Cushman & Wakefield Notes Declining Retail Rents in the MENA Region

The declines in the MENA region were particularly severe in Bahrain (-26.7%), Syria (-16.7%), and Jordan (-7.7%).

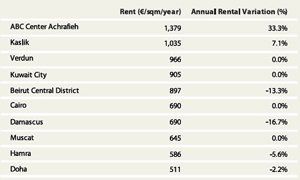

In its latest report “Main Streets across the World–2011”, Cushman & Wakefield noted that rental values in the Middle East and Africa stagnated or witnessed a decline over the year-to-June 2011, while other regions in the world witnessed a more positive growth trend.

The declines in the MENA region were particularly severe in Bahrain (-26.7%), Syria (-16.7%), and Jordan (-7.7%).

The declines in the MENA region were particularly severe in Bahrain (-26.7%), Syria (-16.7%), and Jordan (-7.7%), while the UAE (-3.0%) and Qatar (-2.2%) registered more modest falls. Beirut was the only city in the region to post a rise, with values in the top shopping areas of the Lebanese capital proving resilient to external factors.

The majority of the falls were driven at least in part by the precarious political situation in a number of countries. Following the unrest starting in Northern Africa and parts of the Middle East, the retail market has been affected by a reduction in tourist spending and a reluctance of retailers to progress with expansion, according to Cushman & Wakefield. Indeed, a number of plans have now been postponed and, as a consequence, have adversely affected leasing activity. The downward pressure on rents also stemmed from an oversupply of retail space, with the surplus especially evident in the Gulf markets, where development has been highest.

Yet, it is worth mentioning that the abundance of retail space in the Gulf region has to some extent improved the accessibility of the area for operators. Moreover, the tenant favorable market in the Middle East should prevent a significant supply-demand imbalance as occupiers look to expand and take up existing stock.

Finally, the report indicated that countries such as Egypt and Saudi Arabia, which were previously seen as potentially viable emerging markets by retailers, have now gone down the list of targets as a result of recent political unrest in the region. Such developments may yet facilitate the modernization of the regional economy and lead to the arrival of more international retailers in the future.

Sources: Cushman & Wakefield, Bank Audi’s Group Research Department

The article above has been published as a part of Bank Audi`s MENA Weekly Monitor of Week 37 (2011). It can be accessed via Internet at the following web address : http://www.banqueaudi.com