Gulf Bank Gets Upgraded Credit Ratings from S&P

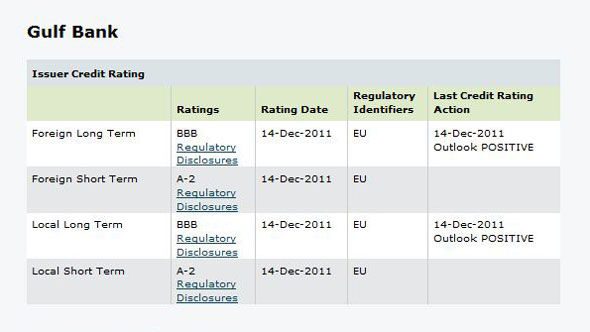

Standard & Poor’s upgraded Gulf Bank’s credit ratings to BBB with a positive outlook and the Bank is thus the only in the region to get both an improved rating and a positive outlook.

Kuwait – 18 December 2011: Standard & Poor’s (S&P), the world’s leading international credit rating agency, today upgraded Gulf Bank‘s long-term credit rating of BBB- to BBB, and raised the Bank’s outlook from stable to positive. The positive outlook indicates the Bank’s financial profile could further improve over the next 12-24 months, especially in terms of asset quality, as well as capitalization. This is the first time S&P has upgraded a bank since the economic crisis in 2009.

“Gulf Bank was the only bank in the region to receive both a rating upgrade as well as an improved outlook in Standard & Poor’s latest assessment.”

Mr. Ali Al-Rashaid Al-Bader, Gulf Bank’s Chairman at that time, said: “Gulf Bank was the only bank in the region to receive both a rating upgrade as well as an improved outlook in Standard & Poor’s latest assessment. S&P’s decision is a great endorsement of our excellent management team, its strong leadership and our dedicated work force, as well as our risk management systems and controls. It also confirms that our strategy of focusing on providing the best and fastest banking services is working, and is delivering the results we had planned.”

“The last two years have seen us put Gulf Bank back on to a firm footing, and I believe we are now well positioned for future growth. We have strengthened our balance sheet significantly, made good progress to meet trading challenges in a difficult market, delivered good results by concentrating on our core banking areas of Consumer and Corporate Banking, and have greatly enhanced our levels of customer service. Our challenge now is to maintain our focus as we continue our development.”

Gulf Bank achieved a net profit of KD 27.4 million in the first nine months of 2011, against KD 10.4 million in 2010. Earnings per share amounted to 11 fils. As of the end of September 2011, the Bank’s total assets increased by 5%, deposits were up by 4%, whilst total shareholders’ equity increased by 8% compared to the same period of 2010.

This press release has been issued by Gulf Bank.