Lebanon Trade Deficit Widens Considerably

Lebanon’s foreign trade has been negatively affected in the first eleven months of 2011.

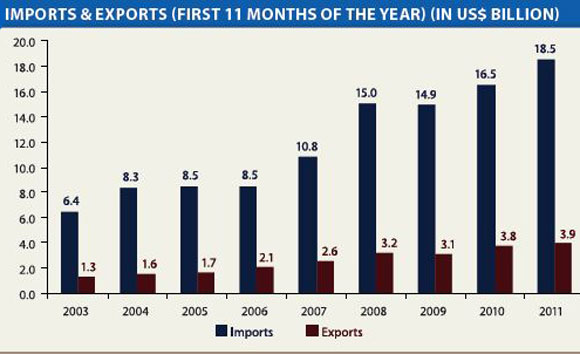

Lebanon‘s foreign trade has been negatively affected in the first eleven months of 2011, within the context of a surging oil import bill and a mild growth in total exports. In fact, figures released by the Higher Customs Council showed that exports grew by a yearly 4.2% during the first eleven months of this year against a much higher increase of 20.7% a year earlier while imports went up by 12.2% year-on-year versus 10.9% during the first eleven months of 2010. The slowdown in exports coupled with the relatively high growth rate in imports resulted in a trade deficit of US$ 14.6 billion in the aforementioned period of this year, up by 14.5% year-on-year. Along the same line, the export-toimport ratio fell from 23% in the first eleven months of 2010 to 21% in the same period of 2011.

The slowdown in exports coupled with the relatively high growth rate in imports resulted in a trade deficit of US$ 14.6 billion in the aforementioned period of this year, up by 14.5% year-on-year.

In details, exports amounted to US$ 3.9 billion in the first eleven months of this year, compared to US$ 3.8 billion during the same period of last year. The breakdown of exports by country of destination indicates that Switzerland was the major receiver of Lebanese products with 11.9% of the total. It was followed by the UAE with 7.5%, Saudi Arabia with 7.1%, Turkey with 6.5%, and Syria with 4.8%. Lebanon’s primary export item in the first eleven months of 2011 was jewelry, which accounted for 35.4% of total exports of Lebanon economy. It was followed by metals and metal products with 12.6%, and electrical equipment and products with 12.2%.

When it comes to imports, their value reached US$ 18.5 billion during the first eleven months of 2011, up from US$ 16.5 billion during the same period of last year. It is worth noting that imports of consumer products grew by 22.1%, indicating a rise in aggregate consumption in the country, while those of investment goods rose by a mere 0.4% reflecting an ongoing wait-and-see attitude from investors.

In fact, Lebanon’s import bill was significantly affected by the rise in oil prices as the value of oil imports accounts for around 20% of total Lebanese imports. Beyond the adverse inflationary effects that the surge in oil prices year-to-date holds for the Lebanon economy, such an oil shock raises Lebanon’s import bill by no less than US$ 1 billion on an annual basis. Indeed, oil prices saw an upsurge of almost 42% in the first eleven months of 2011. When accounting for this augmentation, the real value of Lebanese imports would actually witness a lower growth of 4.0% over the period.

The breakdown of imports by country shows that the US was the major exporter to Lebanon with 10.3% of the total, followed by Italy with 9.1%, China with 8.0%, and France with 7.5%. Lebanon’s primary import item in the first eleven months of 2011 was mineral products which accounted for 23.3% of total exports. It was followed by electrical equipment and products with 10.5% and jewelry with 10.4%.

The article above has been published as a part of Bank Audi`s Lebanon Weekly Monitor of Week 52 (2011). It can be accessed via Internet at the following web address: http://www.banqueaudi.com