EFG HERMES Points To Relatively Contained Inflation In The MENA Region In 2011

EFG Hermes recently released its quarterly Economic Note on the MENA region in which it addressed inflation and interest rate trends in the region.

EFG Hermes recently released its quarterly Economic Note on the MENA region in which it addressed inflation and interest rate trends in the region. EFG Hermes generally expected a weaker rise in upward inflation in the second half of 2011 as a result of three main factors, namely, government measures to stabilize food and fuel price increase, signs of stabilization in global food prices, and indications of weaker global producer price inflation.

… more than half of the countries covered by EFG Hermes saw flat or lower inflation levels in the first half of 2011 compared to end-2010.

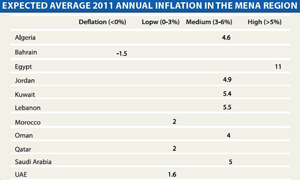

The study indicated that inflationary pressure in the MENA region remains contained, and the investment bank believes it is not a central economic concern as in other emerging market regions and economies, which have seen monetary and fiscal tightening, as well as currency appreciation to tame inflationary pressures. The report noted that more than half of the countries covered by EFG Hermes saw flat or lower inflation levels in the first half of 2011 compared to end-2010. In details, Saudi Arabia, Morocco and Bahrain have seen a lower average inflation level, while overall consumer prices remained flat in Kuwait and the UAE. As such, the investment bank lowered its average annual 2011 inflation forecast for a number of countries including Saudi Arabia, Morocco, Kuwait, and the UAE. Furthermore, EFG Herms now expects to see deflation in Bahrain.

Qatar and Egypt saw some of the greatest increases in inflation in the first half of 2011, up an average of 1.38% and 1.45%, respectively. In Qatar, transportation and communication costs were the main drivers of inflation, followed by food prices. In Egypt, the rise in inflation was largely driven by food prices. There was also some increase in the administered price of butane in early 2011, as disruptions in local transportation networks and political developments resulted in limited supply. However, weak consumption and investment have resulted in a weak non-structural inflation environment, which has also been supported by Egypt’s stable currency policy.

Moving on to interest rates, the study noted that they have largely remained on hold (excluding Jordan and Qatar) in the MENA region, and EFG Hermes expects this trend to continue for the remainder of the year, given that core inflation (non-food and fuel) remains benign. EFG Hermes still sees the most likely risk to this outlook as another cut in Qatar’s lending rate. Most MENA countries would continue to see negative interest rates, as per EFG Hermes. However, the report noted that credit growth would likely be driven by increasing domestic demand.

The article above has been published as a part of Bank Audi`s MENA Weekly Monitor for Week 33 of 2011. It can be accessed via Internet at the following web address : http://www.banqueaudi.com