Lebanon: Improved Economic Performance in October 2011

Clearing activity suggests relatively improved economic performance in October 2011.

The value of cleared checks in the Lebanese banking system, a coincident indicator of overall spending patterns in the economy, suggested that economic performance during the month of October might have relatively improved. Figures released by the Association of Banks in Lebanon indicated that total cleared checks amounted to US$ 6,356 million in October 2010, up by 10.5% from the same month of the previous year. On a monthly basis, the increase in cleared checks was mainly the result of a growth in foreign currency denominated checks, which managed to compensate for the trivial increase in LP denominated checks. The former went up by 13.2% year-on-year to US$ 5,121 million while the latter rose by only 0.5% year-on-year to LP 1,859 billion.

… consumers and investors are gradually regaining confidence towards the local arena, as manifested by the continued increase in spending on consumer and capital goods.

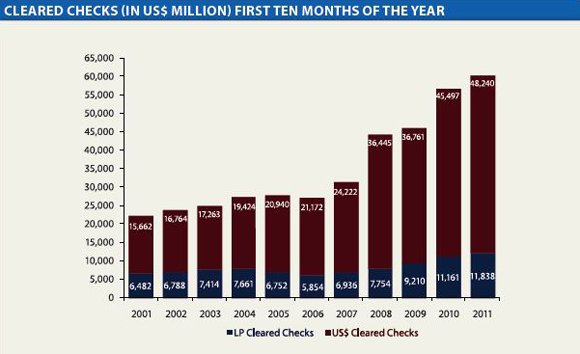

For the first ten months of this year, cleared checks reached US$ 60,091 million in the first ten months of 2011, up by 6.1% from the corresponding period of 2010. This shows that consumers and investors are gradually regaining confidence towards the local arena, as manifested by the continued increase in spending on consumer and capital goods.

The improvement is almost equally attributable to the rise in foreign currency as well as local currency denominated checks. In details, banks’ clearing activity for foreign currency denominated checks posted a 6.0% yearly increase during the first ten months in 2011 to reach a total of US$ 48,240 million. Clearing activity for local denominated checks amounted to LP 17,846 billion over the aforementioned period of this year, up by 6.1% from the first ten months of 2010. The rise in foreign currency denominated checks within the context of a practically equivalent increase in LP denominated checks has led to an equal dollarization rate of 80.3% in the first ten months of 2011.

The article above has been published as a part of Bank Audi`s Lebanon Weekly Monitor of Week 47 (2011). It can be accessed via Internet at the following web address: http://www.banqueaudi.com