lot of money as well as the Americans and the Chinese so they all compete essentially because Cambodia is strategically important.

Vietnam has a very strong export performance, the stock market has performed very badly for the last few years like China, until a year ago, properties have come down but in my view they are now bottoming out. The Vietnamese people are hardworking people not like say easy going like the Thais or the Indonesians or Philipinos, so I believe the country has a great potential.

Number two with the agreement with Iran, I think the future of southern Iraq is guaranteed in other words, from Bagdad south, that whole region where the oil is, Basra, that is Shia, their political future is essentially guaranteed because the Shias of Iran will not let ISIS capture that territory nor let Saudi Arabia invade. The Iraqi stock market is very inexpensive, it is very cheap. It is very difficult to invest now in Iran but in Iraq it is much easier and there are funds so that is an opportunity in my view. For the last few years emerging markets have underperformed say the US grossly, but if I look at the next ten years and in the immediate future, I don’t think that the emerging markets will perform well, they will come off further in my view but they are markets that offer relative good value in the sense that you have many shares say in Singapore, Malaysia, Thailand…that have a dividend yield of say 5-6% so at least you paid to wait. It is not yet at a very attractive valuation level but it´s reasonable. It is a world of inflated assets. Mining stocks are extremely depressed, I mean if someone says what is cheap in the market place then I would say the miners are incredibly low, next station is bankruptcy and maybe one of the big ones still goes bust and that would probably signal the end of the bear market in precious metals. Possible.

I would say the miners are incredibly low, next station is bankruptcy and maybe one of the big ones still goes bust and that would probably signal the end of the bear market in precious metals. Possible.

The future is unknown and we are not dealing with markets that are free markets anymore. A free market is defined as a market when no market participant has a dominant influence and can manipulate the market. Now we have government interventions everywhere and you don’t know what they will buy next. They bought bonds and mortgage backed securities to depress the yields on these securities, they pushed interest rates essentially everywhere to 0, and by doing that they basically expropriate savers because money, one of the functions of paper money is to store value but at zero interest rates there is no store of value.

They may through sovereign funds, they have done it already and the Swiss National Bank already bought shares, the Swiss National Bank they own over a billion dollars in Apple stock! You can be sure that Apple will go down because whatever the Swiss National Bank does is a disaster!

That is a very good sell signal! The other sovereign funds have also bought equities. Now the sovereign funds are not going to increase anymore because most of them are oil related so they have to actually liquidate and that is a game changer from one trillion dollars in assets, sovereign funds in year 2002, they went to over seven trillion, I think they are going to come down to maybe three trillion, that will have an impact on liquidity and on yields.

As for the long-term outlook, if the current set-up fails, what could replace it?

That’s why I think they will take the gold away and go back to some gold standard by revaluing the gold say from now 1000 dollars an oz. to say 10,000 dollars an oz.

This sounds rather far-fetched; at least when listening to professionals and people in academia.

Yes but I want to tell you, just in the last say twelve months, I have observed an increasing number of academics who are questioning monetary policies.

Yes but I want to tell you, just in the last say twelve months, I have observed an increasing number of academics who are questioning monetary policies.

I mean some academics that have been quite mainstream in the past. I mean John Taylor has been critical for a long time as well as Ana Schwartz but she passed away and as Milton Freedman who also passed away a long time ago. But basically now I see more and more academics and influential people, also among the Republicans that are actually questioning the Fed and also the integrity of the Fed. That is a crack and as you said the credibility of the ECB is in my view badly tarnished already because people say how could they lend so much money to Greece?

But you understand, they never ask ordinary people, they ask academics, or economists and they all also get paid somewhere because they are either in the one or the other commission, so they are not going… it’s like if you go into a hospital and a doctor has killed a few patients unintentionally, another doctor will never testify against him. He will shut up because he is afraid one day other people will turn against him. Mistakes happen. And so among academic circles you will very seldom find criticism of central banks.