Jordan’s Top Financial Institutions

Marcopolis.net has compiled the list of the key financial institutions in Jordan. The Kingdom’s most important financial bodies are dominated by the Central Bank of Jordan.

Top Financial Institutions in Jordan

Jordan’s Key Financial Bodies

| Company | Country | Area | Description |

|---|---|---|---|

| Jordan | Finance | Jordan set out preparations to establish the Central Bank of Jordan (CBJ) in the late 1950s. The Law of the CBJ was enacted in 1959. Thereafter, its operational procedures were commenced on the first day of October 1964. The capital of the CBJ, which is totally owned by the government, was increased gradually, from one million to 18 million Jordanian Dinars. The CBJ enjoys the status of an independent and autonomous corporate body, although its capital is owned entirely by the government. The law establishing the CBJ stipulates that “the objectives of the Central Bank shall be to maintain monetary stability in the Kingdom, to ensure the convertibility of the Jordanian Dinar, and to promote the sustained growth of the Kingdom’s economy in accordance with the general economic policy of the government.” |

|

| Jordan | Finance | The Audit Bureau of Jordan is an independent Government agency and a supreme audit institution responsible for auditing the Ministries, public institutions, public departments, municipalities, co-operatives, labour unions, corporations where the Government of Jordan has more than 50% of shares, and any entity that the Council of Ministers assigns the Bureau to audit. The Audit Bureau of Jordan in its present form has been established since 1952, under the Audit Bureau’s Law no 28 of 1952, which has been issued in accordance with the Jordan Constitution. The Jordan constitution stipulates that the “Audit Bureau act has been set to audit the revenues and expenditures of the state and ways of expenditure”. |

|

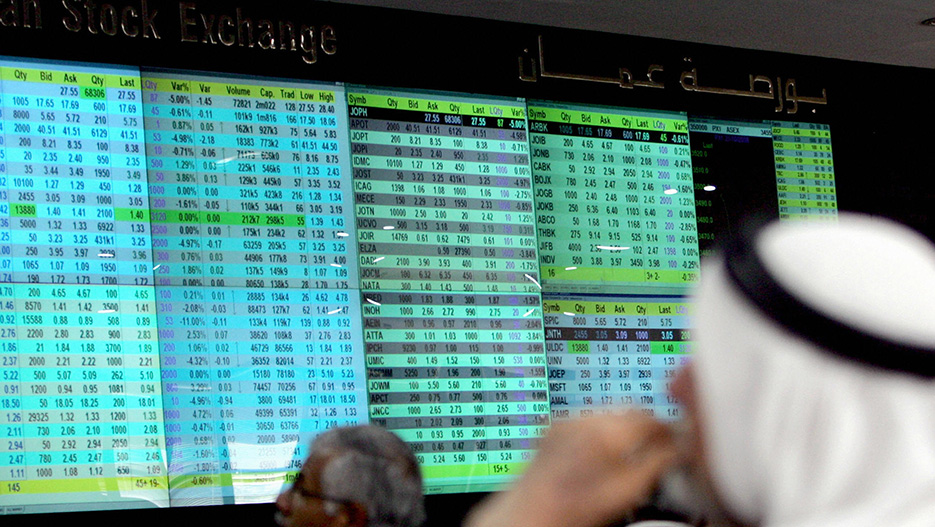

| Jordan | Finance | The Amman Stock Exchange (ASE) was established in March 1999 as a non-profit, private institution with administrative and financial autonomy. It is authorized to function as an exchange for the trading of securities. The exchange is governed by a seven-member board of directors. Interview: Jordan Capital Markets |